Should China Gas Holdings Limited (HKG:384) Be Part Of Your Dividend Portfolio?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Is China Gas Holdings Limited (HKG:384) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

While China Gas Holdings's 1.4% dividend yield is not the highest, we think its lengthy payment history is quite interesting. There are a few simple ways to reduce the risks of buying China Gas Holdings for its dividend, and we'll go through these below.

Explore this interactive chart for our latest analysis on China Gas Holdings!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Looking at the data, we can see that 27% of China Gas Holdings's profits were paid out as dividends in the last 12 months. This is a middling range that strikes a nice balance between paying dividends to shareholders, and retaining enough earnings to invest in future growth. One of the risks is that management reinvests the retained capital poorly instead of paying a higher dividend.

Is China Gas Holdings's Balance Sheet Risky?

As China Gas Holdings has a meaningful amount of debt, we need to check its balance sheet to see if the company might have debt risks. A quick check of its financial situation can be done with two ratios: net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and net interest cover. Net debt to EBITDA is a measure of a company's total debt. Net interest cover measures the ability to meet interest payments. Essentially we check that a) the company does not have too much debt, and b) that it can afford to pay the interest. China Gas Holdings has net debt of 2.27 times its EBITDA. Using debt can accelerate business growth, but also increases the risks.

We calculated its interest cover by measuring its earnings before interest and tax (EBIT), and dividing this by the company's net interest expense. China Gas Holdings has EBIT of 7.58 times its interest expense, which we think is adequate.

Consider getting our latest analysis on China Gas Holdings's financial position here.

Dividend Volatility

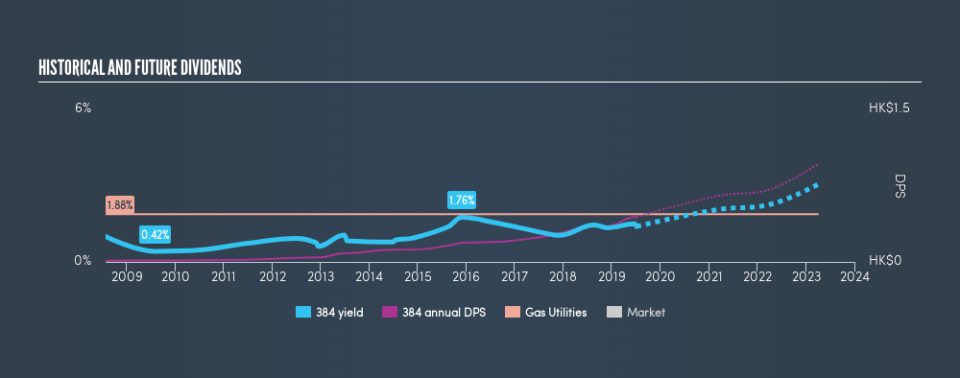

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. For the purpose of this article, we only scrutinise the last decade of China Gas Holdings's dividend payments. During the past ten-year period, the first annual payment was HK$0.012 in 2009, compared to HK$0.44 last year. This works out to be a compound annual growth rate (CAGR) of approximately 43% a year over that time.

With rapid dividend growth and no notable cuts to the dividend over a lengthy period of time, we think this company has a lot going for it.

Dividend Growth Potential

Examining whether the dividend is affordable and stable is important. However, it's also important to assess if earnings per share (EPS) are growing. Growing EPS can help maintain or increase the purchasing power of the dividend over the long run. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see China Gas Holdings has grown its earnings per share at 25% per annum over the past five years. With high earnings per share growth in recent times and a modest payout ratio, we think this is an attractive combination if earnings can be reinvested to generate further growth.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. It's great to see that China Gas Holdings is paying out a low percentage of its earnings and cash flow. Next, growing earnings per share and steady dividend payments is a great combination. All these things considered, we think this organisation has a lot going for it from a dividend perspective.

Earnings growth generally bodes well for the future value of company dividend payments. See if the 23 China Gas Holdings analysts we track are forecasting continued growth with our free report on analyst estimates for the company.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.