China Seen Halting Cash Drainage as Party Congress Kicks Off

- Oops!Something went wrong.Please try again later.

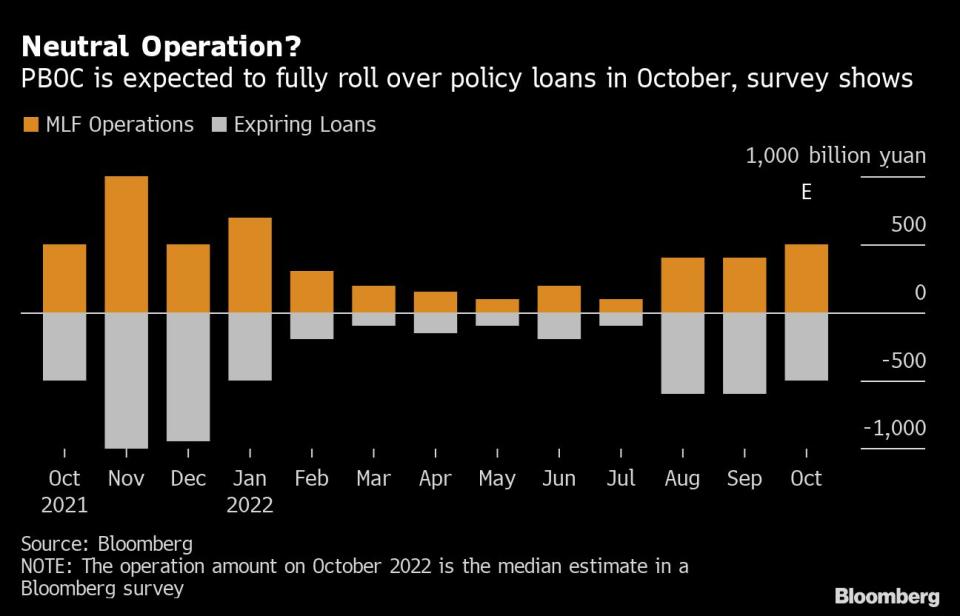

(Bloomberg) -- China may refrain from draining cash via medium term loans for the first time in three months as authorities seek to boost market confidence during the Communist Party’s twice-a-decade leadership congress next week.

Most Read from Bloomberg

Rolex Prices to Drop Further as Supply Surges: Morgan Stanley

Stocks Upended by Inflation Survey’s Sobering View: Markets Wrap

Putin Tried for Years to Stop His Military From Using Western Parts — And Mostly Failed

Core US Inflation Rises to 40-Year High, Securing Big Fed Hike

Six out of eight economists and analysts in a Bloomberg survey expect the People’s Bank of China to offer at least 500 billion yuan ($69 billion) of one-year medium-term lending facility on Monday, as half a trillion yuan of policy loans mature this month. That’s after a withdrawal of 200 billion each in the last two months.

The cash cushion could boost market sentiment dented by Beijing’s adherence to its Covid Zero policy and the crippling slump in the housing market, just as President Xi Jinping is set to secure a third term in power. It could also smoothen out the increased demand for liquidity for tax payments and local government bond issuance.

“The liquidity gap is large as the tax payment amount is typically higher in October while the local governments are required to finish the additional special bond sales,” said Xing Zhaopeng, a senior strategist at Australia & New Zealand Banking Group, who expects China to fully roll over the maturing MLF.

The PBOC could be motivated to keep cash levels ample after the demand for loans recovered more than expected in September, signaling that the stimulus is trickling through into the real economy. Local government bond issuance that’s been muted since July could pick up this month amid an infrastructure push. The State Council had urged local authorities to use up more than 500 billion yuan in existing special bond ceiling limits by the end of October.

The PBOC may still need to tread cautiously on further easing. China’s unexpected rate cut in August triggered the yuan’s slide, which gathered pace on bets for aggressive Federal Reserve rate hikes, and prompted the PBOC to announce a number of measures to slow the currency’s losses. MLF rate is forecast to be left unchanged at 2.75% this month, according to all but one of the 15 economists who responded to the survey.

Aside from smoothing out liquidity via open market operations and MLF, there’s low probability of a reduction in the amount of cash banks need to hold in reserve as it can add to the depreciation pressure on the yuan, said Shuang Ding, Greater China & North Asia chief economist at Standard Chartered Bank Plc.

However, some expect the PBOC to prioritize growth, especially after it indicated that a more market-driven approach to managing the yuan has allowed greater independence in its monetary policy.

The central bank may cut its reserve requirement ratio by 25 basis points in the remaining year, Citigroup Inc. economists led by Xiangrong Yu wrote in a note. “The PBOC will not shy away from a rate cut, if necessary, but it would be data-dependent and more likely focused on the long tenor,” they wrote in a note this week.

Here are some of the survey results:

Most Read from Bloomberg Businessweek

Exxon’s Exodus: Employees Have Finally Had Enough of Its Toxic Culture

Twitter Faces Only Bad Outcomes If the $44 Billion Musk Deal Closes

©2022 Bloomberg L.P.