China Debt Ratio Hits Record But Pace of Borrowing Is Easing

(Bloomberg) -- China’s debt-to-GDP ratio rose to a record in the second quarter, although consumers and businesses are borrowing at a slow pace, reflecting low confidence that’s hitting economic growth.

Most Read from Bloomberg

Subway Offers Free Sandwiches That Come With a Lifetime Commitment

US 10-Year Yield Hits 4% as BOJ Worry Lifts Yen: Markets Wrap

Hawkish Hint in Japan Is Just Enough to Send US Markets Spinning

Total debt — combining the household, corporate and government sectors — climbed to 281.5% of gross domestic product in the second quarter, according to Bloomberg’s calculations based on data from China’s central bank and the National Bureau of Statistics. That was up from 279.7% in the first quarter.

The data suggest China isn’t experiencing a classic “balance sheet recession,” typified by a reduction in corporate and household leverage hitting the economy. But economists argue that slower borrowing growth will put pressure on GDP growth, a somewhat similar process.

China’s National Institution for Finance And Development, a government-linked think tank in Beijing, estimated an increase in the total debt, or macro-leverage ratio, to 283.9% in the second quarter, according to a report released on Tuesday.

However, it pointed out that household debt is rising at half the average rate seen over the past two decades. Corporates are unsure about future economic growth prospects and so have entered “wait and see mode,” it added.

The figures will add to the debate over whether China is entering a “balance sheet recession,” as argued by Richard Koo, chief economist at the Nomura Research Institute. He said last month that China was seeing a pattern similar to what caused Japan’s economic stagnation in the 1990s. His theory is that a sharp fall in asset prices leads the private sector to focus on reducing their leverage by paying down debt, which drives down consumption and investment.

While overall debt in China isn’t contracting, the slowdown means households are becoming more concerned about repairing their balance sheets than they used to be, and corporations are hesitant to borrow to expand, according to the NIFD.

Those trends could in turn slow GDP growth in what could be seen as an “atypical” form of a balance sheet recession, the think tank said. Such an outcome can be avoided if China’s government increases borrowing and cuts interest rates, it said in the report.

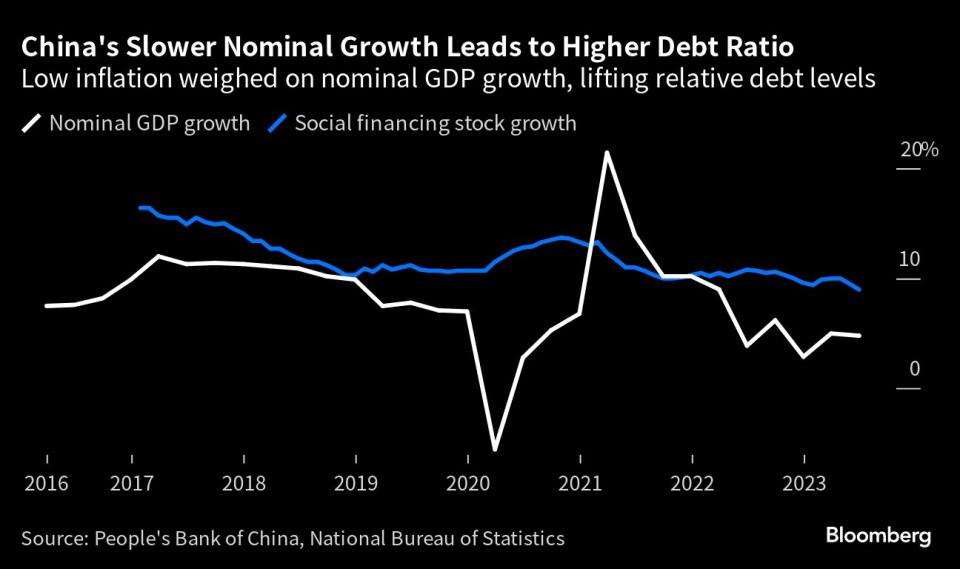

The debt ratio could also be driven higher by deflation, since debt is calculated as a proportion of nominal GDP, rather than inflation-adjusted, or real GDP. The latest official GDP report showed a decline in economy-wide prices, with inflation-adjusted growth outpacing the expansion in nominal GDP.

Concern about de-leveraging marks a turnaround for China.

For most of the last decade, economists have been flagging rising debt in China as a challenge for the economy. That message was taken up by the government from 2017, which began a “deleveraging campaign,” which slowed debt growth with the aim of reducing financial risks. Beijing in 2020 started an effort to reduce leverage in the vast property sector.

“I agree with the conclusion of the NIFD report – that China is not in a balance sheet recession, but is at risk of one as households and firms pursue balance sheet repair,” said Adam Wolfe, an emerging markets economist at Absolute Strategy Research. “The reason households and firms are behaving like this is because of the government’s policies to reduce financial sector risks.”

Andrew Batson, director of China research for Gavekal Dragonomics, has argued for a middle-ground on the balance-sheet recession debate.

While China’s corporate sector as a whole is not deleveraging, he wrote in a note that the real estate sector is — partly as a result of government policy.

Given the outsize role of real estate and construction in China’s GDP, deleveraging in that sector alone can push China’s growth below potential. That would fit with one definition of what it means to be in recession.

“China is therefore probably in a recession, and a big cause of that recession is probably the shrinking of balance sheets in the real estate sector,” Batson wrote. “It may not be worth arguing about whether some people are correct to call that a ‘balance sheet recession.’”

--With assistance from Myungshin Cho and Yujing Liu.

(Updates with paragraph and chart on nominal growth)

Most Read from Bloomberg Businessweek

Influencers Built Up This Wellness Startup—Until They Started Getting Sick

AI in Hollywood Has Gone From Contract Sticking Point to Existential Crisis

The Stainless-Steel Boom Is Tearing a South African Mining Region Apart

This Supposed Mafia Manifesto Doesn’t Stand Up to a Google Search

©2023 Bloomberg L.P.