Century Aluminum (CENX) Q1 Earnings and Sales Lag Estimates

Century Aluminum Company CENX reported net loss of $140 million or $1.55 per share in first-quarter 2021, wider than net loss of $2.7 million or 3 cents per share in the year-ago quarter. The bottom line in the reported quarter was affected by $87.4 million of exceptional items.

Barring one-time items, adjusted loss was 54 cents per share, wider than the Zacks Consensus Estimate of a loss of 32 cents.

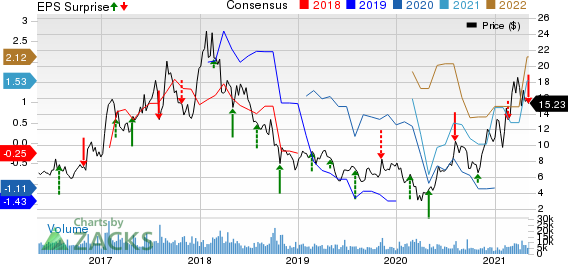

Century Aluminum Company Price, Consensus and EPS Surprise

Century Aluminum Company price-consensus-eps-surprise-chart | Century Aluminum Company Quote

Revenues and Shipments

The company generated net sales of $444 million in the first quarter, up around 5% year over year. The figure missed the Zacks Consensus Estimate of $458.8 million. Sales increased 14% sequentially on higher aluminum prices and regional premiums.

Shipments of primary aluminum were 195,697 tons, down around 4% year over year.

Financials

At the end of the quarter, the company had cash and cash equivalents of $26.3 million, down 82% year over year.

Net cash used in operating activities was $49.8 million for the quarter.

Outlook

Century Aluminum stated that it is seeing continued improvement in industry conditions, which reflects the pace and level of general manufacturing activity. The global primary aluminum market is in balance while global inventories continue to decline, the company noted. Century Aluminum also said that the availability of prompt metal units in its major markets remains constrained due to strong demand and limited global capacity additions.

Price Performance

Shares of Century Aluminum have surged 229.1% in the past year compared with 119.3% rise of the industry.

Zacks Rank & Key Picks

Century Aluminum currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks worth considering in the basic materials space include Nucor Corporation NUE, Dow Inc. DOW and Impala Platinum Holdings Limited IMPUY.

Nucor has a projected earnings growth rate of 228.4% for the current year. The company’s shares have rallied around 134% in a year. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Dow has a projected earnings growth rate of 261.5% for the current year. The company’s shares have shot up around 110% in a year. It currently sports a Zacks Rank #1.

Impala Platinum has an expected earnings growth rate of 197.6% for the current fiscal. The company’s shares have surged around 226% in the past year. It currently carries a Zacks Rank #1.

+1,500% Growth: One of 2021’s Most Exciting Investment Opportunities

In addition to the stocks you read about above, would you like to see Zacks’ top picks to capitalize on the Internet of Things (IoT)? It is one of the fastest-growing technologies in history, with an estimated 77 billion devices to be connected by 2025. That works out to 127 new devices per second.

Zacks has released a special report to help you capitalize on the Internet of Things’s exponential growth. It reveals 4 under-the-radar stocks that could be some of the most profitable holdings in your portfolio in 2021 and beyond.

Click here to download this report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nucor Corporation (NUE) : Free Stock Analysis Report

Dow Inc. (DOW) : Free Stock Analysis Report

Impala Platinum Holdings Ltd. (IMPUY) : Free Stock Analysis Report

Century Aluminum Company (CENX) : Free Stock Analysis Report

To read this article on Zacks.com click here.