i.century Holding (HKG:8507) Has Debt But No Earnings; Should You Worry?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that i.century Holding Limited (HKG:8507) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for i.century Holding

What Is i.century Holding's Net Debt?

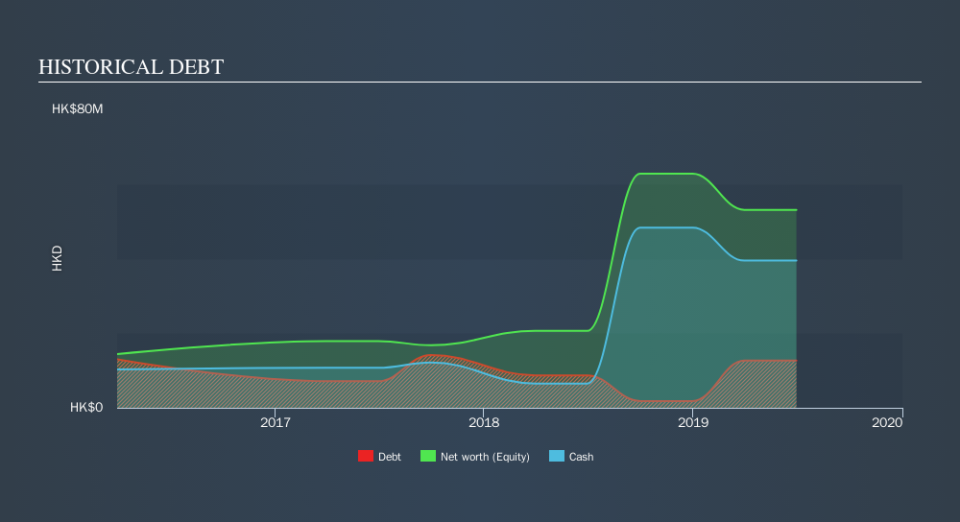

You can click the graphic below for the historical numbers, but it shows that as of March 2019 i.century Holding had HK$12.7m of debt, an increase on HK$8.70m, over one year. However, it does have HK$39.5m in cash offsetting this, leading to net cash of HK$26.8m.

How Healthy Is i.century Holding's Balance Sheet?

According to the last reported balance sheet, i.century Holding had liabilities of HK$33.0m due within 12 months, and liabilities of HK$358.0k due beyond 12 months. Offsetting these obligations, it had cash of HK$39.5m as well as receivables valued at HK$17.1m due within 12 months. So it can boast HK$23.2m more liquid assets than total liabilities.

This surplus liquidity suggests that i.century Holding's balance sheet could take a hit just as well as Homer Simpson's head can take a punch. With this in mind one could posit that its balance sheet is as strong as beautiful a rare rhino. Simply put, the fact that i.century Holding has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is i.century Holding's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year i.century Holding had negative earnings before interest and tax, and actually shrunk its revenue by 4.0%, to HK$118m. That's not what we would hope to see.

So How Risky Is i.century Holding?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And in the last year i.century Holding had negative earnings before interest and tax (EBIT), truth be told. Indeed, in that time it burnt through HK$21m of cash and made a loss of HK$15m. But at least it has HK$26.8m on the balance sheet to spend on growth, near-term. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. For riskier companies like i.century Holding I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.