Carter's (CRI) Q2 Earnings & Sales Beat Estimates, View Up

Carter's, Inc. CRI reported impressive second-quarter 2021 results, wherein the bottom and top lines advanced year over year. Results gained from improved demand for its products, particularly in stores, driven by store re-openings, acceleration of the vaccine program and relaxing of pandemic restrictions. Better marketing, enhanced pricing and robust product portfolio also contributed to the quarterly growth.

The company continued to witness healthy demand, particularly for babywear, from a few of its largest customers like Target TGT, Amazon AMZN and Walmart WMT.

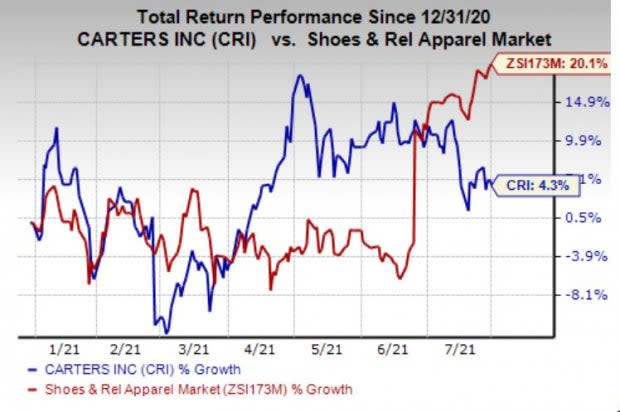

Driven by such upsides, management lifted the 2021 view. Shares of the Zacks Rank #2 (Buy) company have gained 4.3% year to date compared with the industry’s growth of 20.1%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Q2 Highlights

Carter’s reported second-quarter 2021 adjusted earnings of $1.67 per share, surpassing the Zacks Consensus Estimate of 72 cents. The figure surged more than three-fold to 54 cents reported in the prior-year quarter. The metric also grew more than 70% from second-quarter 2019 .

Net sales increased 45% to $746.4 million and exceeded the Zacks Consensus Estimate of $706 million. The uptick can be attributable to growth across all segments, particularly the retail segment. Favorable currency movements of $8 million aided the top-line growth. The company also highlighted that the top line came ahead of the second-quarter 2019 performance.

The company’s global e-commerce business witnessed growth of more than 60% in the first half of 2021 as compared to the first half of 2019. Management expanded its omnichannel facilities to include curbside pickup, same-day pickup and ship-from-store. More than 30% of online orders were fulfilled by stores. It also launched a new mobile app and is investing in RFID capabilities. The rollout of RFID is likely to be completed by this fall and be accretive to the fourth quarter and 2022 results.

Segmental Sales

Sales at the U.S. Retail segment rose 34% year over year to $423.6 million, driven by sturdy store performance and better pricing.

The U.S. Wholesale segment sales witnessed a rise of 53% to $231.6 million owing to strength in its flagship Carter's brand. OshKosh and Skip Hop brands as well as the baby apparel category also performed well.

The International segment witnessed 93% growth in revenues to $91.1 million in the second quarter, driven by improved performance across Canada and Mexico, which more than offset the impacts of store closures. Expanded omnichannel capabilities in Canada and Mexico as well as strength in the Simple Joys brand remained upsides.

Margins

Gross profit surged 56.6% year over year to $368.7 million, while gross margin expanded 370 basis points (bps) to 49.4%. This marked the fifth consecutive quarter of a gross-margin expansion. The uptick can be attributable to sturdy demand for its products, fewer promotions in the retail unit, recovery in demand for Carter's core brand, better product margins and reduced product costs. On the flip side, higher transportation costs due to supply-chain disruptions acted as a deterrent. The metric also expanded 540 bps as compared to second-quarter 2019.

Adjusted SG&A expenses rose 33.8% to $264.9 million in the quarter due to higher store payroll expenses, a rise in marketing expenses and the resumption of employee compensation. As a percentage of sales, S&A expenses contracted 300 bps to 35.5%.

The company’s adjusted operating income skyrocketed 168.6% year over year to $110.4 million in the reported quarter. Adjusted operating margin expanded 680 bps to 14.8% in the quarter under review, driven by solid demand, improved margins stemming from pricing efforts and lower expenses.

Balance Sheet & Shareholder-Friendly Moves

Carter’s ended the second quarter with cash and cash equivalents of $1,120.9 million, net long-term debt of $990.4 million and shareholders’ equity of $1,097.5 million. In the said quarter, the company provided a cash flow of $49.5 million for operating activities.

The company has $746 million remaining under its revolving credit facility. It boasts liquidity of $1.87 billion at the end of the reported quarter.

During the second quarter, Carter’s board approved a quarterly dividend of 40 cents per share. Also, it incurred capital expenditures of $20.5 million in the reported quarter.

Carters, Inc. Price, Consensus and EPS Surprise

Carters, Inc. price-consensus-eps-surprise-chart | Carters, Inc. Quote

Outlook

Driven by the solid quarterly results, management raised the 2021 guidance. The company now anticipates sales to grow roughly 15%, up from the earlier guided view of almost 10%. Earnings are now envisioned to rise nearly 75% year over year compared to the prior view of 40% for 2021. Adjusted operating income is likely to be $475 million, up from the prior year’s reported figure of $279.8 million. This guidance includes $5 million of costs related to additional protective equipment and cleaning supplies, and $3 million of restructuring costs.

The company also issued an upbeat third-quarter view, wherein it expects sales to be nearly $960 million. Adjusted earnings are envisioned to be roughly $1.60 per share with adjusted operating income of $110 million. This view is inclusive of $1 million of pandemic-related costs. It also noted that the third quarter has started on a solid note.

It revealed plans to invest more in e-commerce capabilities, advanced technology, marketing efforts and employee compensation. Improved product assortment, better inventory and government stimulus are also likely to be accretive to the second-half 2021 results. Management also highlighted that sales and gross profit are likely to be higher in the second half of 2021. It plans to close roughly 100 low-margin stores in 2021. Closure of these low-productivity stores is likely to benefit the bottom line and margins in 2021.

However, elevated expenses stemming from faster delivery from Asia in order to meet the growing demand and cover up for production delays due to the pandemic along with supply-chain disruptions, rising transportation costs, international demand, changes in the timing of wholesale shipments, permanent store closures, increased investments in marketing, higher wages and a 53-week fiscal year in 2020 are expected to hurt the company’s performance in the second half of 2021.

Business Development

The company rebranded its core baby assortment from Little Baby Basics to My First love collection in June with its first live digital shopping event on carters.com and received positive customer feedback for the same in both stores and online. Its Age Up strategy also remains a key growth driver for its retail unit. The expansion of age and size ranges has been garnering customers’ attention. Going ahead, Carter’s intends to launch its Little Planet brand, which focuses on organic materials and sustainability, on Amazon in spring 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Carters, Inc. (CRI) : Free Stock Analysis Report

To read this article on Zacks.com click here.