Checkit's (LON:CKT) Wonderful 931% Share Price Increase Shows How Capitalism Can Build Wealth

We think all investors should try to buy and hold high quality multi-year winners. And highest quality companies can see their share prices grow by huge amounts. Just think about the savvy investors who held Checkit plc (LON:CKT) shares for the last five years, while they gained 931%. This just goes to show the value creation that some businesses can achieve. It's even up 5.5% in the last week. But this might be partly because the broader market had a good week last week, gaining 2.9%.

We love happy stories like this one. The company should be really proud of that performance!

Check out our latest analysis for Checkit

Checkit isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last half decade Checkit's revenue has actually been trending down at about 30% per year. So it's pretty surprising to see that the share price is up 59% per year. There can be no doubt this kind of decoupling of revenue growth and share price growth is unusual to see in loss making companies. I think it's fair to say there is probably a fair bit of excitement in the price.

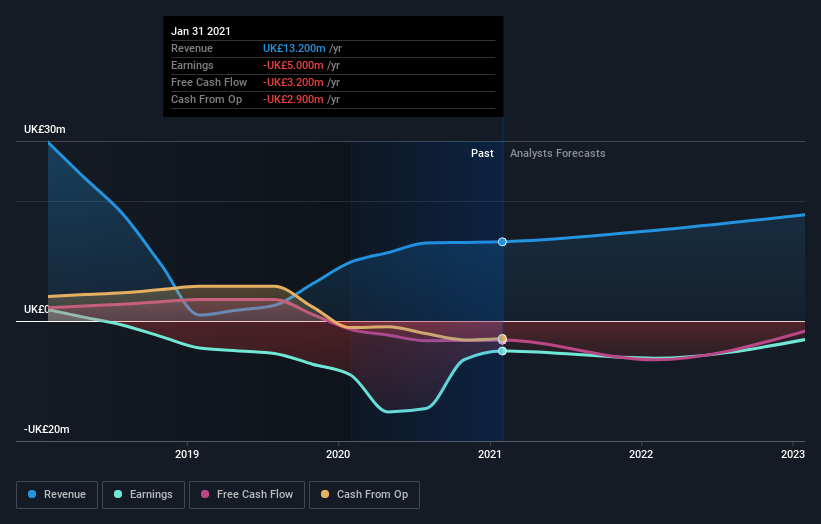

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that Checkit shareholders have received a total shareholder return of 55% over the last year. However, the TSR over five years, coming in at 59% per year, is even more impressive. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Checkit is showing 4 warning signs in our investment analysis , you should know about...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.