Consumer confidence readings hint China was harder hit than US leading up to 'phase one' trade deal

With the U.S. and China coming together to sign what’s being billed as a “phase one” trade deal, scrutiny is turning to which side secured the better deal, and how much negotiating power each of the world’s two largest economies will have at its disposal ahead of “phase two.”

As it stands, the Trump administration intends to keep punitive tariffs in place on about two-thirds of imports from China totaling roughly $360 billion in Chinese goods to ensure China honors its side of the agreement, while China didn’t commit to any tariff reductions past what would be necessary to enable new and agreed upon purchases of U.S. goods.

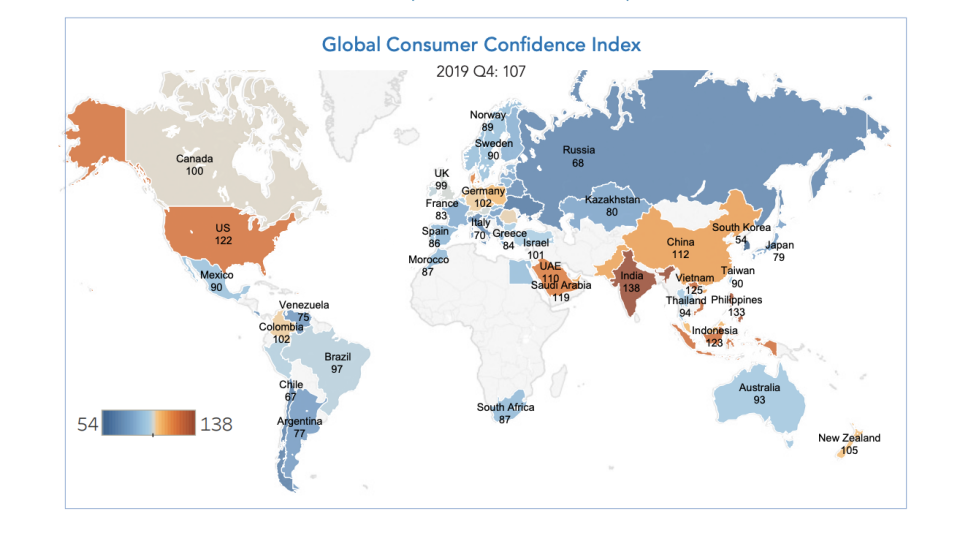

But new fourth quarter global consumer confidence numbers released by The Conference Board Thursday reveal that China may have been hurting more than the U.S. ahead of Wednesday’s “phase one” signing and might experience more pain should additional U.S. tariffs be put back in place in the event “phase two” negotiations fall apart.

China’s latest consumer confidence reading declined for the second consecutive quarter, according to The Conference Board numbers, falling to 112 from 114 in the third quarter (a reading of 100 or above is considered positive.) The drop, according to the report, was “driven by a decline in spending intensions and increasing pessimism about personal finances.”

“Despite an uptick in November because of record high online shopping during Singles Day, consumer spending appears to be softening,” The Conference Board wrote in its latest report, adding that the overall impact of the U.S.-China trade war was somewhat mitigated by a larger ongoing effort by Beijing to focus on consumption-led economic growth.

The impacts of the trade war were apparently far less sharply felt by the consumer in the U.S. The latest confidence reading showed a slight tick higher in the fourth quarter, with sentiment rising from 120 to 122 to near a historic high of 123, according to The Conference Board. Rising wages and low unemployment helped maintain consumer spending through 2019.

Overall, global consumer confidence was unchanged in the final three months of the year from the same 107 reading in the third quarter.

Admittedly, however, many of the tariffs applied to Chinese goods by the Trump administration carefully avoided consumer goods. President Trump even cancelled tariffs that would have targeted popular consumer goods like electronics just weeks ahead of the busy holiday shopping season. As The Conference Board economist Bart van Ark noted last summer, if U.S. strategy should return to applying new tariffs on consumer-facing Chinese goods, U.S. consumer confidence could be impacted by a larger margin than has been seen so far.

Zack Guzman is the host of YFi PM as well as a senior writer and on-air reporter covering entrepreneurship, cannabis, startups, and breaking news at Yahoo Finance. Follow him on Twitter @zGuz.

Read the latest financial and business news from Yahoo Finance

Read more:

Nickelback sees 569% surge in song downloads after Trump's 'Photograph' tweet

Illinois becomes the latest state to legalize marijuana, these states may follow

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.