Chipmakers face uncertain future as trade tensions, 'peak iPhone' take toll

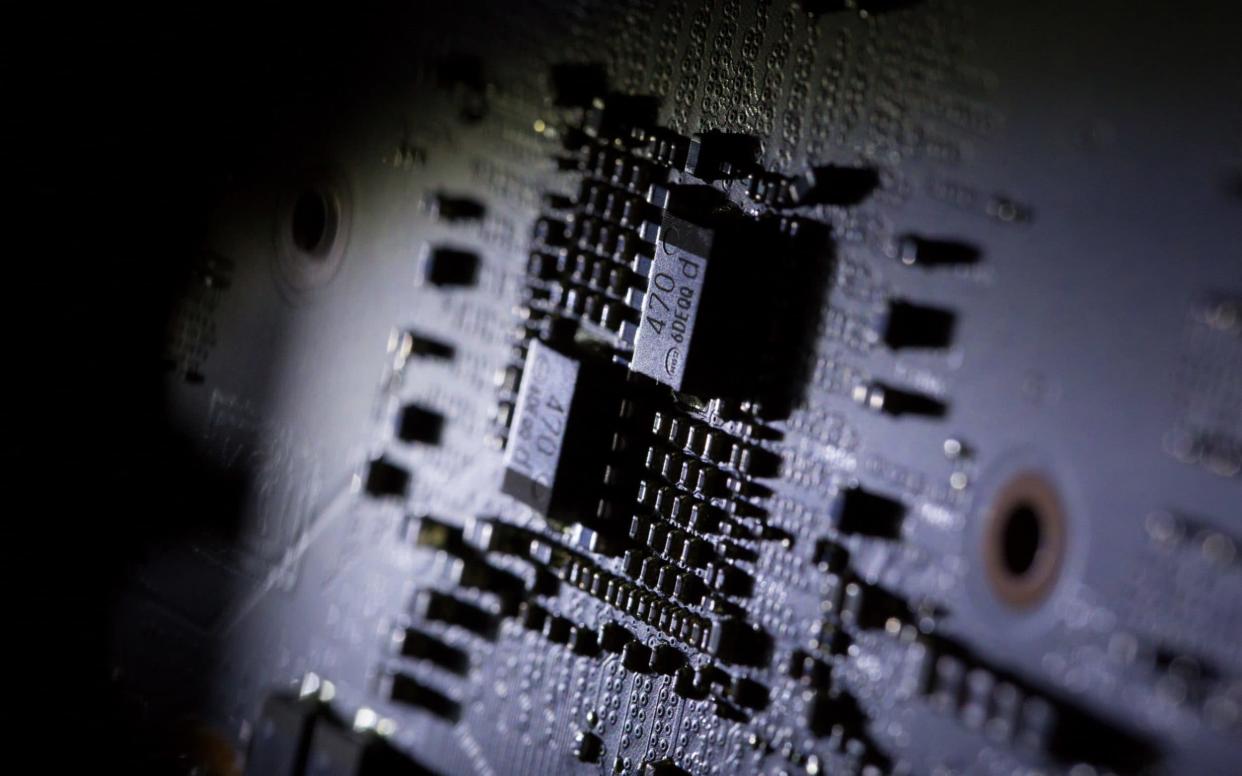

They lie at the heart of the modern global economy, implanted in billions of consumer devices - from phones to cars, tablets to game consoles. They also generate billions of dollars in exports for some of the world's biggest companies like Samsung, Qualcomm and Intel.

But after years of robust growth averaging 13pc per year, fierce headwinds are now buffeting the $412 billion global semiconductor market which in recent weeks have wiped billions of dollars from the market valuations off some of the top computer chip manufacturers and acted as a major drag on the broader market.

Stagnating global sales of tablets and smartphones - a trend dubbed 'peak iPhone' by analysts - present only part of the problem, analysts say.

Just as alarming, some businesses, such as America's Micron Technologies and Korea's Samsung Electronics and SK Hynix and have found themselves caught up in Donald Trump's escalating trade war between the US and China.

After a string of attacks from Washington DC, China this week accused these three businesses of a series of antitrust violations, citing undisclosed “massive evidence” against them.

The three chipmakers are hardly bit-players in the technology world. Combine their production, and together they make around 95pc of all DRAM chips every year, the most popular kind of memory chip in modern devices.

Beijing’s anti-monopoly bureau has accused the chipmakers of price-fixing over several years, a representative said at a press conference last week. It’s not yet clear what action China plans to take against them.

Micron Technologies’ inclusion in the investigation is particularly interesting to observers as it could signal retaliation by the Chinese government to an ongoing investigation into industrial espionage by the US Department of Justice.

Earlier this month, the Department of Justice indicted state-backed Chinese chipmaker Fujian Jinhua and a Taiwanese business, United Microelectronics Corp. Both firms are accused of conspiring to steal trade secrets from Micron Technologies.

Fuijan Jinhua has denied the allegations. A spokesman for the business published a message to its website which said that the business “always attaches great importance to the protection of intellectual property rights.”

In December 2017, US-headquartered Micron Technologies sued Fujian Jinhua and United Microelectronics Corp. in US Federal Court. It accused the businesses of persuading former Micron employees to download confidential files to laptops and portable drives in order to transfer them to the rival businesses.

Fujian Jinhua and United Microelectronics Corp have both denied the allegations.

“Memory and storage has been a feast or famine market for decades,” said Patrick Moorhead, the principal analyst at Moor Insights and Strategy. “Chipmakers build new capacity to meet demand when prices are high, then hit an over-supply state and prices crater. These lawsuits pop up time and time again when prices are high,” he said.

The ongoing disputes between US and Chinese chipmakers are a clear sign that valuable technology businesses are becoming caught up in a trade war which could disrupt a crucial global market.

China has struggled to establish a home-grown chipmaking giant that can rival businesses in the US, leaving it reliant on US imports to supply local manufacturing businesses.

Of the world's top ten semiconductor manufacturers, six are American, two are South Korean, one Japanese and one Taiwanese. The fact that none are Chinese is an understandable source of irritation for China given its otherwise powerful role in global electronics manufacturing.

But America is desperate to protect its own chip industry, which employs 250,000 Americans directly and supports another 1m jobs. It is a lynchpin, too, of America's broader IT industry.

Getting pulled into a geopolitical storm isn’t the only issue facing some chipmakers, however.

Other suppliers, however, face a very different problem. Chipmaker Nvidia, which designs and manufactures graphics processing chips, is reeling from the continued slump in cryptocurrency prices.

The business had enjoyed strong sales in its graphics cards to cryptocurrency advocates, as the powerful devices could be used to generate cryptocurrency.

Rising demand for Nvidia’s graphics card pushed up prices to several times their original prices, with $200 (£155) graphics cards reaching $800 in some markets.

However, as the price of the online currencies have dropped, so have sales of Nvidia’s mid-range products.

Nvidia is now in the midst of a “crypto hangover,” warned chief executive Jensen Huang. For months, analysts had speculated just how much of the business’ sales had been to cryptocurrency fans.

Last week, Nvidia gave a forecast of $2.7bn in revenue for the current quarter, far below analyst expectations of $3.4bn. “The crypto hangover lasted longer than we expected,” Mr Huang said.

Nvidia’s stock plunged 18pc following the news, wiping $23bn off the US business’ market cap.

“Nvidia’s ‘crypto challenges’ ironically have little to do with crypto,” Mr Moorhead said. “When gaming board makers and PC makers couldn’t get the supply they wanted, they over-ordered, sometimes asking for 2-3X what they wanted.”

“When crypto demand weakened, supply improved, then those gaming board makers and PC makers cut their forecasts,” he said.

The business of manufacturing chips has always seen rises and falls in demand, but even manufacturers supplying the world’s largest technology business have seen problems.

Apple has reportedly cut production orders for all three of its new iPhones, according to suppliers in Asia. The reduction in demand from Apple has left gaping holes in the order books of its suppliers.

For weeks, analysts who closely follow Apple’s supply chain in Asia and the US have warned of “sharp iPhone production cuts.” Now, those cuts are starting to be realised.

One supplier, Lumentum Holdings, cut its outlook and warned that one of its largest customers had asked to “materially reduce shipments.”

Lumentum Holdings reduced its expected net revenue for the second quarter of 2019 from between $405m (£314m) and $430m to between $335m and $355m and suffered a drop of almost 28pc in its share price.

iPhone suppliers do not typically name Apple in their forecasts, but the move had all the signs of Apple reducing production orders for its new devices.

Apple stock is down 10pc since it announced its earnings at the start of the month, although its suppliers have borne the brunt of the production cuts.