Some China Shengmu Organic Milk (HKG:1432) Shareholders Have Taken A Painful 88% Share Price Drop

We're definitely into long term investing, but some companies are simply bad investments over any time frame. We don't wish catastrophic capital loss on anyone. For example, we sympathize with anyone who was caught holding China Shengmu Organic Milk Limited (HKG:1432) during the five years that saw its share price drop a whopping 88%. The falls have accelerated recently, with the share price down 11% in the last three months.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

View our latest analysis for China Shengmu Organic Milk

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

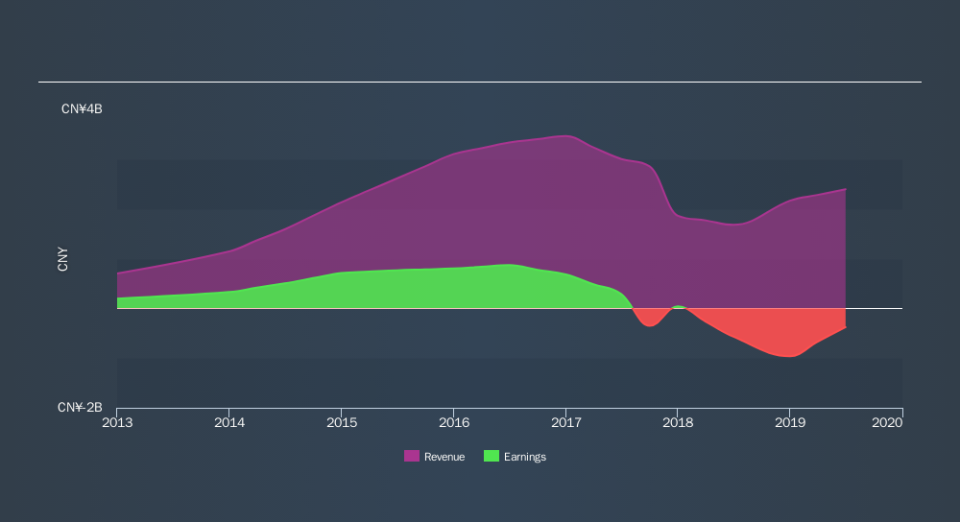

We know that China Shengmu Organic Milk has been profitable in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. Other metrics may better explain the share price move.

The revenue decline of 1.0% isn't too bad. But if the market expected durable top line growth, then that could explain the share price weakness.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Investors in China Shengmu Organic Milk had a tough year, with a total loss of 12%, against a market gain of about 5.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 34% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. If you would like to research China Shengmu Organic Milk in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.