Is Chevron a Buy?

Chevron (NYSE: CVX) was outbid by Occidental Petroleum in the Andadarko Petroleum acquisition fight. It was something of a stunner to see the oil giant lose out to a company that's around a fifth of its size. If Chevron had won, it would have expanded its reach in the hot onshore U.S. energy market. Is Chevron worth owning without that? Here's what you need to know to decide.

No big deal

The first and perhaps most important thing to understand about the Anadarko acquisition attempt is that Chevron didn't actually need to ink a deal. It was trying to buy a strong asset in a market that's been out of favor for some time. To put a number on that, even after the boost from the merger, Anadarko's shares are still roughly 40% below their 2014 peak. It was an opportunistic move.

Image source: Getty Images

The second big takeaway here is that Chevron chose not to get into a protracted bidding war. Yes, it lost out on Anadarko, but management was clearly unwilling to overpay for the asset. That shows discipline, and investors should be quite comforted that egos didn't trump financial common sense.

In the end, losing out on Anadarko may have looked bad in the headlines, but it wasn't a huge loss for Chevron. It still has a strong growth profile, rock-solid finances, and the scale and reach to reward investors in good times and bad. Here's a quick breakdown on those positives.

Good things to come

In the first quarter of 2019, Chevron's production was up 7% year over year. That increase was driven by the Wheatstone LNG facility in Australia and continued strength in the onshore U.S. space. That U.S. onshore, meanwhile, has not only been a strong contributor to performance, but it has been doing even better than originally expected.

Here's the thing, the first quarter's production growth isn't a one-off event. Chevron has plans to spend around $20 billion a year through 2023 to grow its business. It expects that money to generate a solid 3% to 4% compound annual production growth rate. Some quarters and years will be better than others, of course, but the overall trend is still solidly heading higher.

Meanwhile, Chevron has one of the best balance sheets in the industry. Long-term debt makes up a modest 15% or so of the oil giant's capital structure. It has more than enough financial flexibility to support its business even if oil prices should slump again. It should also have more than ample resources to support its dividend in such an event, noting that it didn't cut its dividend during the deep oil downturn that started in mid-2014. In fact, it has paid higher dividends each year for an incredible 32 years and counting. The only way to reach a number like that is to run a great business, noting that the oil industry has a history of being volatile.

This brings up another important aspect of Chevron's operations: diversification. Although Chevron may be more tilted toward upstream (oil and gas drilling) than some of its peers, its business spans the upstream, midstream (pipelines), and downstream (chemicals and refining) sectors. When the upstream operation is struggling, the downstream is often benefiting from lower input costs since oil and gas are key feedstocks. Midstream tends to be pretty consistent in good years and bad for commodity prices. The overall result is a more stable business.

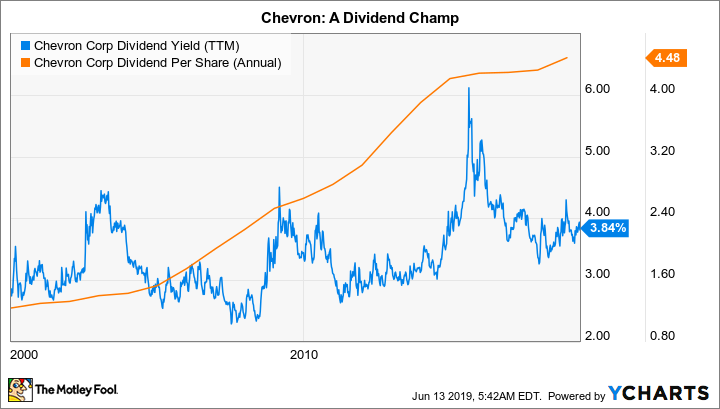

CVX Dividend Yield (TTM) data by YCharts.

Chevron is very well positioned today. Add in a generous 4% dividend yield, and the oil giant starts to look pretty enticing -- especially for income investors. It's also worth noting that the yield is toward the high end of the company's yield range since the turn of the century, suggesting now is at least a decent time to be looking at Chevron.

If you like oil...

Chevron is a financially strong oil giant putting up solid operating results. It expects to keep doing so for years to come, too. Yes, it lost out on Anadarko, but that's simply evidence of a disciplined management team and doesn't change the upward trajectory Chevron's business is on today. Although you have to believe that oil and natural gas will remain key sources of energy if you buy Chevron, the loss in the Anadarko contest shouldn't dissuade you, here. Chevron is definitely worth buying, particularly for conservative income investors.

More From The Motley Fool

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.