Cimpress (CMPR) Q2 Earnings Beat Estimates, Revenues Miss

Cimpress plc CMPR reported mixed second-quarter fiscal 2022 results, wherein earnings beat the Zacks Consensus Estimate but revenues missed the same.

The company reported adjusted earnings of $2.08 per share, beating the Zacks Consensus Estimate of a loss of $1.58 by 31.65%. The bottom line improved from the year-ago quarter’s earnings of $1.22 per share.

Top-Line Details

Total revenues in the fiscal second quarter were $849.7 million, reflecting an increase of 8.8% from $780.9 million in the year-ago quarter. The top line missed the consensus estimate of $852 million by 0.3%.

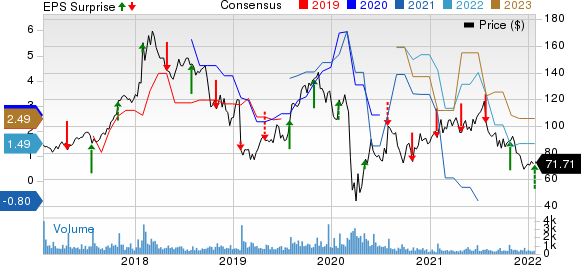

Cimpress plc Price, Consensus and EPS Surprise

Cimpress plc price-consensus-eps-surprise-chart | Cimpress plc Quote

Segmental Information

The National Pen segment generated revenues of $124.7 million, up from $114.7 million in the prior-year quarter. Vistaprint — the largest revenue-generating segment of the company — reported aggregate revenues of $448.1 million, up from $431.1 million in the year-ago quarter.

The Upload and Print segment’s revenues increased to $227.8 million from $198 million in the year-ago quarter. The segment consists of two subgroups — PrintBrothers and The Print Group. PrintBrothers’ revenues increased to $137.7 million from $121.8 million in the prior-year quarter. The Print Group generated revenues of $90.1 million, up from $76.2 million. Revenues from All Other Businesses increased to $57.7 million from $55.4 million.

Margin Details

In the quarter, Cimpress' cost of revenues was $423.9 million, up 11.3% on a year-over-year basis. It represented 49.9% of total revenues. Total selling, general & administrative expenses were $255.3 million, up 13.3%. It represented 30% of total revenues in the fiscal second quarter.

Gross profit increased 6.4% year over year to $425.8 million with a margin of 50.1%, down 110 basis points. Net interest expenses fell 15.6% to $25.4 million.

Balance Sheet and Cash Flow

As of Dec 31, 2021, Cimpress had $231.2 million in cash and cash equivalents compared with $193.2 million at the end of the previous quarter. Also, the company’s total debt (net of issuance costs) was $1,718.3 million, down from $1,729.7 million sequentially. In the fiscal second quarter, Cimpress refrained from buying back shares.

In the first six months of fiscal 2022, net cash provided by operating activities was $179.9 million compared with $256.2 million a year ago.

Outlook

The company is likely to benefit from end-market recovery in the quarters ahead. However, pandemic-related restrictions in some end markets might affect its performance. It remains focused on its organic growth investment in fiscal 2022.

For fiscal 2022, Cimpress is likely to incur capital expenditures, primarily for investment in product innovation and launches.

Zacks Rank & Stocks to Consider

The company currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Zacks Consumer Discretionary sector are discussed below.

Rent-A-Center, Inc. RCII presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here. Its earnings surprise for the last four quarters was 10.09%, on average.

Rent-A-Center’s earnings estimates increased 0.2% for 2021 (results are awaited) and 1.7% for 2022 in the past 30 days. Its shares have lost 19.6% in the past three months.

Clarus Corporation CLAR presently carries a Zacks Rank #2. Its earnings surprise in the last four quarters was 9.21%, on average.

In the past 30 days, Clarus’ earnings estimates have been stable for both 2021 (results are awaited) and 2022. CLAR’s shares have lost 19% in the past three months.

Delta Apparel, Inc. DLA presently carries a Zacks Rank #2. Its earnings surprise in the last four quarters was 95.48%, on average.

Delta Apparel’s earnings estimates have increased 0.6% for both fiscal 2022 (ending September 2022) and fiscal 2023 (ending September 2023) in the past 30 days. DLA’s shares have gained 11% in the past three months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RentACenter, Inc. (RCII) : Free Stock Analysis Report

Cimpress plc (CMPR) : Free Stock Analysis Report

Delta Apparel, Inc. (DLA) : Free Stock Analysis Report

Clarus Corporation (CLAR) : Free Stock Analysis Report

To read this article on Zacks.com click here.