Carl Icahn's Top 6 Holdings

According to current portfolio statistics, Carl Icahn (Trades, Portfolio)'s top six holdings as of the second quarter are Icahn Enterprises LP (NASDAQ:IEP), CVR Energy Inc. (NYSE:CVI), Occidental Petroleum Corp. (NYSE:OXY), Herbalife Nutrition Ltd. (NYSE:HLF), Cheniere Energy Inc. (LNG) and Caesars Entertainment Corp. (NASDAQ:CZR).

The New York Post reported Thursday evening that Icahn announced "quietly" to his staff at IEP he will close the New York City and White Plans offices at the end of first-quarter 2020 and open a new office in Miami on April 1, 2020. The activist investor cited in his letter that while heading south was a hard decision to make, he wanted to enjoy his retirement where there is "a warmer climate and a more-casual place year-round."

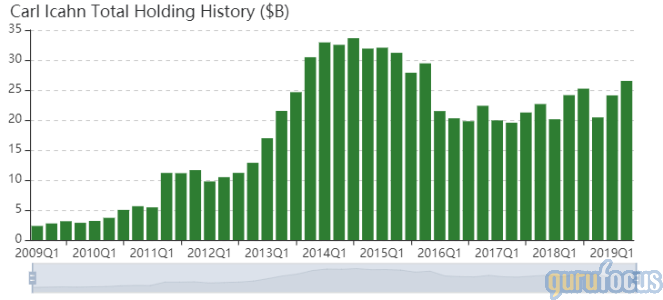

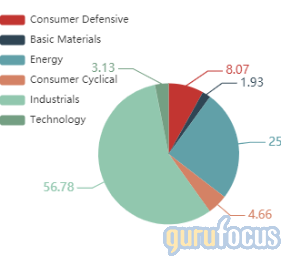

As of the end of the second quarter, Icahn's $26.52 billion equity portfolio contains 16 positions, including a new holding in Occidental. The top three sectors in terms of weight are industrials, energy and consumer staples, with weights of 56.78%, 25.42% and 8.07%. However, the sector weights reflect a 50.60% weight in IEP: Icahn owns 185,333,620 shares of the company where he is chairman of the board.

Icahn seeks out-of-favor companies and pushes for changes to unlock shareholder value. The investor mentions the consensus is generally wrong and that momentum can deteriorate.

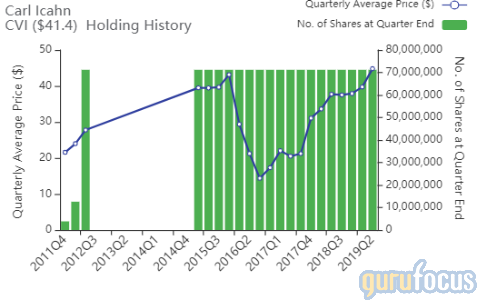

CVR Energy

Icahn owns 71,198,718 shares of CVR Energy, giving the stake 13.42% weight in the equity portfolio. Shares averaged $44.80 during the quarter.

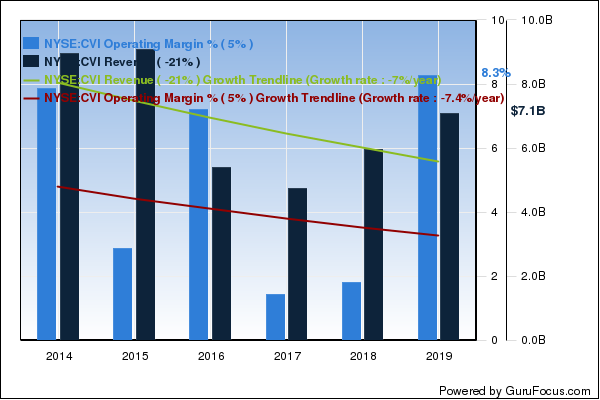

The Sugar Land, Texas-based company engages in petroleum refining and nitrogen fertilizer manufacturing through its holdings in CVR Refining LP and CVR Partners LP. GuruFocus ranks the company's financial strength and profitability 6 out of 10: Even though it has declining revenue and profit margins, CVR has a strong Piotroski F-score of 7 and a solid Altman Z-score of 3.68.

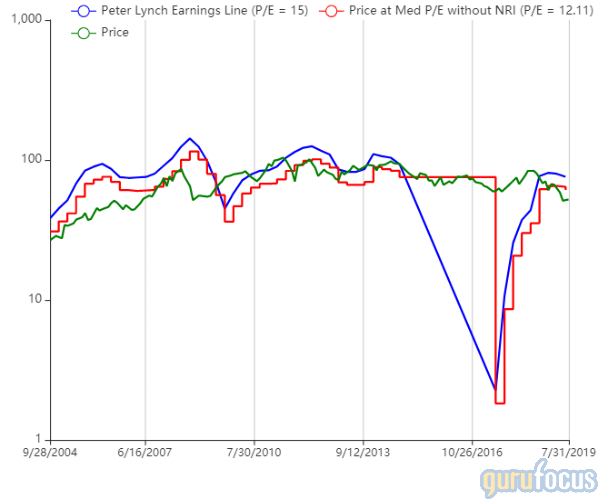

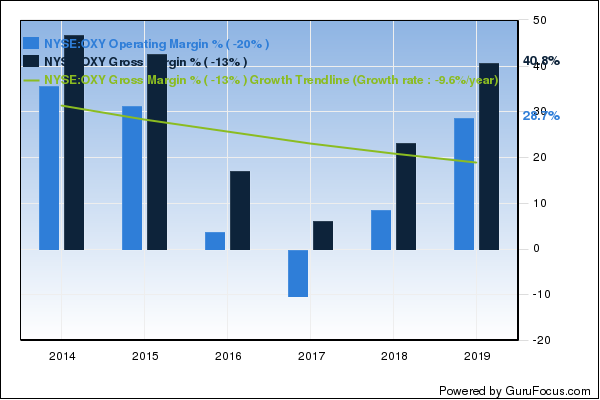

Occidental Petroleum

Icahn owns 33,244,429 shares of Occidental Petroleum, dedicating 6.30% equity portfolio weight to the position. Shares averaged $56.32 during the quarter.

The investor listed in an Aug. 28 letter several concerns regarding the Houston-based company, including the potential for additional mistakes from CEO Vicki Hollub and her board regarding the acquisition of Anadarko Petroleum Corp. (NYSE:APC). Icahn said in a previous letter that Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B) CEO Warren Buffett (Trades, Portfolio) "took her to the cleaners" when he and Hollub reached a deal regarding the financing for the acquisition.

Icahn then mentioned in his latest letter that although Hollub agrees Occidental needs new directors, the stockholders should have the power to elect the directors and not Hollub herself.

GuruFocus ranks Occidental's profitability 7 out of 10: Although the company has a strong Piotroski F-score of 8, its revenue and gross margins have declined over the past five years. Additionally, operating margins are underperforming 50.58% of global competitors.

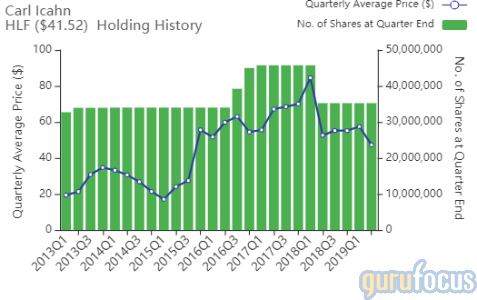

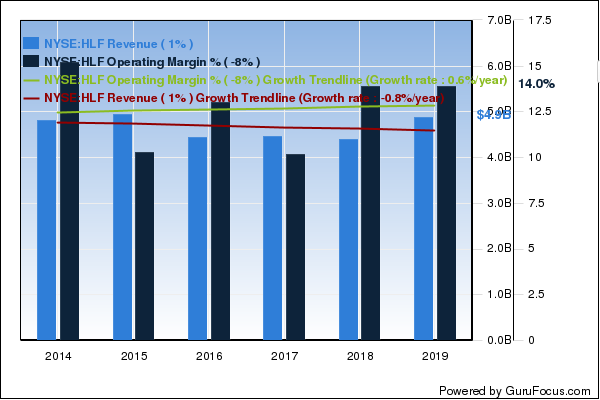

Herbalife

Icahn owns 35,227,904 shares of Herbalife, dedicating 5.68% of the equity portfolio to the holding. Shares averaged $47.33 during the quarter.

Herbalife, the battleground company where Bill Ackman (Trades, Portfolio) took a billion-dollar short position in December 2012, operates five revenue segments: weight management, targeted nutrition, energy, sports and fitness. GuruFocus ranks the company's profitability 8 out of 10: Operating margins have increased approximately 0.60% per year on average over the past five years and are outperforming 74.69% of global competitors. Additionally, Herbalife has a strong Piotroski F-score of 8 and a 2.5-star business predictability rank on the heels of consistent revenue growth.

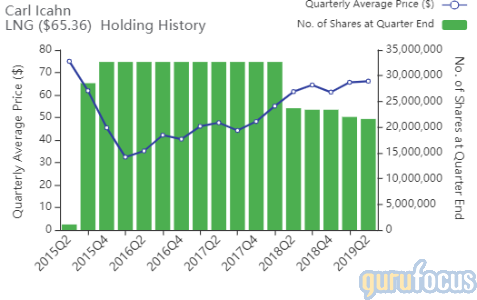

Cheniere Energy

Icahn owns 21,585,094 shares of Cheniere Energy, dedicating 5.57% of the equity portfolio to the stake. Shares averaged $66.15 during the quarter.

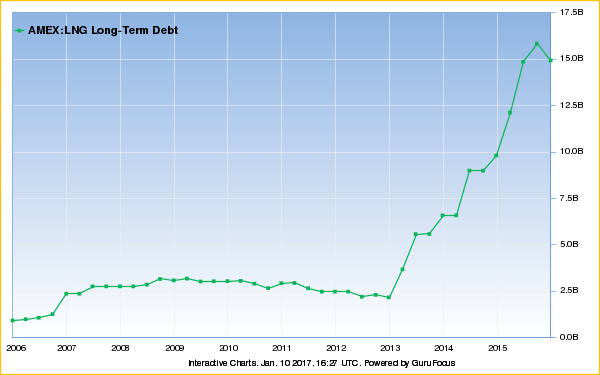

The Houston-based company owns and operates the Sabine Pass liquefied natural gas terminal via its stake in Cheniere Partners. GuruFocus ranks the company's financial strength 3.1 out of 10 on several weak signs, which include poor interest coverage and an Altman Z-score that suggests possible financial distress. The website also warns that Cheniere's long-term debt has increased by $9.9 billion over the past three years.

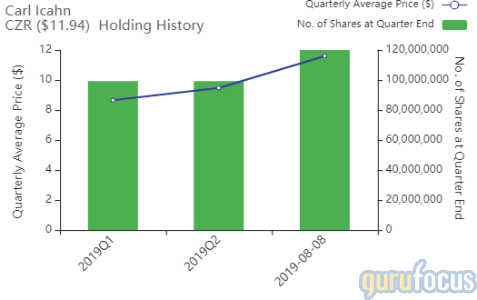

Caesars Entertainment

Icahn owns 119,975,363 shares of Caesars as of Aug. 8 according to GuruFocus Real-Time Picks, a Premium feature.

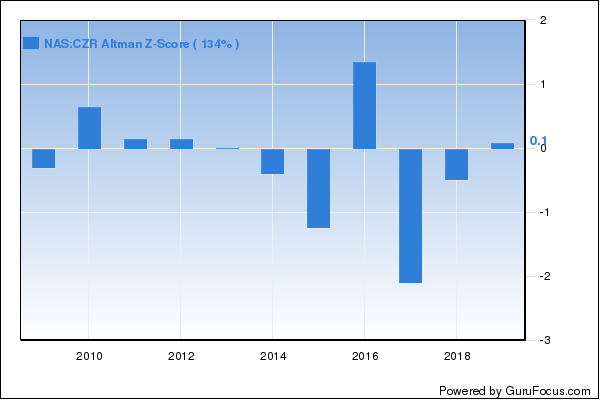

The Las Vegas-based company operates casinos such as Harrah's, Caesars Palace, Bally's, Planet Hollywood, The Flamingo and Paris. GuruFocus ranks Caesars' financial strength 3.1 out of 10 on several warning signs, which include a weak Altman Z-score of 0.67 and debt ratios that underperform over 85% of global competitors. Additionally, Caesars' interest coverage of 0.7 is significantly below Benjamin Graham's safe threshold of five.

Disclosure: No positions.

Read more here:

6 Undervalued-Predictable Chinese Companies

4 5-Star Companies to Consider as Dow Eclipses 27,000

5 Apparel and Footwear Manufacturing Companies Gurus Agree On

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.