Chesapeake (CHK) Q4 Earnings Beat Estimates, Revenues Miss

Chesapeake Energy Corporation CHK reported fourth-quarter 2019 loss per share (excluding special items) of 4 cents, narrower than the Zacks Consensus Estimate of a loss of 6 cents. However, in the year-ago quarter, the company had reported a profit of 3 cents.

Operating revenues amounted to $969 million, down from $1,731 million in the year-ago quarter. Moreover, the top-line missed the Zacks Consensus Estimate of $1,212 million.

The narrower-than-expected loss was a result of higher oil equivalent production. Lower price realizations of commodities partially offset the positive.

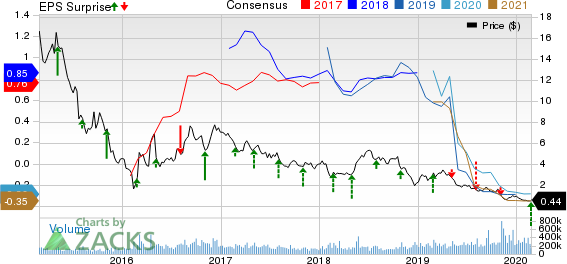

Chesapeake Energy Corporation Price, Consensus and EPS Surprise

Chesapeake Energy Corporation price-consensus-eps-surprise-chart | Chesapeake Energy Corporation Quote

Operational Performance

Total Production Increases

Chesapeake’s production in the reported quarter was approximately 44 million barrels of oil equivalent (MMBoe), up from 43 MMBoe a year ago. The total production comprised 12 million barrels (MMbbls) of oil (up 50% year over year), 178 billion cubic feet of natural gas (down 4%) and 3 MMbbls of natural gas liquids or NGLs (down 25%).

Price Realizations Plunge

Oil equivalent realized price — exclusive of gains (losses) on derivatives — was $25.17 per barrel, down from $29.64 a year ago. Oil price was $57.48 per barrel, down from $62.98 in the year-ago quarter. Moreover, natural gas prices declined to $2.24 per thousand cubic feet from the year-ago level of $3.59. Average sales price of NGLs was recorded at $16.05 per barrel in the quarter compared with $25.11 a year ago.

Operating Expenses

Total operating costs in the fourth quarter declined to $2,099 million from $2,375 million in the prior-year quarter. However, quarterly production expenses per Boe increased to $2.86 from $2.48 in the year-ago period.

Capital Expenditure

Total capital expenditure increased to $487 million in the fourth quarter from $476 million in the year-ago quarter, primarily due to a rise in drilling and completion capital spending.

Balance Sheet

At the end of the quarter under review, Chesapeake had a cash balance of $6 million. Net long-term debt was $9,073 million, leading to a debt-to-capitalization ratio of 67.3%.

Guidance

Chesapeake expects oil equivalent production for 2020 in the range of 161 to 173 MMBoE. Notably, in 2020, the company is planning to invest capital in the range of $1,325 to $1,625 million.

Zacks Rank & Stocks to Consider

Chesapeake currently carries a Zacks Rank #3 (Hold). Meanwhile, a few better-ranked players in the energy sector include Marathon Oil Corp. MRO, Chevron Corp. CVX and Hess Corp. HES, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Marathon Oil is likely to see earnings growth of 7.8% in the next five years, higher than the industry’s 7%.

Chevron’s bottom line for 2020 is expected to rise 12.8% year over year.

Hess’ bottom line for 2020 is likely to grow 93.7% year over year.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chesapeake Energy Corporation (CHK) : Free Stock Analysis Report

Marathon Oil Corporation (MRO) : Free Stock Analysis Report

Chevron Corporation (CVX) : Free Stock Analysis Report

Hess Corporation (HES) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research