The City must hug China close in order to thrive, lobbyists say

The Square Mile must embrace Communist China to thrive after Brexit, City lobbyists have said in a manifesto which risks drawing the wrath of Tory backbenchers.

Ministers should help firms deepen their ties with the authoritarian country and could offer to help Beijing develop its capital markets according to TheCityUK, which represents financial and professional service companies across London.

Other proposals in its manifesto for British finance include cutting the tax burden on UK lenders by scrapping the bank surcharge; reducing sponsorship costs and processing times for visas for highly skilled workers; and providing clearer guidance about how a new national security act will be applied.

The China charm offensive aligns the lobby group with Rishi Sunak, the Chancellor, who has backed a closer relationship. However, it drew swift condemnation from campaigners and MPs critical of China's brutal treatment of Uighur Muslims and its suppression of democracy campaigners in Hong Kong.

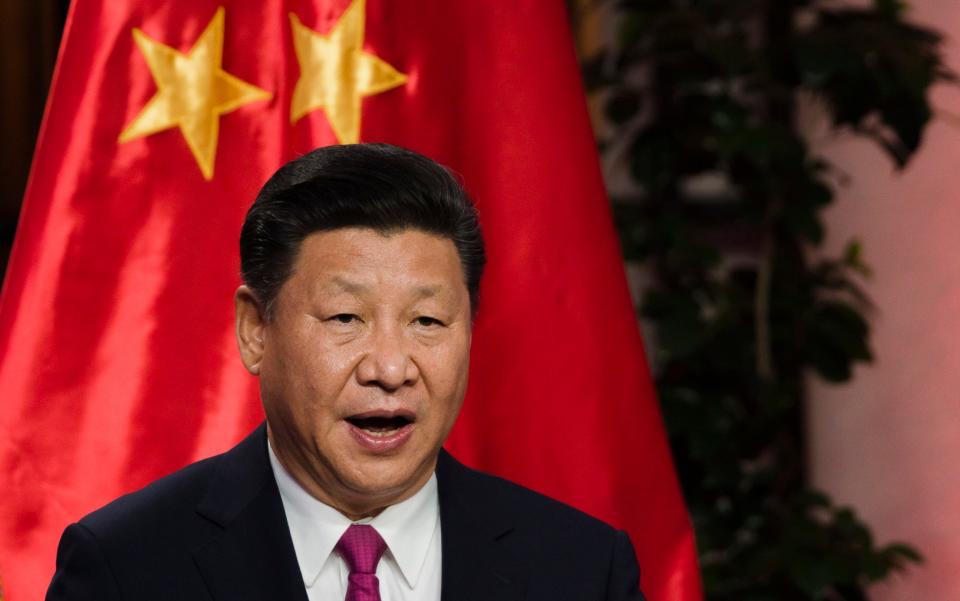

Tom Tugendhat, a Conservative MP and chairman of the Commons foreign affairs committee, said: "Over the past three months, we have seen Beijing order a wave of crackdowns on Chinese businesses, including companies being warned that they won’t be able to list abroad.

"When Xi is tightening his grip over the Chinese economy, now is surely the time for British businesses to show extra caution about deepening relationships with the Chinese government and its capital markets."

TheCityUK said that finance firms should help China to develop its markets and expand its green finance and fintech industries. It added that the Square Mile should also look to do more business with other developing markets, including Russia, Saudi Arabia and India.

It made the proposals as part of a new international strategy aimed at helping London to overtake New York as the world’s leading financial centre within five years.

Mr Sunak hailed China as "one of the most important economies in the world" and said that the UK's relationship with it "lacks nuance" in a speech at Mansion House two months ago.

Some City firms have already responded kindly to the chancellor’s remarks, with Legal & General, the UK’s biggest pensions manager, plotting an expansion into China.

But Gray Sergeant of the Henry Jackson Society, a foreign policy think-tank, said he is concerned about efforts to forge a new partnership with Beijing.

He said: “If deeper ties means deeper dependency then such an approach will only make it harder for Britain to stand up to China’s challenges to the existing liberal international order."

TheCityUK said it wants London to grow the UK's share of key global financial markets, as well as building new capabilities in areas such as data, technology and international risk management.

The UK lost its crown as the world’s leading international financial centre to the US in 2018, according to the Global Financial Centres Index.

Stock market listings, which are a key indicator of the strength of a financial centre, plunged in the UK between 2010 and 2020. The number of international companies listed on the London Stock Exchange fell from 599 to 370.

Miles Celic, chief executive of TheCityUK, said: “One of the greatest risks for any successful financial centre is complacency. Europe is littered with cities that were once the leading international centre of their day. The last decade has been one of growth for our industry, yet global competitors have grown faster.

“However, with the right strategy in place and a clear focus on delivery, the UK can pull away once again from its competitors. It is an ambition that needs industry, government, and regulators to work together. It will take sustained focus, cooperation and determination.”