Carvana (CVNA) Up 19.4% Since Lower Q4 Loss and Sales Beat

Carvana Co CVNA extended its rally for the third straight day yesterday, following solid fourth-quarter 2020 results unveiled on Feb 25, after the closing bell. Over the past three trading sessions, the shares of the automotive e-retailer rallied more than 19%. Not only did the company post a narrower year-over-year loss on the back of higher salesbut also delivered a comprehensive beat in the quarter under review.

Carvana reported fourth-quarter 2020 loss per share of 41 cents, narrower than the Zacks Consensus Estimate of a loss of 48 cents. Higher-than-anticipated sales across all of the company’s segments led to this narrower-than-expected loss. The reported loss is also significantly narrower than the year-ago quarter’s loss of 79 cents per share.

During the fourth quarter, total revenues were $1,826 million, surpassing the Zacks Consensus Estimate of $1,595 million. Moreover, the top-line figure increased from the year-ago sales of $1,104 million.

During the December-end quarter, the number of vehicles sold to retail customers jumped 43% to 72,172 compared with the prior-year period’s 50,370. Total gross profit amounted to $243.8 million, up a whopping 70.8% year over year. SG&A expenses were $342.6 million, up 41.8% year on year.

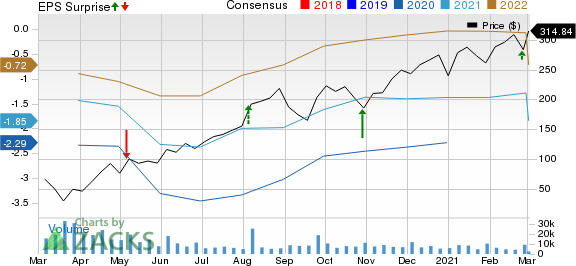

Carvana Co. Price, Consensus and EPS Surprise

Carvana Co. price-consensus-eps-surprise-chart | Carvana Co. Quote

Segmental Performance

Used vehicle sales totaled $1,495.4 million in the fourth quarter,surging 57.4% year over year. The sales figure also beat the Zacks Consensus Estimate of $1,299 million. Gross profit for used vehicle amounted to $91.3 million, climbing 36.7% year over year. However, the reported figure missed the Zacks Consensus Estimate of $111 million.

For the reported quarter, wholesale vehicle sales totaled $186.3 million, soaring 135.5% year over year. The figure also beat the consensus mark of $110 million. Gross profit for wholesale vehicle came in at $7.8 million, up a whopping 524.7% year over year. The metric also outpaced the consensus mark of $7.4 million.

For the October-December period, other sales and revenues climbed 94.3% year over year to $144.7 million. The figure also surpassed the Zacks Consensus Estimate of $126 million. Gross profit came in at $144.7 million, surging from $74.5 million in the comparable year ago period. In addition, the metric outpaced the Zacks Consensus Estimate of $102 million.

Other Tidbits

Notably, the company had cash and cash equivalents of $300.8 million as of Dec 31, 2020, as compared with $76 million as on Dec 31, 2019. Long-term debt amounted to $1,617 million as of Dec 31, 2020, up from the $883.1 million recorded as of Dec 31, 2019. Carvana currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In light of the encouraging progress made by Carvana— which shares space with TrueCar Inc. TRUE, CarGurus, Inc. CARG and Vroom, Inc. VRM —on production capacity, management expects robust growth in 2021. The company expects gross profit per unit in the mid-$3,000 level in 2021 as compared with $3,252 recorded in 2020.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research