Chatham sales tax negotiations stall. Why the breakdown poses a threat to property owners

Chatham County and its eight municipalities are carving up the next 10 years worth of sales tax revenue, and stakeholders are miles — and mills — apart on the size of their respective shares.

Nearly one month and three sessions into the Local Option Sales Tax (LOST) renegotiations, discussions have stalled on how funds from a 1% tax levy should be distributed amongst the county government and Chatham's eight incorporated municipal governments.

The latest session was held Tuesday, with the county proposing it should receive 50% of the approximately $1 billion in projected revenue from LOST collections between 2023 and 2032 and the municipalities countering with a proposal that limits Chatham County's share to 14%.

LOST? What you need to know about the Local Option Sales Tax

The municipalities' lead negotiator, Savannah City Manager Jay Melder, capped his presentation by telling Chatham Commission Chairman Chester Ellis the cities are "ready for mediation," a negotiation stage whereby a third-party mediator is enlisted to help find compromise.

Ellis closed the gathering moments later by promising the county would "be in touch about mediation."

Tough talk from Chatham County

LOST renegotiations happen every 10 years after the decennial U.S. Census as distributions are partly based on population.

In the past, debates over which governmental entities deserve a larger share have led to contentious, acrimonious exchanges, and even court-ordered arbitration between the county and the City of Savannah, which typically leads negotiations on behalf of the municipal governments because of the city's standing as the largest jurisdiction.

This year, government officials have expressed concerns about another round of thorny discussions. Tensions boiled over even before negotiations began. Some municipal officials say the first meeting was canceled and the following meeting led to angry outbursts from the chairman.

More on taxes: Chatham County Commission rolls back millage rate, adopts $231 million FY2023 budget

In case you missed it: City of Savannah to consider lowest millage rate in decades

At a negotiation session earlier this month, Chatham's Ellis presented letting LOST expire as an option, a move that would have a significant impact on revenues and force all governments to hike their property tax millage rates.

The proposal came across as an attempt by Ellis to leverage the county's position of power and to bully the municipalities into agreeing to a significantly larger LOST share for the county, said several sources with both direct and indirect knowledge of what was expressed in the meeting. Those sources spoke on condition of anonymity out of fear of retaliation.

Ellis declined comment on the LOST discussions following Tuesday's session.

Facing a hard deadline for funding breakdown

Negotiators met Tuesday at the Savannah Civic Center ballroom and exchanged drastically different proposals for the new funding breakdown.

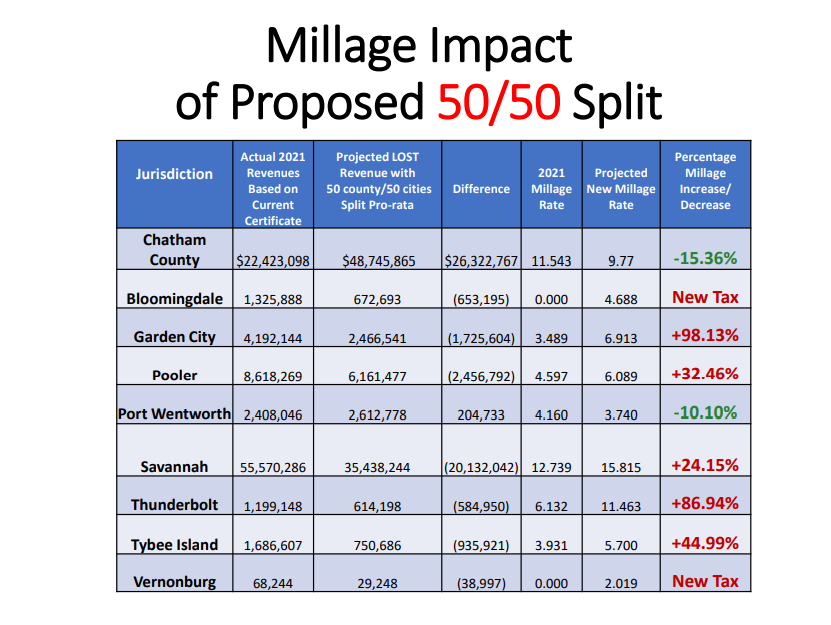

The county, which received a 23% share in the last 10 years, proposed a 50/50 split. The municipalities proposed cutting the county's share to 14%.

A consensus between the county and the cities is to be reached by August 30. If the deadline is not met, the two parties must settle disagreements through mediation or nonbinding arbitration. Mediation is where a facilitator or mediator helps the parties negotiate a settlement that everyone agrees to. Nonbinding arbitration is non-enforceable and the arbitrator’s decision is purely advisory.

LOST negotiations in 2012: Judge denies Chatham challenge to tax law

The mechanism is different from the binding arbitration or “baseball arbitration” that Chatham and Savannah employed in 2012’s negotiations of LOST funding. That legal remedy, which involved arguments before a Superior Court judge, has been ruled unconstitutional since.

A signed agreement on the funding breakdowns between the county and the municipalities must be officially settled before the end of the year, or else Chatham County and its jurisdictions will lose their ability to collect the 1% sales tax, resulting in millions of lost revenue.

To reimplement the LOST tax, county residents would have to vote on a ballot referendum to bring back the 1% sales tax, a hard deal to sell, said city officials.

LOST a crucial funding source

LOST has generated nearly $1 billion in the last 10-year cycle. With tourism abounding in the area, approximately 40% has come from out-of-county visitors.

“So, it’s a pretty good deal for local taxpayers,” said Savannah's Melder, who is heading the negotiations alongside Pooler City Manager Robbie Byrd.

LOST revenue has contributed significantly to county and municipal general funds and has kept property taxes lower for homeowners, LOST’s main stated goal.

Without LOST, a majority of residents across the county, whether they’re living in incorporated or unincorporated areas, would see a drastic property tax hike, according to the municipalities' accounting.

In some municipalities, property taxes could increase over 100% or even double. Bloomingdale a city of 2,800 and Vernonburg, a town of about 140 people, would likely have to levy their first-ever property tax.

Municipalities and county debate

The county’s proposed tax breakdown suggests biting off a chunk of Savannah’s share and leaving the smaller municipalities’ share the same. Savannah currently receives about 57% (or $55,570,286) of total LOST revenue.

According to Tuesday’s presentation, the county suggested decreasing Savannah’s portion to about 26%, which would yield a projected $26.5 million in LOST revenue for the city. On the flip side, the county would then receive 50% of the revenue (or about $53 million) as opposed to its current 23%.

Ellis argued that the county’s share is disproportionately low considering the number of services the county provides for all citizens of Chatham County — an estimated $140.8 million worth of services ranging from the county jail, courthouses and various public safety and public health resources.

Service delivery responsibilities are just part of the criteria for determining LOST shares. Georgia law outlines eight criteria for distributing LOST funds, including the point of sale that generates LOST proceeds, the effect of LOST funds on government debt and any existing intergovernmental agreements.

The City of Savannah has traditionally been the main draw for tourists and their dollars.

As part of Melder’s defense of the proposed 86% municipalities’ share, the Savannah city manager cited population growth as well. Citing U.S. Census data, Melder said 84% of Chatham’s overall growth from the past decade occurred in incorporated municipalities. While populations in unincorporated areas also grew, their share of the county’s population decreased.

Melder also buffered his argument with a quote from Clint Mueller of the Association County Commissioners of Georgia (ACCG): “Typical LOST percentages only change by 2% to 3% every 11 years.”

“The reason why that’s true is because the best tax policies are tax policies that are steady and reliable and don’t fluctuate,” said Melder, who added that negotiations are still in their early stages.

In a previous negotiating session, the cities proposed an 88% LOST share, a number scaled back to 86% in Tuesday's presentation. The county’s proposal, initially at 55%, is now at 50%.

Nancy Guan is the general assignment reporter covering Chatham County municipalities. Reach her at nguan@gannett.com or on Twitter @nancyguann.

This article originally appeared on Savannah Morning News: Chatham-Savannah local option sales tax negotiations stall