Charles de Vaulx Exits 4 Stocks, Boosts 2 Holdings in 1st Quarter

Charles de Vaulx (Trades, Portfolio), chief investment officer of International Value Advisors, disclosed this week that he jettisoned four holdings in his IVA Worldwide Fund during the first quarter: Samsung Electronics Co. Ltd. (XKRX:005930), Bank of America Corp. (NYSE:BAC), Goldman Sachs Group Inc. (NYSE:GS) and Z Holdings Corp. (TSE:4689). With the proceeds, de Vaulx boosted the fund's holding in Warren Buffett (Trades, Portfolio)'s conglomerate Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B) and LKQ Corp. (NASDAQ:LKQ).

Prior to joining IVA, de Vaulx managed several funds for First Eagle Investment (Trades, Portfolio) and Sofire Fund Ltd., winning "fund of the year" in 2005 and 2006 for Sofire. The co-winner of Morningstar Inc.'s (NASDAQ:MORN) "International Portfolio Manager of the Year" in 2001 employs a value-oriented approach, seeking investments in stocks with high financial strength, temporarily depressed earnings or entrenched franchises. Additionally, de Vaulx emphasizes fundamental value and invests globally.

Guru updates volatile market environment during the first quarter

De Vaulx said in his quarterly review that the Worldwide Fund returned -19.15% for the three months ending March 31, outperforming the MSCI All Country World Index's return of -21.37%. The fund manager said that although the first two months of the first quarter continued the strong momentum from 2019, driven by trade agreements between the U.S. and China, the coronavirus outbreak in late February to March shattered life "as we know it."

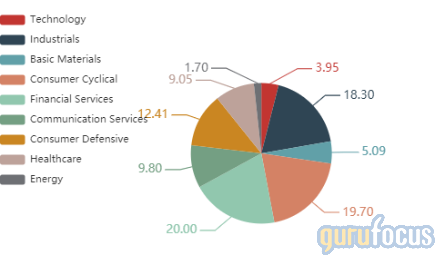

As of the quarter-end, the Worldwide Fund's $2.25 billion equity portfolio contains 71 stocks with a turnover ratio of 24%. The top four sectors in terms of weight are financial services, consumer cyclical, industrials and consumer defensive, representing 20%, 19.7%, 18.3% and 12.41% of the portfolio.

Samsung

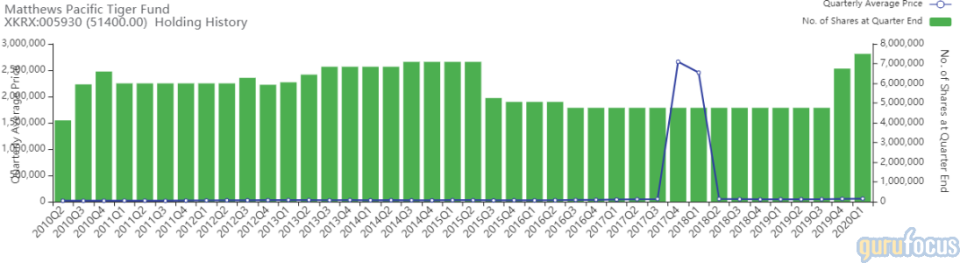

De Vaulx sold 3,024,786 shares of Samsung, trimming the equity portfolio 4.42%. Shares averaged 56,041.50 won ($45.91) during the first quarter.

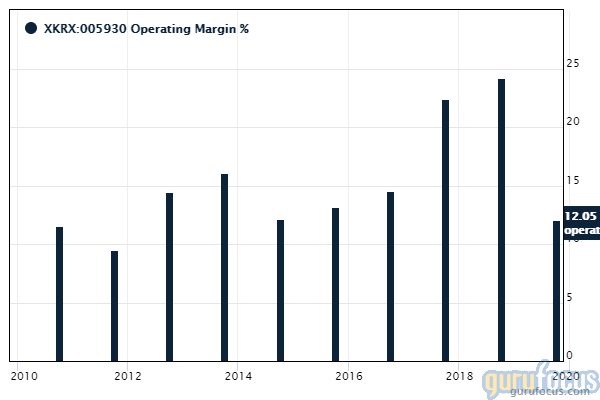

The South Korean consumer electronics giant manufactures a wide range of products, including smartphones, semiconductor chips, printers, home appliances, medical equipment and telecom equipment. GuruFocus ranks Samsung's financial strength and profitability 8 out of 10 on several positive investing signs, which include debt ratios and profit margins that outperform over 85% of global competitors.

Gurus with holdings in Samsung include the Matthews Pacific Tiger Fund (Trades, Portfolio), Sarah Ketterer (Trades, Portfolio)'s Causeway International Value (Trades, Portfolio) Fund and David Herro (Trades, Portfolio)'s Oakmark International Fund.

Bank of America

De Vaulx sold 3,098,276 shares of Bank of America, paring 3.31% of the equity portfolio. Shares averaged $30.21 during the first quarter.

GuruFocus ranks the Charlotte, North Carolina-based bank's financial strength 3 out of 10 on the back of debt ratios underperforming over 66% of global competitors, suggesting high leverage.

Berkshire owns over 925 million shares of Bank of America, making the position its second-largest holding with an 11.19% equity portfolio weight.

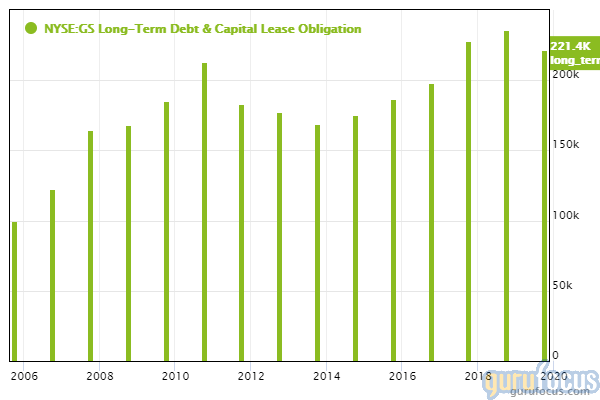

Goldman Sachs

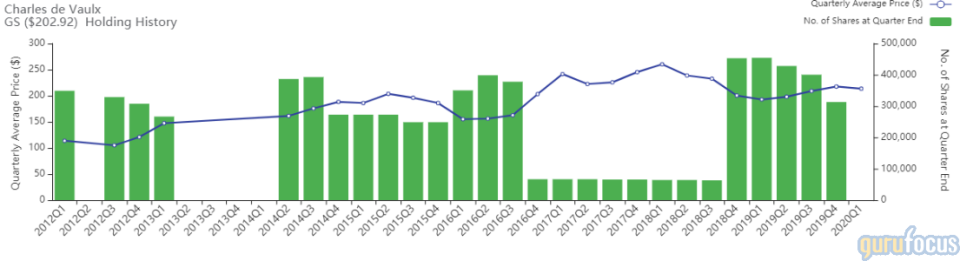

De Vaulx sold 313,055 shares of Goldman Sachs, trimming the equity portfolio 2.18%. Shares averaged $213.50 during the first quarter.

GuruFocus ranks the New York-based investment bank's financial strength 3 out of 10 on the back of increasing long-term debt over the past three years, contributing to debt ratios that are underperforming over 90% of global competitors.

Berkshire sold over 10 million shares of Goldman Sachs during the quarter, leaving just 1,920,180 shares or approximately 16% of its December 2019 holding of 12,004,751 shares.

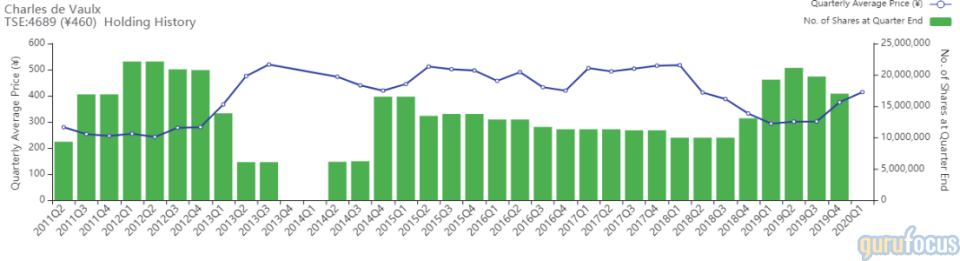

Z Holdings

De Vaulx sold 16,990,400 shares of Z Holdings, trimming 2.16% off the equity portfolio. Shares averaged 413.63 yen ($3.80) during the first quarter.

The Tokyo-based company operates Yahoo Japan, a platform that operates internet services like e-commerce, online travel and online video. GuruFocus ranks the company's profitability 9 out of 10, driven by consistent revenue growth and operating margins that are outperforming over 90% of global competitors despite contracting over the past five years.

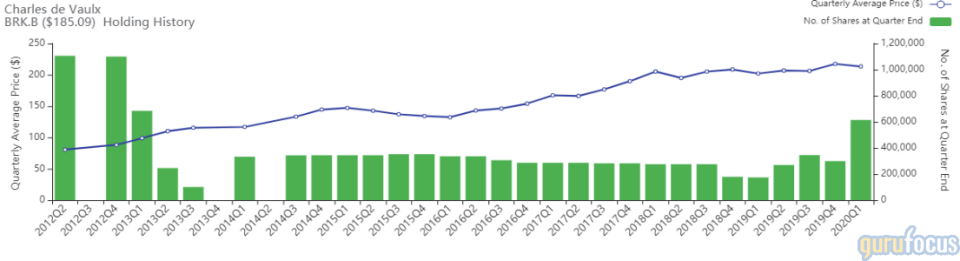

Berkshire Hathaway

De Vaulx purchased 314,938 Class B shares of Berkshire Hathaway, increasing the position 105.39% and the equity portfolio 2.56%. Shares averaged $213.25 during the first quarter.

The Omaha, Nebraska-based insurance conglomerate invests its float in equity securities using a four-criterion approach based on Buffett and Charlie Munger (Trades, Portfolio)'s strategy: strong business predictability, high competitive advantages, no meaningful long-term debt and attractive price-earnings-to-growth valuations.

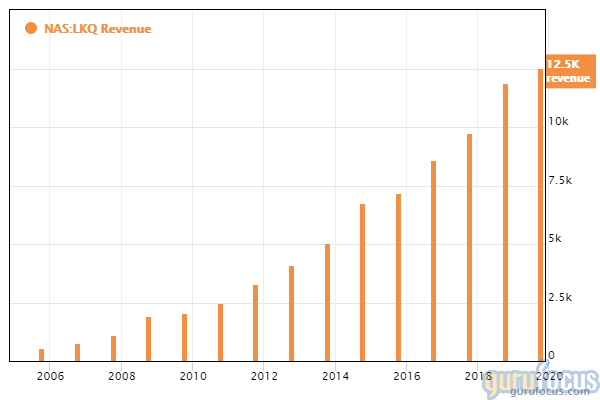

LKQ

De Vaulx purchased 2,819,604 shares of LKQ, increasing the stake 186.72% and the equity portfolio 2.57%. Shares averaged $29.87 during the first quarter.

The Chicago-based company distributes non-OEM automotive parts around the globe. GuruFocus ranks the company's profitability 9 out of 10 on several positive investing signs, which include a high Piotroski F-score of 7 and a 4.5-star business predictability rank.

Disclosure: No positions.

Read more here:

Warren Buffett's Market Indicator Reaches 144% Heading Into June

Michael Burry's Firm Axes Alphabet, Buys 5 Stocks in the 1st Quarter

Carl Icahn Takes Over $1.6 Billion Loss on Embattled Hertz

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.