CF Industries (CF) Up 21% in 3 Months: What's Driving It?

Shares of CF Industries Holdings, Inc. CF have gained around 20.7% in the past three months. The company has also outperformed the industry’s decline of roughly 2.7% over the same time frame.

CF Industries, a Zacks Rank #3 (Hold) stock, has a market cap of around $10.7 billion. Average volume of shares traded in the past three months was around 2,437.5K. The company has expected long-term earnings per share (EPS) growth rate of 6%.

Let’s take a look into the factors that are driving this fertilizer company.

Driving Factors

Forecast-topping earnings performance in the second quarter and upbeat outlook have driven the company’s shares.

CF Industries’ adjusted EPS went up more than two-fold year over year to $1.28 in the second quarter. It also topped the Zacks Consensus Estimate of 81 cents.

Net sales rose 15.5% year over year to $1,502 million, mainly driven by higher average selling prices across all major products. The figure also beat the Zacks Consensus Estimate of $1,373 million.

The company stated that it is optimistic about the nitrogen fertilizer industry and expects fundamental factors to be positive in the near and the long term.

It expects demand for nitrogen in North America to remain strong in the near term. This is expected to result from the impact of adverse planting and growing conditions in many parts of the United States in 2019. Historic flooding is expected to reduce corn production in 2019 due to considerably lower planted acres and yields. The company expects this to create a strong price incentive for farmers in the United States, which will boost planted corn acres considerably over the next two seasons.

Globally, demand for urea from Brazil and India are expected to stay strong over the next two years. Per the company, through the end of June 2019, urea imports to India were 3.5 million metric tons, up 11% year over year. Moreover, urea imports to Brazil for 2019 are expected to rise.

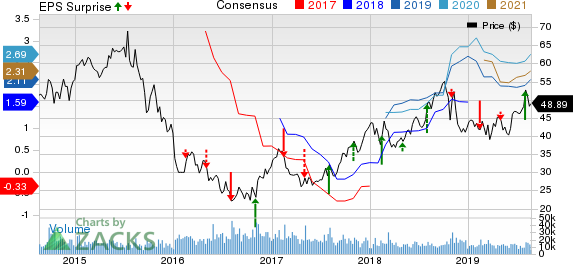

CF Industries Holdings, Inc. Price, Consensus and EPS Surprise

CF Industries Holdings, Inc. price-consensus-eps-surprise-chart | CF Industries Holdings, Inc. Quote

Stocks to Consider

Some better-ranked stocks worth a look in the basic materials space are Kinross Gold Corporation KGC, Alamos Gold Inc AGI and Arconic Inc ARNC, all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Kinross has an expected earnings growth rate of 150% for 2019. The company’s shares have surged 62.6% in the past year.

Alamos Gold has projected earnings growth rate of 320% for the current year. The company’s shares have rallied 65% in a year’s time.

Arconic has an estimated earnings growth rate of 50% for the current year. Its shares have moved up 18.7% in the past year.

It’s Illegal in 42 States, But Investors Will Make Billions Legally

In addition to the companies you read about above, today you get details on the newly-legalized industry that’s tapping into a “habit” that Americans spend an estimated $150 billion on every year.

That’s twice as much as they spend on marijuana, legally or otherwise.

Zacks special report revealing how investors can profit from this new opportunity. As more states legalize this activity, the industry could expand by as much as 15X. Zacks’ has just released a Special Report revealing 5 top stocks to watch in this space.

See these 5 “sin stocks” now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CF Industries Holdings, Inc. (CF) : Free Stock Analysis Report

Alamos Gold Inc. (AGI) : Free Stock Analysis Report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report

Arconic Inc. (ARNC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research