Your Career Blueprint: How to Become a CPA in Florida

AI was used in the creation of this article. The article was reviewed, fact-checked and edited by a content review team. We might earn a commission if you make a purchase through one of the links. McClatchy newsrooms were not involved in the creation of this content.

Becoming a Certified Public Accountant (CPA) in Florida isn’t just about crunching numbers. Think of it as a challenge where less than half of the players (according to NASBA, under 50% on their first try) make it past the boss level: the Uniform CPA Examination.

This isn’t your average test; it tests your mettle in financial accounting, business law, and more. Florida throws its curveballs, requiring CPA hopefuls to rack up 150 semester hours of education with a hefty dose of accounting and business courses. And let’s not forget the real-world experience—getting your hands dirty with taxation, auditing, and financial advisory tasks is part of the deal.

This guide cuts through the fluff and dives straight into what you need to know about how to become a CPA in Florida. From passing the Uniform CPA exam to applying for Florida CPA licensure, below are the Florida-specific hurdles you need to jump.

Key Takeaways

Eligibility and Education: Florida welcomes CPA candidates without imposing age or residency restrictions, requiring 150 semester hours of education, including specific accounting and business courses.

Work Experience: Aspiring CPAs need at least one year of relevant work experience, which can be part-time or volunteer, under a licensed CPA or IQAB-recognized chartered accountant.

CPA Exam Structure: The exam consists of core sections (AUD, FAR, REG) and a Discipline-specific section (BAR, ISC, TCP), allowing candidates to tailor their licensure to career goals.

International Requirements: Non-residents and international candidates must have their educational credentials evaluated and meet English proficiency, with specific steps for SSN provision and work authorization.

License Renewal: Licensed CPAs in Florida must complete 80 hours of CPE every two years, using a reporting tool to document compliance, ensuring their practice remains uninterrupted.

General Eligibility Criteria for CPA Candidates in Florida

Unlike some professions where age, residency, or citizenship might be restrictive, the CPA profession in Florida focuses more on educational achievements and professional integrity.

Key Eligibility Criteria

Age Requirement: Florida does not impose an age limit for CPA candidates. This inclusivity ensures individuals can pursue the CPA designation at any career stage.

Social Security Number (SSN): Candidates must provide a Social Security Number as part of their application. This requirement is standard for many professional licensures in the United States, serving as a unique identifier for each applicant.

Residency Requirement: Interestingly, Florida does not require CPA candidates to be state residents. This opens the door for individuals from across the country and even international candidates who meet the educational and experience requirements to pursue CPA licensure in Florida.

Good Moral Character: While not a quantifiable requirement like education or experience, demonstrating good moral character is essential for CPA candidates. This includes a background free of significant criminal offenses or financial misdeeds that could question a candidate’s ability to uphold the profession’s ethical standards.

Florida CPA Requirements: Education and Experience

Becoming a CPA in Florida is more than just passing an exam; it’s about meeting specific educational and professional prerequisites. The Florida Board of Accountancy has laid out precise requirements to ensure that every CPA possesses the knowledge and skills necessary to uphold the standards of certified public accounting.

Educational Requirements

150 Semester Hours: To sit for the CPA exam in Florida, candidates must complete 150 semester hours of college education. This goes beyond the typical bachelor’s degree, requiring additional coursework to deepen your expertise in accounting and business.

Accounting Courses: You must complete 36 semester hours in upper-division accounting courses. These aren’t just any accounting classes; they must cover essential topics like financial accounting, auditing, taxation, and cost accounting, ensuring you have a comprehensive understanding of the field.

Business Courses: Besides accounting, you’ll need 39 semester hours in general business courses. This includes a mandatory business law course covering the Uniform Commercial Code, which is vital for any CPA’s toolkit. Other courses include economics, finance, management, and marketing, providing a well-rounded business education.

Real-World Experience Requirement

Aspiring CPAs in Florida are required to have at least one year of relevant work experience, which can be demonstrated through various forms of employment, including part-time positions or volunteer work, as long as it is under the supervision of a licensed CPA or a chartered accountant recognized by the International Qualifications Appraisal Board (IQAB).

The experience must involve applying skills in accounting, attestation, compilation, consulting, financial advisory, management advisory, and tax. It must be gained in one of several approved settings, including academia, government, industry, or public practice, ensuring that CPAs have a broad understanding of the field.

The work experience can be accumulated over different time frames: a minimum of 20 hours per week for up to 104 weeks or a full-time basis of 40 hours per week for at least 42 weeks. This flexibility allows candidates to gain the necessary experience in a manner that fits their personal and professional lives. To officially document this experience, candidates must use the Verification of Work Experience form, which requires validation from their supervising CPA.

International CPA License Requirements in Florida

International applicants aiming for CPA licensure in Florida face unique requirements, yet the state’s inclusive approach allows non-residents and those without U.S. citizenship to apply. Key steps include having educational credentials evaluated by services approved by the Florida Board of Accountancy to ensure they meet the 150-semester hour requirement equivalent to U.S. standards.

International candidates must also provide a Social Security Number (SSN), though alternatives may be available for those without one. Proficiency in English is essential, as the CPA exam is in English, potentially requiring proof through tests like the TOEFL.

Additionally, while Florida doesn’t mandate residency, visa, and work authorization are necessary for completing the required professional experience in the U.S.

CPA Exam in Florida

The CPA exam in Florida is meticulously structured to assess the comprehensive abilities of candidates across several critical domains of accounting and finance. This includes the following sections:

Auditing and Attestation (AUD): This section evaluates a candidate’s ability to perform audits, including understanding the process, principles, and auditing standards. It also covers attestation engagements and the ethics and independence required in auditing.

Financial Accounting and Reporting (FAR): FAR tests knowledge of financial accounting principles and the application of International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP) in the United States. It includes preparing financial statements, the conceptual framework, and financial reporting for entities such as government and non-profit organizations.

Regulation (REG): This section assesses understanding of business law, ethics, and federal tax procedures. It covers federal taxation of individuals, entities, and property transactions, as well as business law topics like contracts, the legal responsibilities of agents and principals, and the implications of government regulation on businesses.

Discipline Section Choice

Candidates must choose one of the following Discipline-specific sections, allowing them to tailor their licensure to their career goals or areas of interest:

Business Analysis and Reporting (BAR): Focuses on the analytical aspects of accounting and reporting. It covers advanced topics in financial accounting, including business combinations, intercompany transactions, foreign currency transactions, and strategic planning and data analysis techniques.

Information Systems and Controls (ISC): This section is designed for those interested in the intersection of accounting and information technology. It covers the design, implementation, and monitoring of internal control systems and the evaluation of technology’s impact on accounting processes and the protection of information assets.

Tax Compliance and Planning (TCP): Ideal for those who wish to specialize in taxation, this section delves into tax compliance, tax planning strategies, and the management of tax liabilities for individuals, businesses, and other entities. It includes understanding the tax implications of complex transactions and strategic tax planning.

In Florida, CPA candidates are provided with an 18-month window to pass all sections of the CPA exam, starting from the date they pass their first section. This timeframe is designed to ensure that candidates maintain a focused and timely approach to completing their licensure requirements while accommodating the comprehensive study and preparation needed to excel in each distinct area of the exam.

Navigating the CPA Licensing Process in Florida

After conquering the CPA exam, the journey to becoming a licensed CPA in Florida enters its crucial phase: navigating the licensing process.

Submission of Official Transcripts: Your first step is to submit official transcripts to the Florida Board of Accountancy. These documents must verify that you’ve met the 150 semester hours requirement, including the specific accounting and business courses mandated by Florida CPA exam requirements.

Verification of Experience: Alongside your educational credentials, you must provide proof of your professional experience. Florida requires CPA candidates to complete at least one year (2,000 hours) of work under the supervision of a licensed CPA.

Although the licensing timeline varies, CPA applicants report that receiving a licensing answer can take 1-2 months.

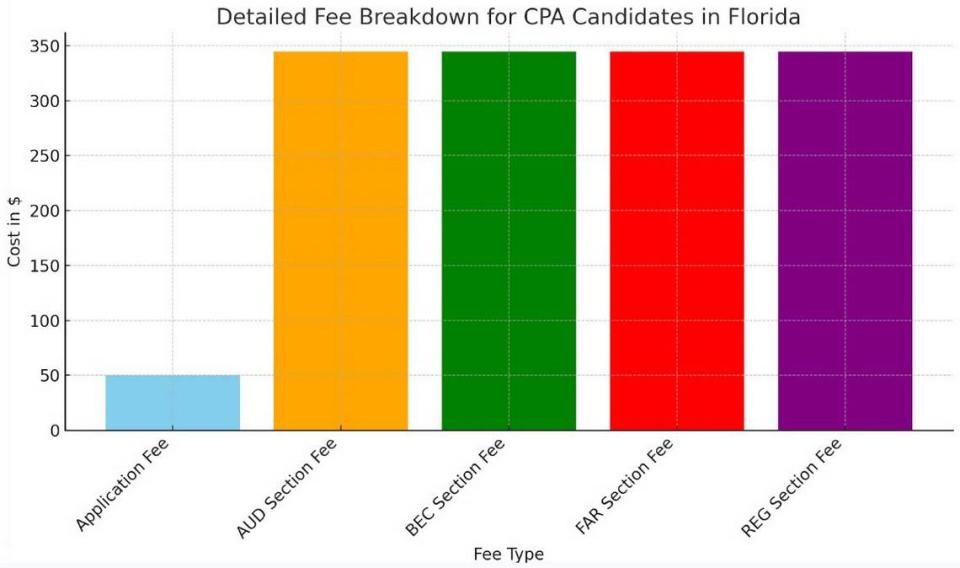

Detailed Fee Breakdown for CPA Candidates in Florida

The overall cost to take all four sections of the CPA exam in Florida is $1,379.20. This fee is divided equally among the four sections, making the cost per section $344.80. This standardized fee structure ensures that candidates know exactly how much they need to budget for the examination phase of their CPA licensure process.

When submitting your application to sit for the CPA exam in Florida, there is a non-refundable application fee of $50.

Renewing Your Florida CPA License

Renewing a CPA license in Florida requires attention to specific deadlines and compliance with CPE requirements. The license renewal cycle occurs every two years, with CPAs needing to submit a renewal application through the Florida Department of Business and Professional Regulation (DBPR) website.

Additionally, CPAs must report 80 hours of CPE credits earned during the two years preceding the renewal deadline. This includes specific mandates such as 4 hours of Board-approved ethics CPE and a balance of hours in accounting, auditing, and other relevant subjects. CPAs must use a CPE reporting tool.

Failure to meet these requirements by the renewal deadline, typically December 31st of the renewal year, may result in the inability to renew the license and could lead to inactive status or additional fees to reactivate the license.

Comparison of Florida’s CPA Requirements with Other States

When considering where to pursue CPA licensure, understanding how Florida’s requirements stack up against other states can provide valuable insights. Here’s how Florida compares:

Education Requirements

Florida: Requires 150 semester hours of education, including 36 hours of upper-division accounting courses and 39 hours of general business courses. Notably, Florida mandates a business law course covering the Uniform Commercial Code.

Other States: The 150-hour rule is standard across most states, but the specifics can vary. For example, Texas also requires 150 hours but specifies 30 hours of upper-division accounting courses, slightly less than Florida. Some states, like California, have unique requirements, such as ethics studies.

Residency Requirement

Florida: Florida does not require CPA candidates to be state residents. This open approach allows candidates from anywhere in the U.S. or internationally to obtain licensure in Florida, provided they meet other requirements.

Other States: Some states, like Alabama, have residency requirements, necessitating candidates to be residents, have a place of business, or be employed in the state for a certain period before applying for the exam.

Experience Requirement

Florida: Candidates must complete one year (2,000 hours) of work experience under the supervision of a licensed CPA. This experience can be gained in public practice, industry, government, or academia.

Other States: The experience requirement is fairly consistent across states, with one to two years being common. However, the nature of the work and the settings in which it can be obtained (e.g., public accounting vs. industry) can differ. For instance, New York requires at least one year of experience but is more specific about the type of work that qualifies.

Ethics Examination

Florida: This state does not require passing an ethics exam, often provided by the AICPA, as part of the licensure process.

Other States: The ethics exam requirement is expected but not universal. States like Missouri also require an ethics exam, but the content and provider may vary. Some states may have their own ethics exam or course requirement instead of or in addition to the AICPA exam. Then there are states like Florida that don’t require it at all.

Continuing Professional Education

Florida: CPAs must complete 80 hours of CPE every two years, with specific requirements for accounting, auditing, and ethics CPE credits.

Other States: CPE requirements vary widely. For example, Illinois requires 120 hours of CPE in three years, with no specific mandate for ethics credits, showcasing a more flexible approach compared to Florida’s more structured CPE criteria.

Conclusion

Becoming a Certified Public Accountant in Florida is a multifaceted process transcending mere academic achievement. It is a comprehensive pathway that includes meeting stringent educational prerequisites, gaining real-world experience under seasoned professionals, and successfully navigating the Uniform CPA Examination.

Florida’s inclusive criteria welcome candidates from diverse backgrounds by not imposing age or residency restrictions, thereby broadening the opportunity for aspiring CPAs both domestically and internationally.

Additionally, the requirement for continuous professional development ensures that CPAs in Florida maintain the highest standards of knowledge and ethics in their practice. For those ready to embark on this challenging yet rewarding career path, Florida offers a well-defined blueprint for success in the accounting profession.

FAQ

How long does it take to become a CPA in Florida?

Becoming a CPA in Florida typically takes around eight years, encompassing the time needed to complete a bachelor’s degree (4 years), the additional coursework to meet the 150-semester hour requirement (1-2 years), and gaining the necessary depending on work experience (1 year). Additionally, preparing for and passing the CPA exam can add time to this journey on the individual’s study schedule and success in passing the exam sections.

Can international candidates become CPAs in Florida?

Yes, international candidates can pursue CPA licensure in Florida. The state’s Board of Accountancy allows candidates outside the U.S. to apply, provided they meet the educational and experience requirements. A recognized credential evaluation service must evaluate international education, and candidates must navigate visa and residency considerations, making Florida an accessible choice for international CPA aspirants.

What is the real-world experience requirement for Florida CPAs?

Florida requires CPA candidates to complete at least one year (2,000 hours) of professional experience under a licensed CPA’s supervision. This experience, which can be gained in public practice, industry, government, or academia, is crucial for applying theoretical knowledge to practical situations.

Is there an ethics examination requirement for Florida CPAs?

No. Florida does not require CPA candidates to pass an ethics examination as part of the licensure process. Although many states require an AICPA-administered course and exam, Florida is not one of them.

What are the CPE requirements for maintaining a CPA license in Florida?

Licensed CPAs in Florida must complete 80 hours of Continuing Professional Education (CPE) every two years. This requirement includes specific mandates for accounting, auditing, and ethics CPE credits, ensuring that CPAs stay current with evolving accounting standards, practices, and regulations.

How much does a CPA make in Florida?

CPA salaries in Florida range from $50,000 to $120,000 annually, depending on experience and specialization. This variation reflects differences in market demand, employer size, and individual performance.