Charlotte small businesses ‘left out in the cold,’ anxious for new shot at fed loans

The 10 days Lori Konawalik waited before she could apply for the federal government’s small business relief program last month felt endless.

Konawalik owns Mac Tabby Cat Cafe in NoDa, and finally received a link in her inbox late on April 15 from Wells Fargo, directing her to apply for a loan through the $349 billion Paycheck Protection Program.

Like other businesses, Mac Tabby had to shut down after Mecklenburg County issued a stay-at-home order on March 24. The Paycheck Protection Program, part of a massive federal stimulus bill, was intended to keep businesses like Konawalik’s afloat.

But as Konawalik sat down the morning of April 16 to complete her application, a headline flashed across her screen: the program that would have helped her cafe reopen was out of money.

Funds were depleted before Konawalik and many other Charlotte business owners could even get their applications in. Others had submitted them, but are unsure whether the applications made it to the Small Business Administration before the money was used up.

Such concerns played out for small businesses across Charlotte and the country. Now, they have another shot: Congress voted last week to replenish the loan program with an additional $320 billion.

Several Charlotte area business owners said they’re anxious but cautiously optimistic that they’ll make the cut this time.

Applications for the second round of funds opened Monday to another rocky start, as multiple media outlets reported that the government’s online systems were crashing throughout the day.

And the bumpy roll out of the loans already has had direct consequences for business owners.

Konawalik said she’s grateful that her customers have purchased merchandise and gift cards, as well as made direct contributions to the cafe. She kept her staff of six on as long as she could, but without the certainty of the Paycheck Protection loan, she couldn’t afford to keep making payroll. So she laid them off on April 17.

Every day, Konawalik tries to figure out ways to earn income and have sufficient funds to reopen.

“It’s not just my business,” she said. “It’s what I live for, what I love.”

Losing hope

Phil Levine woke up at 4 almost every morning throughout the past few weeks, stressing about his application to the Paycheck Protection Program.

Levine’s business, Phil’s Deli, has been a fixture in Charlotte for decades. He’s been banking with BB&T, now Truist, for a majority of that time too.

But as he was filling out the application, he said he couldn’t get any bank representatives to answer his questions. He eventually submitted the application the day before the funding ran out with the help of his accountant and someone he hired to help with the online forms.

Meanwhile, he’s been giving two of his staff members who are out-of-work $100 a week out of his personal savings to help them support their families.

Truist spokesman David White said in an email that the company was one of the “most active lenders” and helped businesses obtain about $10 billion in loans for an average of $323,000. He said the bank has thousands of staff helping business clients with the PPP application process.

Given the demand, he said it is not guaranteed that all qualified applicants will receive a loan.

Levine said he’s not expecting to receive a check from the program, even with new funds. If he did, he said he could bring back at least four of his dozen or so employees to his Providence Road location, which is open for takeout and delivery.

“I think myself and a lot of the small business people are going to be left out in the cold,” he said.

Will this round be different?

Following a backlash over major chains receiving funds while many small businesses missed out, the new relief package includes $60 billion for smaller lending institutions.

“This is exactly what minority-owned businesses, women-owned businesses, non-profits and micro-businesses need — and what was missing in the original CARES Act,” U.S. Rep. Alma Adams, a Democrat whose district covers parts of Charlotte, said in a statement.

Adams and other Democrats pushed for the changes included in the bill, but Republicans say that stalled much-needed funding.

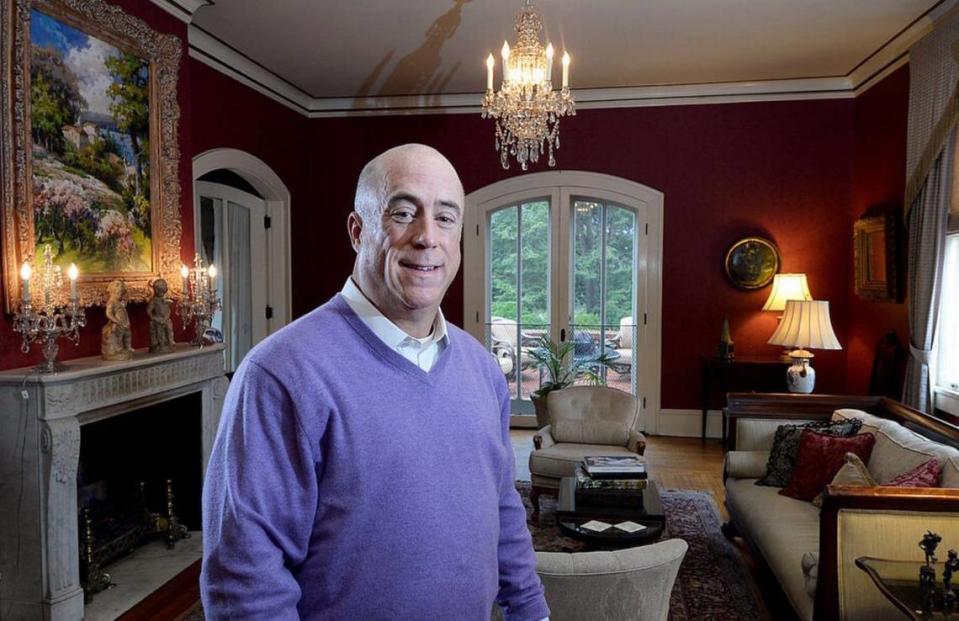

Billy Maddalon, owner of the Morehead Inn in Dilworth, reached out to his banker at Truist before the loans even became available the first time so he could get in line.

But he said at first he received a link for the application that didn’t work. After he finally uploaded his information into the system, he received emails from the bank, saying it was still working on his application. Then the funding ran dry for the first round.

Maddalon said he is considering switching to another bank because of the issues he faced in the first round of applications. And he submitted paperwork through online lender Kabbage and North Carolina-based Dogwood State Bank while waiting for the second wave of funds to open up.

“I think the shiny is coming off the penny,” Maddalon said. “For small businesses, i don’t think big banks are a really good fit anymore.”

White, the Truist spokesman, said the bank did not give preference to larger or more wealthy applicants. The bank is no longer taking new applications for the program due to overwhelming demand, he said Monday.

A series of class-action lawsuits filed in California and New York allege Bank of America, Wells Fargo and other lenders of sending larger loans to the Small Business Administration ahead of smaller ones. Several of the banks disputed the claims or said they were without merit, while others declined to comment, the Observer reported. Truist is not part of that lawsuit.

Konawalik, from the cat cafe, remains frustrated that corporations like Ruth’s Chris Steakhouse were able to obtain the loans while many small businesses like hers were left out. The restaurant chain has since said it will repay the money it received.

“These loans are such a lifeline to these small businesses,” Konawalik said.

“It’s not just, ‘oh your small business has to close.’ This is their livelihood, this is what people do for a living — they put their heart and souls into it.”