Choice Hotels: A Solid Buffett-Munger Stock

In times of confusion, one way to find direction is by looking at selections coming out of the Buffett-Munger Screener. It's the GuruFocus screener for finding high-quality companies at a reasonable cost.

It uses these four criteria to make its selections:

A high predictability rank, that is, the ability to consistently grow revenue and earnings.

Competitive advantage(s) or a moat, to maintain or grow profit margins.

Little or no debt.

Fairly valued or undervalued based on the PEPG indicator (PEPG is the price-earnings ratio divided by the average growth rate of Ebitda over the past five years).

Choice Hotels International Inc. (NYSE:CHH) is one of just 20 stocks to currently qualify for Buffett-Munger status.

In its most recent 10-K, the company described itself this way: "We are one of the largest hotel franchisors in the world with 7,153 open hotels comprising 590,897 rooms and 1,135 hotels under construction, awaiting conversion or approved for development comprising 100,868 rooms as of December 31, 2019, located in 50 states, the District of Columbia and over 40 countries and territories outside the United States. Choice franchises lodging properties under the following proprietary brand names: Comfort Inn(R), Comfort Suites(R), Quality(R), Clarion(R), Clarion Pointe (TM), Sleep Inn(R), Econo Lodge(R), Rodeway Inn(R), MainStay Suites(R), Suburban Extended Stay Hotel(R), WoodSpring Suites(R), Everhome(TM) Suites, Cambria(R) Hotels, and Ascend Hotel Collection(R) (collectively, the 'Choice brands')."

Significantly, it is not a hotel owner, with the exception of five recently-purchased Cambria hotels and 97% of its 2019 revenues came from franchising fees.

Predictability

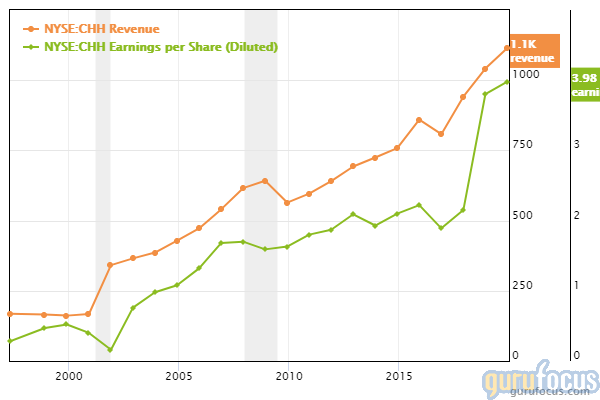

Choice has earned a GuruFocus predictability rating of 4.5 out of five stars because of its ability to steadily grow both its revenue and earnings. The following chart shows its revenue in orange and diluted earnings per share in green:

That consistency will likely take something of a hit in 2020 because of Covid-19 and lockdowns depressing travel and hotel occupancy.

In a news release issued on April 8, it announced it would improve its cash position, strengthen its liquidity and reduce discretionary costs.

It also noted that it would continue to benefit because of its predominately franchise-only model that had provided fairly stable earnings and low demand for capital expenditures.

Competitive advantage

As with most other franchisors, the moat is the brand name and associated intellectual property. As it noted in the 10-K, the company said, "We believe that our trademarks and other intellectual property are fundamental to our brands and our franchising business."

To assess the intangible value of a moat, GuruFocus contributor and Nintai Investments fund manager Thomas Macpherson looks for a 10-year median of at least 15% for return on capital and return on tangible equity:

ROC: Over the past decade, Choice's return on capital has ranged between 38.81% and 22.10%, so obviously it will meet this criterion for a median of at least 15%.

ROTE: It has a negative return on tangible equity; GuruFocus explains, "Return-on-Tangible-Equity is calculated as Net Income attributable to Common Stockholders divided by its average total shareholder tangible equity. Total shareholder tangible equity equals to Total Stockholders Equity minus Intangible Assets."

Given that only one of these criteria is relevant, and the one that is relevant is very strong, Macpherson's test confirms there is a competitive advantage.

Debt

Value investors like Buffett and Munger are wary of debt because it often becomes a millstone around the neck of an otherwise successful company. Generally, companies carefully calculate how much they can afford to pay in interest before committing to new debt. However, that equation can quickly fall apart if economic conditions change. We are living through one such change, and we went through others in 2008 and 2000. The cost of debt can lead to bankruptcy.

The interest coverage ratio is an important indicator of a company's ability to take care of its debt obligations. On June 3, the ratio was 4.07. That's calculated by dividing its operating income (Ebit - earnings before interest and taxes) by the interest expense. At the end of March 2020, Choice had operating income of $46 million and an interest expense of $11 million.

According to GuruFocus, Benjamin Graham, the father of value investing, wanted a minimum interest coverage of 5, and saw coverage of less 2 as "burdened by debt."

Valuation

As noted, a company should be fairly or undervalued, based on its PEPG ratio. Turning to the Summary page, we see Choice has a PEG ratio (the same as PEPG) of 1.45, which suggests the stock is moderately overvalued.

Normally, we consider a stock undervalued if its PEG ratio is below 1 and overvalued if it is above 1. The PEG/PEPG reading is consistent with the discounted cash flow calculation; it shows Choice having a negative margin of safety of - 56.78%.

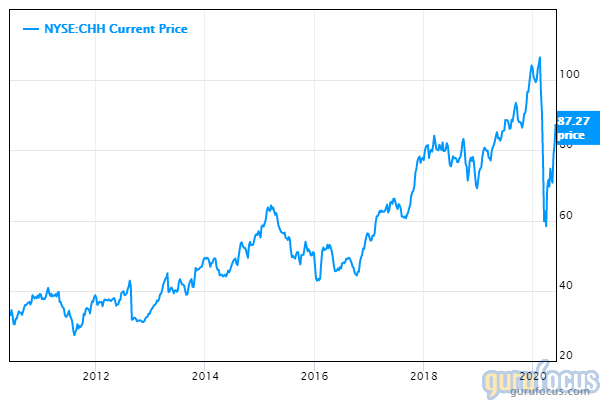

Still, the stock is relatively cheap now when compared with its previous prices, as shown in this 10-year chart:

Gurus

Among the investing giants followed by GuruFocus, only four have holdings in Choice. Ron Baron (Trades, Portfolio) of Baron Funds has made a major commitment to the name with 4.7 million shares. The other holders are Tom Gayner (Trades, Portfolio) of Markel Gayner Asset Management (213,000 shares), Pioneer Investments (Trades, Portfolio) (just under 41,000 shares) and Joel Greenblatt (Trades, Portfolio) of Gotham Asset Management (14,275 shares).

In a letter to his funds' stakeholders, Baron commented (about Choice): "The company should have a smaller decline in business than lodging peers given 80% of its business is leisure travel and almost all of its hotels are in drive to markets. Choice continues to have a strong balance sheet, and we believe the business is in a good position to mitigate the effects of this downturn given its asset light, fee-based business model."

Conclusion

Based on a quantitative analysis, Choice Hotels International is a fit for the Buffett-Munger list, a high-quality company selling at a reasonable price. Its business model, and particularly its low need for capital expenditures, is helping it get through the current Covid-19 and economic crises, and it is well positioned for recovery.

It has a good record for predictably growing revenues and earnings, along with a competitive advantage to protect its margins. Its long-term debt is a concern; it has more than enough operating income to cover its interest expenses but would be viewed more favorably if the interest coverage ratio was at least a point higher. Choice's valuation is relatively high, but the level of the current discount is likely as good as it's going to get.

All in all, Choice Hotels is worth the attention of value investors who want a steady growth stock with minimal drama.

Disclosure: I do not own shares in any companies named in this article and do not expect to buy any in the next 72 hours.

Read more here:

ViacomCBS: Can You Get Past Its Debt?

Booking: Is This a Value Stock?

Taro Pharmaceuticals: Strong Balance Sheet and Strong Competition

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.