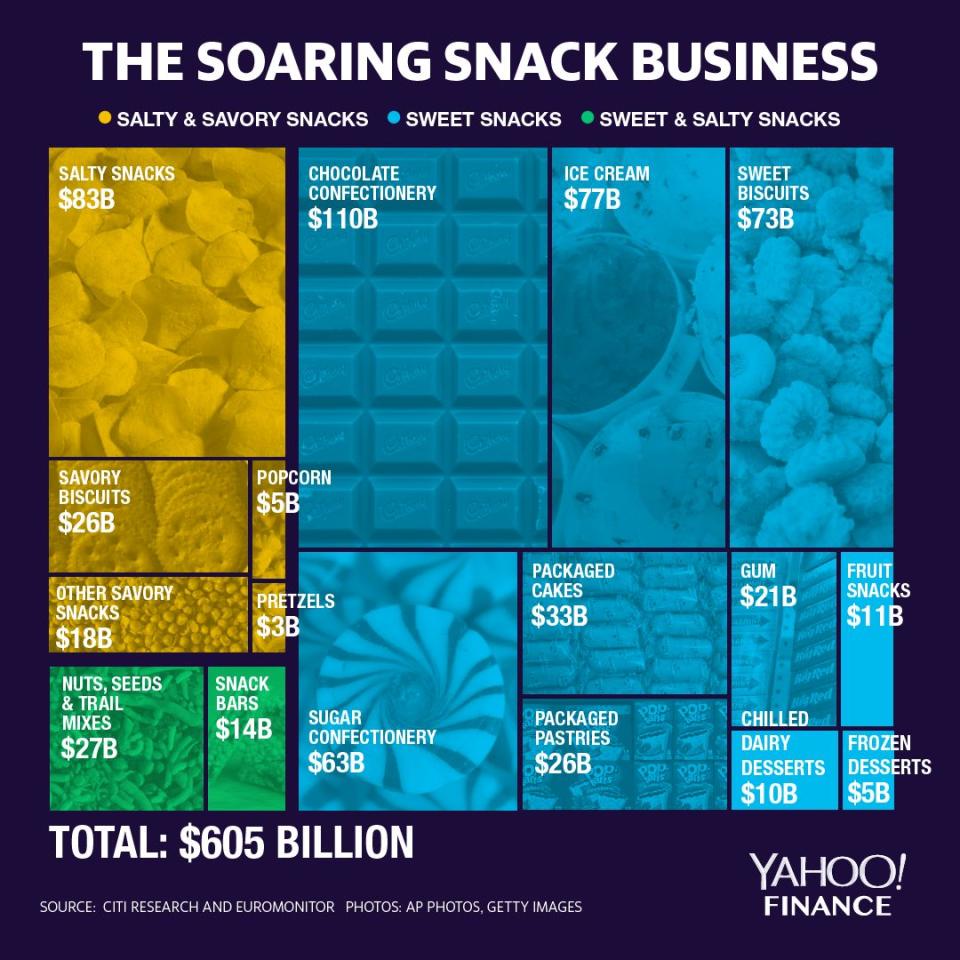

Here’s what the $605 billion global snack market looks like

The snack market is booming, bringing in a whopping $605 billion in global sales last year, and there are even more growth opportunities ahead, according to Citi.

In an environment where consumer tastes are changing, the demand for snacks has only gone up, especially in the U.S. “The average number of snacks consumed per day in the U.S. more than doubled since the late 1970's from 1 to 2.5 today. Moreover, 40% of U.S. adults in the late ‘70's didn't snack at all on any given day! Now, 95% of U.S. adults consume at least one snack daily,” analyst David Driscoll wrote in a note Wednesday.

So, what snacks are people reaching for the most? Within snacks, the largest global category is chocolate, which brought in about $110 billion in sales and accounts for 18% of the market. Second was salty snacks, which brought in $83 billion and represents 14%. Ice cream ranks third with about $77 billion in global sales and 13% of the total snack market. Fourth was sweet biscuits, raking in about $73 billion and representing 12%. Rounding out the top five is sugar confection, or candy. That group brought in $63 billion in sales and accounted for 10% of the global snack market. “In aggregate, these top 5 snacking categories represent 67% of global snack sales, or $406B in annual sales.”

Snacks’ rise in popularity is due to social and economic shifts, Driscoll argued. It is no longer just a treat, but snacks now also serve as a primary source of fuel.

“The rise in snacking occasions in the U.S. over the past 40 years has been driven largely in part to social and economic shifts, including consumers having busier, faster-paced lives, more women in the workforce, and smaller households. Consumers now need or want to eat more on the go, or cooking full sit-down meals is not as much as priority,” Driscoll said.

Given the increase in snack consumption, Driscoll sees major opportunities for businesses. Not only is demand is strong, but margins are also better with snacks. “One benefit of selling snacks is that they generally offer manufacturers comparatively better margins relative to other categories,” Driscoll said. “When we break out snacks, when possible, from individual company disclosures, our analysis indicates operating margins at or above the 14.7% operating margin for food globally.”

In developed markets, snacks are growing faster than total food. “This a key reason why large global food companies are increasingly trying to shift their portfolios—and their narrative—toward snacks,” Driscoll explained.

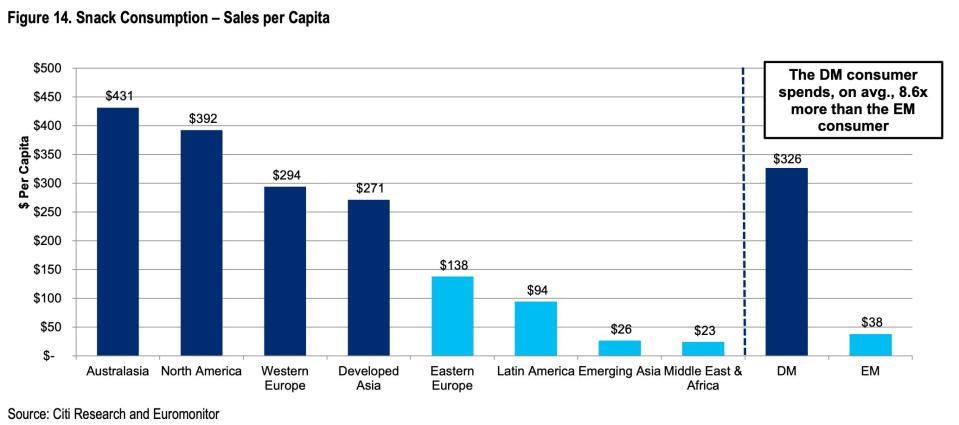

North America and Western Europe are currently the largest snack markets, accounting for nearly 50%. According to Driscoll, the developed markets represent about 60% of total sales, while emerging markets represent the remaining 40%.

Snacking in emerging markets has grown at a 7.3% compound annual growth rate over the past five years, three times faster than in developed markets. “The higher or faster level of absolute growth speaks to the attractiveness of snacks in the emerging markets and an area of focus for large, global food companies,” Driscoll said.

Growth rates are strong, but the average consumer in an emerging market only spends about $38 a year on snacks, while the average consumer in a developed country spends about $328 annually. Thus, Driscoll argued that there is still a long journey for snack trends in emerging markets to catch up to developed markets. However, it remains an area of great opportunity.

So which companies depend on snack sales? Hershey (HSY) and Hostess (TWNK) top the list. Snacks comprise 96% of total sales for both companies. Snacks account for 88% of total sales for Mondelez (MDLZ), 54% for PepsiCo (PEP), 50% for Kellogg (K) and 40% at Campbell Soup (CPB).

As snacks soar, so have many of these stocks. Hershey has surged 23% this year, while Hostess jumped 21%, and Mondelez rose 31%. PepsiCo was up 18%, and Campbell Soup increased 16%. Kellogg was the laggard, as shares were up a modest 1% in 2019. The broader market jumped 14% in the same time period.

—

Heidi Chung is a reporter at Yahoo Finance. Follow her on Twitter: @heidi_chung.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

More from Heidi:

Chipotle downgraded on concerns over African swine fever impact

Fast food needs to beef up delivery to stay relevant: Wells Fargo

Jack in the Box has a minimum-wage problem

Game of Thrones: The staggering numbers behind HBO’s biggest show

Early Uber investor sees 'the same kind of situation' as Tesla