Cintas (CTAS) Exhibits Solid Prospects, Challenges Persist

Cintas Corporation CTAS stands to gain from strength across its healthcare and hygiene end markets, driven by strong demand for its personal protective equipment like face masks, gloves, sanitizers and other critical items. Also, the company’s focus on enhancement of the product portfolio and customer base along with its strong supply chain, distribution network and sales force is likely to be advantageous. For the fourth quarter of fiscal 2021 (ended May 2021, results are awaited), it expects revenues of $1.80-$1.83 billion, indicating growth of 2.1% on a sequential basis.

Also, the company focuses on expanding its market share, product offerings and customer base through acquisitions. Its acquisition of Doritex Corp. (February 2020) has strengthened its offerings and customer reach across Buffalo and the surrounding Western New York region. It invested $53.7 million in acquisitions in fiscal 2020 (ended May 2020) and $7.6 million in the first nine months of fiscal 2021.

Moreover, it remains committed to rewarding shareholders handsomely through dividend payments and share buybacks. In the first nine months of fiscal 2021, the company used $371.8 million for paying out dividends and repurchasing shares worth $154.5 million. Also, it hiked its annual dividend rate by 10.2% in October 2020. Notably, it changed its dividend payment policy from annual to quarterly.

However, persistent weakness across the airline, cruise line, hospitality and gaming end markets on account of the coronavirus-led issues might affect Cintas’ top-line performance in the near term.

In addition, the company’s high-debt profile poses a concern. In the last five fiscal years (2016-2020), its long-term debt rose 19.5% (CAGR). Notably, the metric remained high at $2,291.4 million at the end of the third quarter of fiscal 2021 (ended February 2021). Any further increase in debt levels can raise the company’s financial obligations.

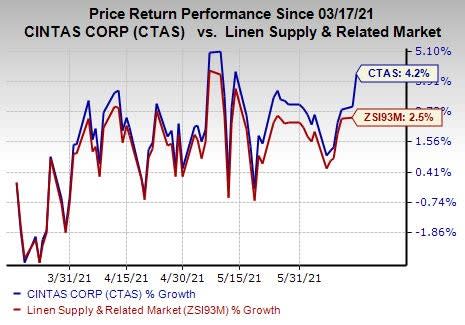

In the past three months, this Zacks Rank #3 (Hold) stock has returned 4.2% compared with the industry’s growth of 2.5%.

Image Source: Zacks Investment Research

Key Picks

Some better-ranked stocks from the Zacks Industrial Products sector are Alcoa Corporation AA, AGCO Corporation AGCO and Avery Dennison Corporation AVY. While Alcoa sports a Zacks Rank #1 (Strong Buy), AGCO and Avery Dennison carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Alcoa delivered an earnings surprise of 64.58% in the last reported quarter.

AGCO delivered an earnings surprise of 80.18% in the last reported quarter.

Avery Dennison delivered an earnings surprise of 19.40% in the last reported quarter.

Zacks' Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create "the world's first trillionaires." Zacks' urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alcoa Corp. (AA) : Free Stock Analysis Report

Avery Dennison Corporation (AVY) : Free Stock Analysis Report

AGCO Corporation (AGCO) : Free Stock Analysis Report

Cintas Corporation (CTAS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research