Charles Schwab Review

Long before investing disruptors E-Trade and Betterment came on the scene, there was Charles Schwab & Co., Inc. A maverick since its inception in 1973, Charles Schwab brokerage cut its fees by half when the Securities and Exchange Commission (SEC) deregulated the securities industries. Today, the company is a full-service brokerage and investment advisor. It continues to innovate, offering online access, 24-hour client support, no-commission online U.S. stock trades – and most recently, the ability to trade fractions of stocks.

Investor’s Business Daily named Charles Schwab, which has 12 million brokerage customers, the “#1 Broker Overall” in its 2019 survey. Also in 2019, StockBrokers.com named the brokerage firm “Best in Class Overall,” and Fortune ranked the brokerage firm #1 for “Innovation in Key Attributes of Reputation” within the securities and asset management category of its annual list of world’s most admired companies.

Charles Schwab Overview Pros – Full-service broker

– No-commission equity, ETF & option online trades- Gold-standard customer service Cons – $25 service charge for broker-assisted trades

– Overwhelming number of services and options Best For – Sophisticated online traders

– New investors who can afford to pay for assistance Drawbacks – Brokers are held to FINRA’s suitability standard rather than a fiduciary standard Fees Under Charles Schwab

To stay competitive with newcomer e-brokers and free investing apps, Charles Schwab announced in October 2019 that it was cutting its online U.S. stock trade commission from $4.95 to $0. It also eliminated its commissions for exchange-traded funds (ETFs) and options. One of the first volleys in the no-commission digital brokerage wars, the move has since caused TD Ameritrade, E-Trade, Ally Invest and Fidelity to follow suit. (Charles Schwab has since upped the ante, announcing that it would allow clients to buy fractional shares of stocks.)

As you would expect of the original discount broker, Charles Schwab’s fees are on the low end, particularly for online trades. Its service charge for broker-assisted trades has come down to $25, which is standard for other large brokerages, but high compared to investing apps like Robinhood that charge $0. It also charges up to $49.95 for each purchase of a mutual fund that is not part of its family or network of mutual funds. It has no fees or minimums for opening an account, however.

Charles Schwab Transaction Fees Trade Type Rates Stock & ETF – Online: $0

– Automated phone trades: $5

– Broker-assisted: $25 service charge Schwab Funds and Funds through Schwab Mutual Fund OneSource – Online: $0

– Automated phone trades: $0

– Broker-assisted: $25 service charge Other Mutual Funds – Online: u p to $49.95 per purchase

– Automated phone trades: u p to $49.95 per purchase

– Broker-assisted: Online pricing + $25 service charge Options – Online: $0 + $0.65 per contract

– Automated phone trades: $0+ $0.65 per contract + $5 service charge

– Broker-assisted: 0 + $0.65 per contract + $25 service charge Futures and Futures Options – Online: $1.50 per contract

– Broker-assisted: bonds: $1.50 per contract Treasuries – Online: $0

-Broker-assisted: $25 service charge Other Secondary Trades – Online: $1 per bond; $10 min; $250 max

– Broker-assisted: Online pricing + $25 service charge Preferred Stocks & REITs – Online: $0

– Automated phone trades: $0

– Commission-free ETF short-term trading: $13.90

– Broker-assisted: $25 service charge

The U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) impose their own transaction fees. These are far smaller than typical commissions and service charges (less than a penny per share) and are only significant when you’re trading large blocks of shares.

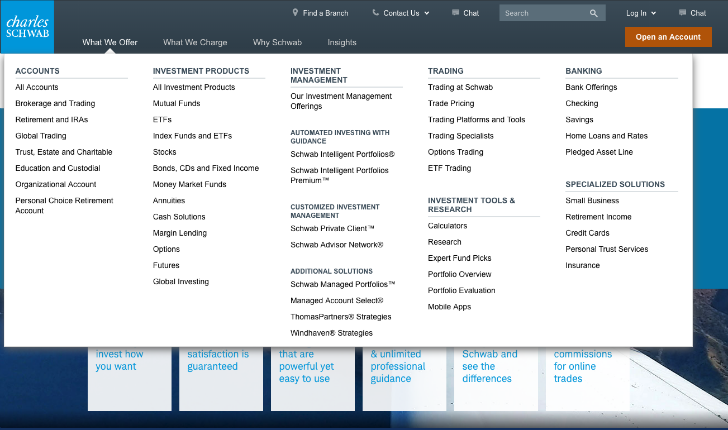

Charles Schwab Services & Features

Charles Schwab’s services are as full and comprehensive as you would expect from one of the oldest and largest brokerages in the country. It provides access to the investing universe; proprietary online research for experienced investors; educational resources for rookies; online access to accounts; robo-investing and more. For people who need help designing and implementing portfolios and want the human touch, the brokerage provides a plethora of choices: from its own advisors to affiliate advisors to affiliate firms. You can also use SmartAsset’s free pro matching tool to find a financial advisor near you.

In fact, if there is one criticism to be made of Charles Schwab’s services, it’s that there are so many options that you don’t even know where to start. This is particularly true if you are entirely new to investing and don’t know what you need – and what you don’t know that you don’t need. The company does offer 24-hour telephone and e-chat help, but keep in mind that representatives are ultimately there to help open accounts and drive sales.

If you are an experienced investor, though, you will probably appreciate the platform, proprietary research – and no-commission trades. If you are not sure about what you are doing, you would probably benefit from hiring a financial advisor – or at least talking to a few. That way, you at least have something to compare Schwab advisors against. Our financial advisor firm reviews can give you some context, and our free tool will match you with up to three advisors, based on your needs.

Charles Schwab Services & Features Feature/Service Details Online Research – Earnings reports and news (from Reuters, Briefing.com and more)

– Daily or weekly commentaries (from Morningstar, Credit Suisse, Ned Davis, Argus, and Market Edge)

– Schwab Equity Ratings and third-party reports

– Morningstar Rating for mutual funds and ETFs

– Schwab BondSource (with ratings from Standard & Poor’s and Moody’s)Market Edge®: current market and technical analysis Online Tools – Customizable trading platform and portfolio overview

– Portfolio evaluation (compares your portfolio to benchmarks)

– Schwab Mobile app Automated Investing with Guidance – Schwab Intelligent Portfolios

– Schwab Intelligent Portfolios Premium Customized Investment Management – Schwab Private Client

– Schwab Advisor Network

– Schwab Managed Portfolios

– Managed Account Select

– ThomasPartners Strategies

– Windhaven Strategies Educational Resources -Online articles, OnInvesting magazine, podcasts, webcasts, special events, branch workshops Available Investment Products – Mutual Funds; ETFs; Stocks; Bonds, CDs and Fixed Income; Money Market Funds; Annuities; Cash Solutions; Margin Lending; Options; Futures and Global Investing Charles Schwab Online Experience

There’s a very good reason that StockBrokers.com awarded Charles Schwab “Best in Class” for its platform and tools. Its website has all the bells and whistles you would want – watchlists, fundamental and technical research, charting, screening and more. It is designed for sophisticated investors, but it has an intuitive design so that less sophisticated DIYers can explore and learn.

When you start, you are looking at the simplest dashboard – an overview of your accounts – and as you tab over, you will be in windows that offer more and more technical functionality with options like Bollinger rings and 20-day moving charts. If you have the time and inclination, you can apply the analytical tools that professional stock-pickers use. If you don’t, you can be in, place your trade and be out.

Charles Schwab offers the option of downloading its software or accessing its cloud-based platform over the Internet. The downloadable version is for PCs only. To work on your computer, you’ll need:

an operating system that is Windows 8.1 or later (Windows 10 or later is recommended)

a CPU of IntelCore i5 or higher (Intel Core i7/AMD FX 8150 or faster is recommended)

memory of 2 GB RAM or higher (4 GB RAM or higher)

disk space of 200 MB hard drive space

graphics of 512 MB Video card or higher (1 GB Video card or higher )

download speed of 10+ Mbps (15+ is recommended).

The PC computer requirements for online users are:

an operating system of Windows 7 with Service Pack 1 (Windows 8.1 or later is recommended)

Internet Explorer, Safari or Firefox browser

an internet connection of 5+ Mbps (10+ is recommended while wireless is not recommended).

For online users with Macs, the requirements are:

an operating system of Mac OS X 10.5 or higher

Internet Explorer, Safari or Firefox browser

an internet connection of 5+ Mbps (10+ is recommended while wireless is not recommended).

Charles Schwab Mobile Experience

Schwab Mobile, the app, is not as robust as the online platform, of course, but it provides what an investor would need on the go – and then some. In addition to being able to place trades, track your positions and the market and see real-time quotes, you can do such things as livestream CNBC, use analytical tools like technical indicators and overlays and get options ideas from what Schwab calls the “idea hub.” Depending on your device, you may also be able to log into your account with your fingerprint.

The version for iPhones has a 4.8 star rating (from 207,000 ratings), while the version for Androids has a 4.5 star rating (from 11,000 ratings). Schwab Mobile also works on Apple Watches and iPads.

Charles Schwab Customer Support

As you would expect of one of the largest brokerages in the country, Charles Schwab’s customer support is the gold standard. Online help is available 24 hours a day, and the response time was immediate the two times SmartAsset submitted a question. Of course, there’s also an 800 number. For people who just opened an account and prefer to speak on the phone, there’s even a dedicated phone number for new client concierge services.

Additionally, all account holders have free access to trading specialists. Experts in such areas as fixed income, options and futures, these brokers do not provide advice. But they can help you review and evaluate your choices and strategies. If they place a trade for you, however, there will be a $25 service charge.

Who Is Charles Schwab For?

Charles Schwab positions itself as being for every kind of investor, from newbies to savvy, high-volume traders. It offers 24/7 support (and hand-holding) over the phone and internet and in person at its physical branches during business hours. Yet that support is not necessarily free, despite the $0 commissions and $0 account maintenance fees. The free trades are for online ones. If a broker assists you with a transaction, it will come with a $25 service charge. And if you sign on with an investment advisor, there will be annual management fees that are generally charged as a percentage of your invested assets.

Which is all to say that while Charles Schwab offers great customer service, it may actually be the best deal for savvy investors who can place their trades online without any help.

How Does Charles Schwab Compare?

In the race to be the brokerage with the lowest costs, Charles Schwab is leading the pack. That is, it was the first of the big players to eliminate online commissions. But as more brokerages cut their online commissions to $0, the head start is just a head start – in fact, it was just a matter of days.

Instead, the competition seems to be in technological advances. In that regard, Charles Schwab is certainly not letting its age affect its innovation. With its robust online platform and app, the company is holding its own among e-brokers, robo-advisors and apps who are on the cutting edge. But Schwab does have something many of them lack: comprehensive customer support, available 24/7, online and over the phone.

Brokerage Comparison Brokerage Firm Fees Minimum Best For Charles Schwab $0 $0 – Savvy, online investors

-Investors who need guidance and are willing to pay for it Robinhood $0 $0 – Mobile/online traders

– Self-sufficient investors Merrill Edge $6.95 $0 – Desktop traders

– Bank of America account holders Charles Schwab: What’s the Catch?

For all the attention Charles Schwab received for slashing its online commissions to $0, it still has a $25 service charge for broker-assisted trades and a $5 service charge for automated phone trades. Those fees are low compared to what they once were. But they can still hurt if you are a frequent trader (remember: you pay when you buy and when you sell) or your gains are small.

Additionally, while its research tools are impressive, you will need to know something about investing to benefit from them. If you are new to investing, you may be better off calling the firm than looking online, since the options online can be overwhelming.

Charles Schwab Disclosures

With a history as long as Charles Schwab’s, it’s not surprising that it has disclosures on its record: 52 regulatory events, 3 civil events and 223 arbitrations. Fines for regulatory violations ranged from $25 to $57.3 million, and for civil actions, they ranged from $2.8 million to $5 million. Awards for arbitrations of disputes between clients and Charles Schwab ranged from $0 to $758,944.13.

In the arbitrated dispute that involved the largest reward, a trust claimed breach of contract and warranties, among other things, regarding its investment in a Schwab mutual fund. The company denied the allegations, but the FINRA panel ruled that Charles Schwab pay compensatory damages of $604,094, plus the trust’s attorney fees and other costs.

Charles Schwab: Bottom Line

Though one of the oldest and largest brokerages in the country, Charles Schwab is still nimble and at the top of its game, making investing accessible to the masses. It’s doing this by cutting commissions, making fractions of shares available and offering online platforms with powerful analytical tools. At the same time, it’s not letting up on the quality of its customer support.

Tips for Finding a Financial Advisor

Ask how candidates get paid. Advisors whose only compensation is client fees will likely have fewer conflicts of interests than those who also receive commissions. That said, if any advisors say they are fiduciaries, that means they will work in your best interests.

Use SmartAsset’s pro matching tool. Simply answer questions about your financial situation and preferences, and the program will match you with up to three suitable advisors in your area.

Photo Credit: ©Charles Schwab

The post Charles Schwab Review appeared first on SmartAsset Blog.