How Central Garden & Pet Company’s (NASDAQ:CENT) Earnings Growth Stacks Up Against The Industry

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

In this commentary, I will examine Central Garden & Pet Company’s (NASDAQ:CENT) latest earnings update (29 December 2018) and compare these figures against its performance over the past couple of years, as well as how the rest of the household products industry performed. As an investor, I find it beneficial to assess CENT’s trend over the short-to-medium term in order to gauge whether or not the company is able to meet its goals, and ultimately sustainably grow over time.

View our latest analysis for Central Garden & Pet

Commentary On CENT’s Past Performance

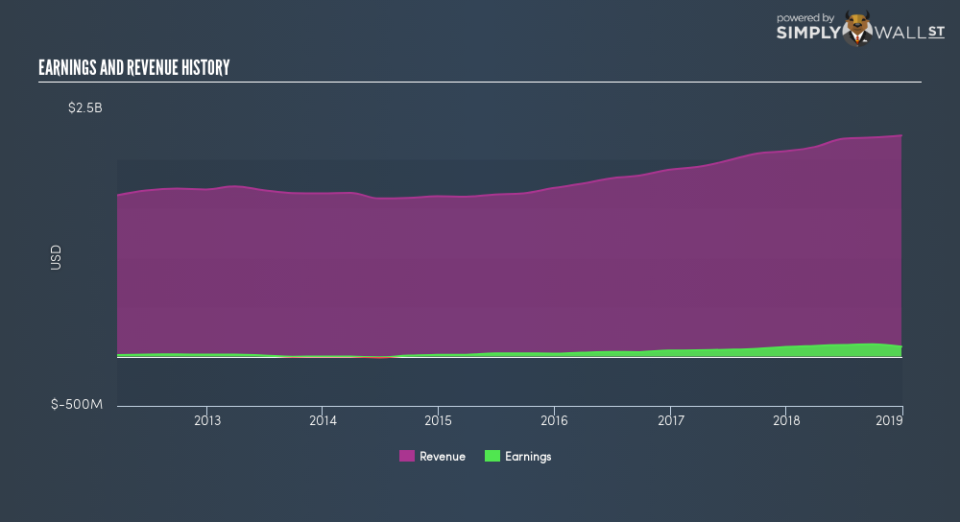

CENT’s trailing twelve-month earnings (from 29 December 2018) of US$99m has increased by 2.0% compared to the previous year.

However, this one-year growth rate has been lower than its average earnings growth rate over the past 5 years of 49%, indicating the rate at which CENT is growing has slowed down. Why could this be happening? Well, let’s take a look at what’s transpiring with margins and whether the whole industry is experiencing the hit as well.

In terms of returns from investment, Central Garden & Pet has fallen short of achieving a 20% return on equity (ROE), recording 10% instead. Furthermore, its return on assets (ROA) of 7.0% is below the US Household Products industry of 8.4%, indicating Central Garden & Pet’s are utilized less efficiently. And finally, its return on capital (ROC), which also accounts for Central Garden & Pet’s debt level, has declined over the past 3 years from 11% to 9.1%.

What does this mean?

Central Garden & Pet’s track record can be a valuable insight into its earnings performance, but it certainly doesn’t tell the whole story. Companies that have performed well in the past, such as Central Garden & Pet gives investors conviction. However, the next step would be to assess whether the future looks as optimistic. You should continue to research Central Garden & Pet to get a better picture of the stock by looking at:

Future Outlook: What are well-informed industry analysts predicting for CENT’s future growth? Take a look at our free research report of analyst consensus for CENT’s outlook.

Financial Health: Are CENT’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you. Check out our financial health checks here.

Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

NB: Figures in this article are calculated using data from the trailing twelve months from 29 December 2018. This may not be consistent with full year annual report figures.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.