Carl Icahn Plunges Into HP and Cloudera in 3rd Quarter

Carl Icahn (Trades, Portfolio), founder of Icahn Capital Management and board chairman of Icahn Enterprises LP (NASDAQ:IEP), disclosed last week he took activist positions in HP Inc. (NYSE:HPQ) and Cloudera Inc. (NYSE:CLDR) during the third quarter. Further, Icahn this week took a $400 million bet against struggling malls according to CNBC sources.

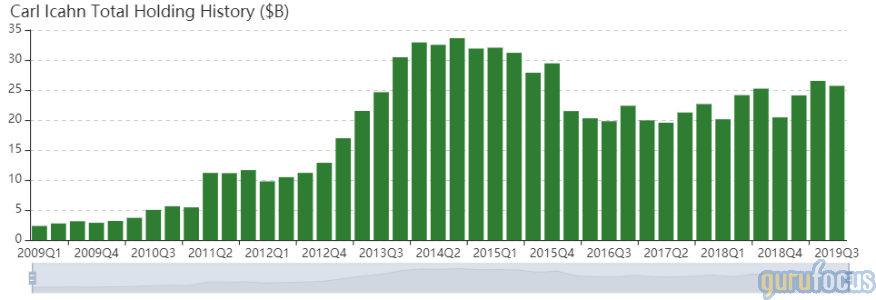

Managing a portfolio of 18 stocks, Icahn seeks activist positions through three investment vehicles: the Icahn Partners hedge fund, American Real Estate Partners and Icahn Capital Management. GuruFocus tracks the holdings in Icahn Capital Management, which also covers all stocks held by Icahn Partners.

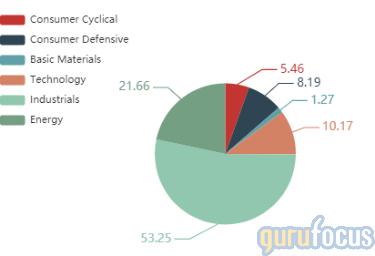

Icahn said that the consensus thinking is generally wrong and that going with the trend can eventually backfire. The investor thus seeks out-of-favor companies and pushes for change to unlock shareholder value. Although Icahn's $25.69 billion equity portfolio's top three sectors as of quarter-end are industrials, energy and technology, the 53.25% weight in industrials includes a 47.69% weight in Icahn Enterprises.

HP

Icahn purchased 62,902,970 shares of HP, giving the stake 4.63% weight in the equity portfolio. Shares averaged $19.64 during the quarter.

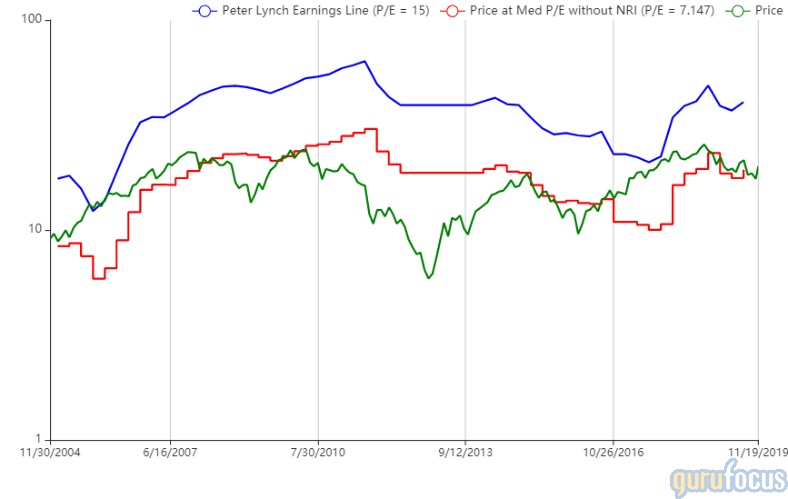

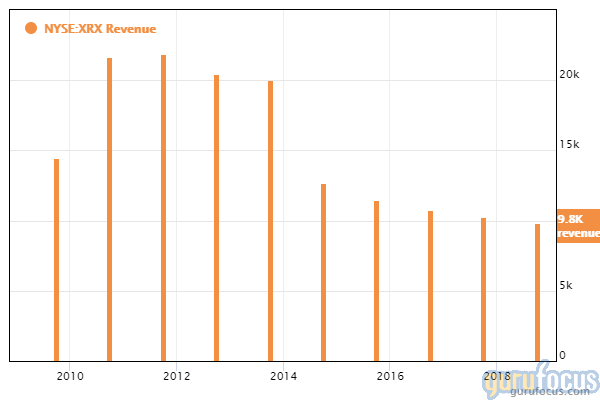

On Sunday, the Palo Alto, California-based personal computer giant rejected a takeover offer from Xerox Holdings Corp. (NYSE:XRX), saying in a letter that the merger proposal "significantly undervalues HP and is not in the best interest in HP shareholders." The HP board of directors also noted that Xerox's revenue declined on a trailing 12-month basis from June 2018 to June 2019, raising concerns regarding the trajectory of the Norwalk, Connecticut-based company's printing business. GuruFocus further warns that Xerox's revenue has declined approximately 2.90% per year on average over the past three years and approximately 7.20% per year on average over the past five years. Additionally, Xerox's three-year revenue decline rate underperforms 73.59% of global competitors.

Despite the rejection, the Wall Street Journal reported that Icahn said HP's merger with Xerox is a "no-brainer," strongly believing in the cost synergies of over $2 billion.

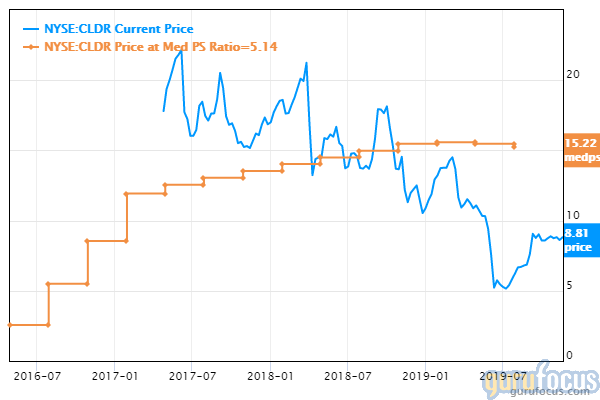

Cloudera

Icahn disclosed a 54,795,218-share stake in Cloudera, giving the position 1.89% weight in the equity portfolio. Shares averaged $6.92 during the quarter.

On Aug. 12, the Palo Alto, California-based company reached a voting and standstill agreement with Icahn in which Cloudera will appoint two of his employees to its board of directors. Cloudera CEO Martin Cole said he and Icahn had "constructive conversations" about driving shareholder value through initiatives with the Cloudera Data Platform.

According to GuruFocus, Cloudera's cash-to-debt ratio underperforms 53.89% of global competitors while its debt-to-equity ratio outperforms 57.90% of global software companies.

Investor discloses bet against struggling malls

The Wall Street Journal reported on Wednesday that Icahn disclosed a $400 million bet against shopping malls that are unable to payoff debt. CNBC sources added that the nationwide shuttering of stores this year can exacerbate mall owners struggling to drive traffic to their anchor department stores.

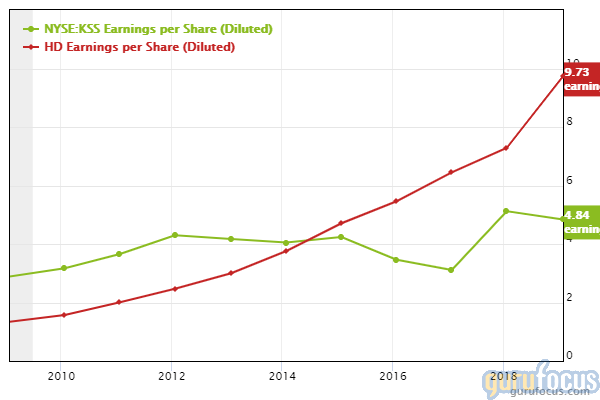

Shares of retailers like The Home Depot Inc. (NYSE:HD), Kohl's Corp. (NYSE:KSS) and Macy's Inc. (NYSE:M) tumbled on Tuesday on the heels of reporting third-quarter earnings results and full-year outlooks that disappointed investors. The Atlanta-based home improvement retailer slashed its full-year revenue growth from 2.3% to 1.8% and comparable sales growth from 4% to 3.5%. Likewise, Kohl's reduced its full-year earnings guidance range from $5.15 to $5.45 to $4.75 to $4.95.

Disclosure: No positions.

Read more here:

Steven Cohen's Top 5 Buys in the 3rd Quarter

Daniel Loeb's Top 5 Buys in the 3rd Quarter

Top 5 Buys of John Rogers' Ariel Investment

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.