Some China Success Finance Group Holdings (HKG:3623) Shareholders Have Taken A Painful 72% Share Price Drop

Long term investing works well, but it doesn't always work for each individual stock. We really hate to see fellow investors lose their hard-earned money. Spare a thought for those who held China Success Finance Group Holdings Limited (HKG:3623) for five whole years - as the share price tanked 72%. There was little comfort for shareholders in the last week as the price declined a further 1.3%.

Check out our latest analysis for China Success Finance Group Holdings

China Success Finance Group Holdings isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last half decade, China Success Finance Group Holdings saw its revenue increase by 4.5% per year. That's far from impressive given all the money it is losing. Nonetheless, it's fair to say the rapidly declining share price (down 23%, compound, over five years) suggests the market is very disappointed with this level of growth. We'd be pretty cautious about this one, although the sell-off may be too severe. A company like this generally needs to produce profits before it can find favour with new investors.

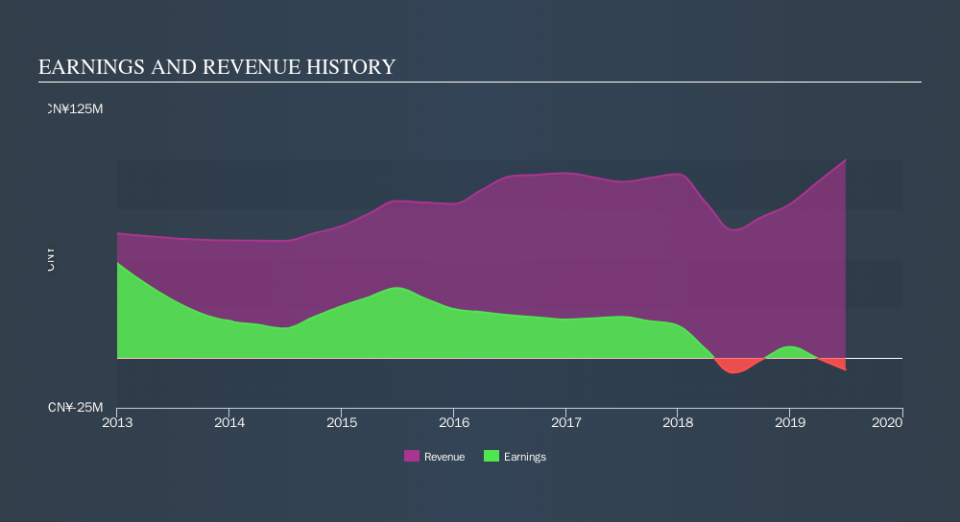

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of China Success Finance Group Holdings's earnings, revenue and cash flow.

A Different Perspective

While the broader market lost about 3.3% in the twelve months, China Success Finance Group Holdings shareholders did even worse, losing 16%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, longer term shareholders are suffering worse, given the loss of 22% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. Before spending more time on China Success Finance Group Holdings it might be wise to click here to see if insiders have been buying or selling shares.

We will like China Success Finance Group Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.