Charlotte grocers in billion-dollar battle for shoppers. Here’s where we spent the most

Charlotte-region shoppers continue to choose retail giant Walmart for spending their grocery dollars, despite growing competition.

For the fourth year in a row, Walmart captured the most sales revenue compared to any other local grocer, according to a new report by Chain Store Guide. The sales tracking firm gets its data directly from grocery stores.

The hyper-competitive Charlotte grocery store market saw sales hit nearly $9.5 billion last year, a 10% increase from 2021 totals.

Walmart took 24.2% of the grocery market share last year. That’s up from 21.2% in 2021.

Matthews-based grocer Harris Teeter, owned by The Kroger Co., is second with 16.1% market share in 2022 — down from 17.3% in 2021.

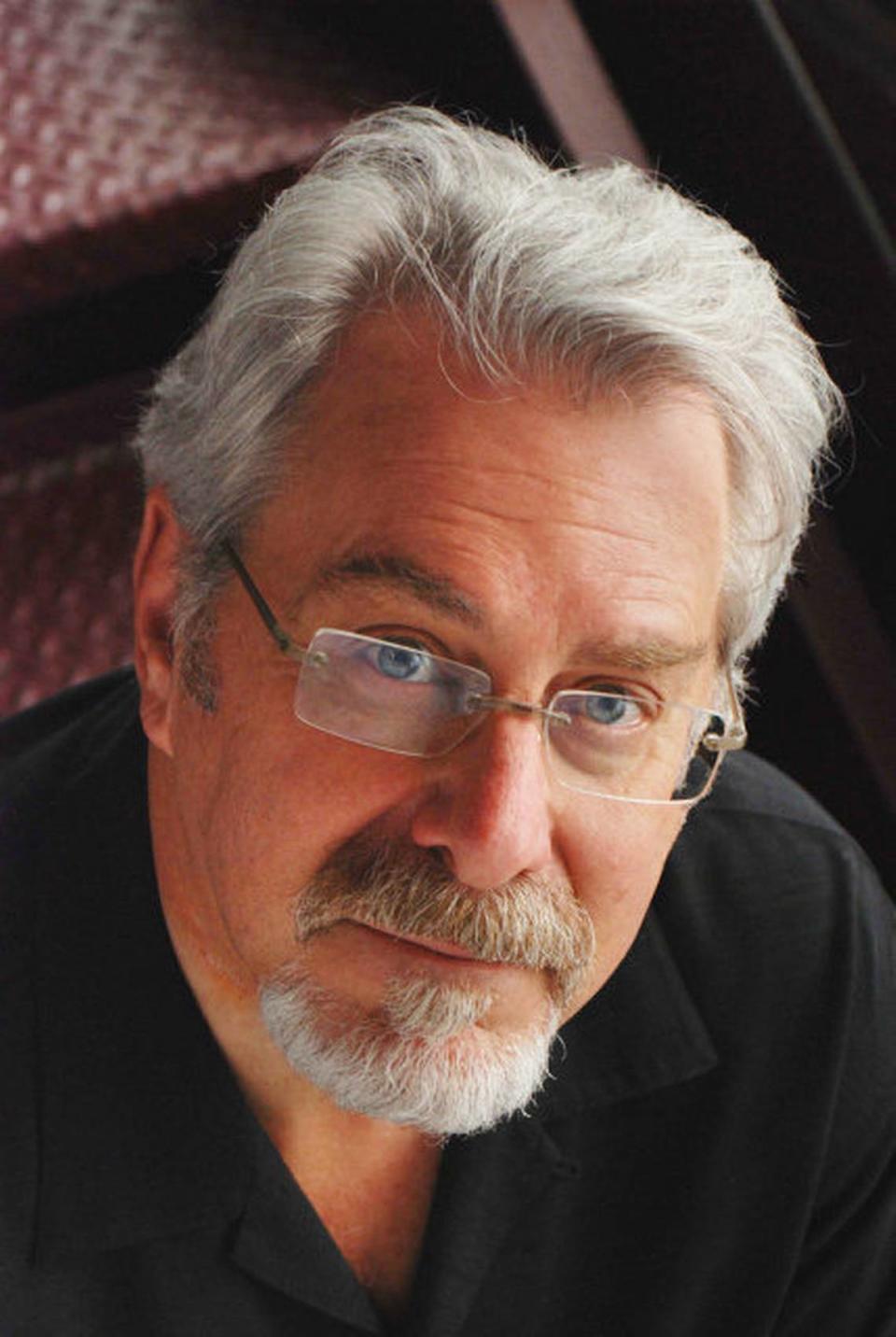

In explaining Walmart’s dominance, “Supermarket Guru” Phil Lempert cited changes in consumer behaviors. People are more concerned about value and looking for more choices, which Walmart has, said Lempert, who analyzes consumer behavior and market trends.

“Walmart has done a phenomenal job building their online presence and making that experience better than it was a year ago,” he added.

Walmart has dominated the Charlotte market share since 2019, knocking Harris Teeter from the No. 1 perch. Harris Teeter had held the top ranking from 2016-2018.

Salisbury-based Food Lion, owned by Ahold Delhaize, has consistently ranked third, taking 13.9% of the market share last year, down from 14.4% in 2021.

Walmart has 32 supercenter stores in the region, up from 28 in 2021, compared to Harris Teeter’s 58 stores, down from 60 in 2021, according to the report. Food Lion’s store count was unchanged at 103 regional stores.

The three chains made up more than half of all local grocery sales last year, despite increased competition from Publix, Lidl and Aldi.

Walmart had $2.3 billion in Charlotte region market sales, followed by Harris Teeter with $1.5 billion and Food Lion at $1.3 billion, according to the report.

The report considers the Charlotte region to include Cabarrus, Gaston, Iredell, Lincoln, Mecklenburg, Rowan and Union counties as well as Chester, Lancaster and York counties in South Carolina.

Inflation’s bite

In addition to demand, another factor contributing to an increase in overall grocery sales was inflation.

Last year, inflation raised prices on nearly everything as global supply chain issues created shortages and purchase limits on some grocery store products. And bird flu was behind the historic high egg prices.

The average price for a dozen large white eggs hit an all-time high in December at $4.25, according to the Consumer Price Index. In Charlotte, the average price for a dozen large eggs skyrocketed 128% over 10 months, according to an Observer analysis in November.

While egg prices have dropped, Lempert warned that other items still could cost more this year, and he expects to see shortages over the next six months. For instance, flooding in California has decimated leafy green crops, like lettuce, Lempert said.

Meanwhile, companies like Coca-Cola also are planning price hikes.

Market share moves

The regional grocery war, with newcomers and expansions, is splintering the market share.

Rounding out the top 10 after Walmart, Harris Teeter and Food Lion were: Publix, 9.2%; Sam’s Club, 6.2%; Cotsco Wholesale, 3%; Lidl, 2.7%; Aldi 2.2%; Dollar General, 2.1%; and Target, 2.1%.

All 10 grocers saw modest increases in market share except Publix, Sam’s Club and Target. Target saw the biggest drop from 4.4% in 2021 as Dollar General jumped into the top 10 for the first time since it tied with Aldi in 2018.

A winner’s been crowned. Here’s your favorite grocery store in the Charlotte area

Dollar stores are becoming big players in the grocery scene, Lempert said. “Dollar stores don’t have the physical infrastructure of traditional grocers,” he said, “so it’s faster, easier and cheaper to build a dollar store.”

After the top 10, here’s how other stores ranked for capturing market share: BJ’s Wholesale Club, 1.9%, Whole Foods Market, 1.7%; Ingles,1.5%; Family Dollar, 1.3%; Trader Joe’s, 0.9%; Earth Fare, 0.8%; Dollar Tree, 0.7%; Fresh Market, 0.6%, Lowes Foods, 0.6%, Compare Foods, 0.4%, and B Robert’s Foods, 0.4%.

Another 106 stores comprise nearly 3% of the market share, down from 110 stores and 3.5% market share in 2021.

‘Disruptors’ of the scene

Lempert called discount grocers like Aldi and Lidl major “disruptors.” That’s an industry term for retailers that have potential to change the market, as in this case, by offering items at lower prices.

Lidl shopper Maria Colgrove of Lake Wylie, South Carolina, said she hits the Steele Creek store weekly because she finds better bargains compared to other stores. She also likes Lidl’s fresh produce and international prepared foods.

“It’s not outrageously expensive,” Colgrove said, who still goes to traditional grocery stores for name-brand items the family prefers such as cereal, peanut butter and coffee.

Colgrove shops with her twin 3-year-old daughters Mia and Penelope, who helped their mom by filling up their own “Future Lidl-er” child-sized shopping carts.

“They enjoy it,” Colgrove said. “It’s a nice culture for all of us.”

Who has the best grocery prices in Charlotte? There’s a new winner out of 11 stores

Charlotte region’s evolving grocery stores

But not all grocers are finding success around the Charlotte region.

In 2021, Southeastern Grocers closed all Bi-Lo and Harveys grocery stores across the Carolinas as part of its bankruptcy restructuring.

Earth Fare closed two of its reopened stores, in Davidson last year and SouthPark in 2021.

And, two online-only grocers that made East Coast debuts in Charlotte have left the market.

In December, Food Rocket began operating in two Circle K stores at 8505 S. Tryon St. and 8008 Harris Station Blvd. In February, the company moved its headquarters to Charlotte from Chicago before closing all operations this month.

In November 2020, Farmstead opened its first East Coast operations in west Charlotte but closed its North Carolina operations last August.

Despite such busts, there still are other grocers joining the fray, including the re-emergence of Winston-Salem based Lowes Foods.

Other grocers are adding stores, too, like Publix, Lidl and family-owned international grocer Super G Mart, which opened its third and largest North Carolina store in December in Pineville.

And specialty grocer Sprouts Farmers Market will open its second Charlotte store in the fall, in the former Steele Creek Earth Fare store.

“Charlotte is one of those markets in the country that is always changing, getting hipper and younger, and those consumers change how we buy our groceries,” Lempert said.

Harris Teeter, for example, said that as consumers’ needs shift and the market changes, it is making innovations in e-commerce and fuel delivery, and expanded offerings.

Last month, Harris Teeter also rebranded with a new logo and tag line to reflect the supermarket’s growth as a more elevated shopping experience with friendly service, neighborhood stores and community service, the company said in a statement to The Charlotte Observer.

Grocers in a competitive market like Charlotte have to keep up with changing consumer tastes.

“It means supermarkets that are mediocre go out of business, and supermarkets that put customer service first, win,” Lempert said. “Heavy competition is always good for the consumer.”

A French-Asian bakery opens second store in Charlotte area inside new Super G Mart