City comment: Where is London’s answer to $1 trillion Tesla?

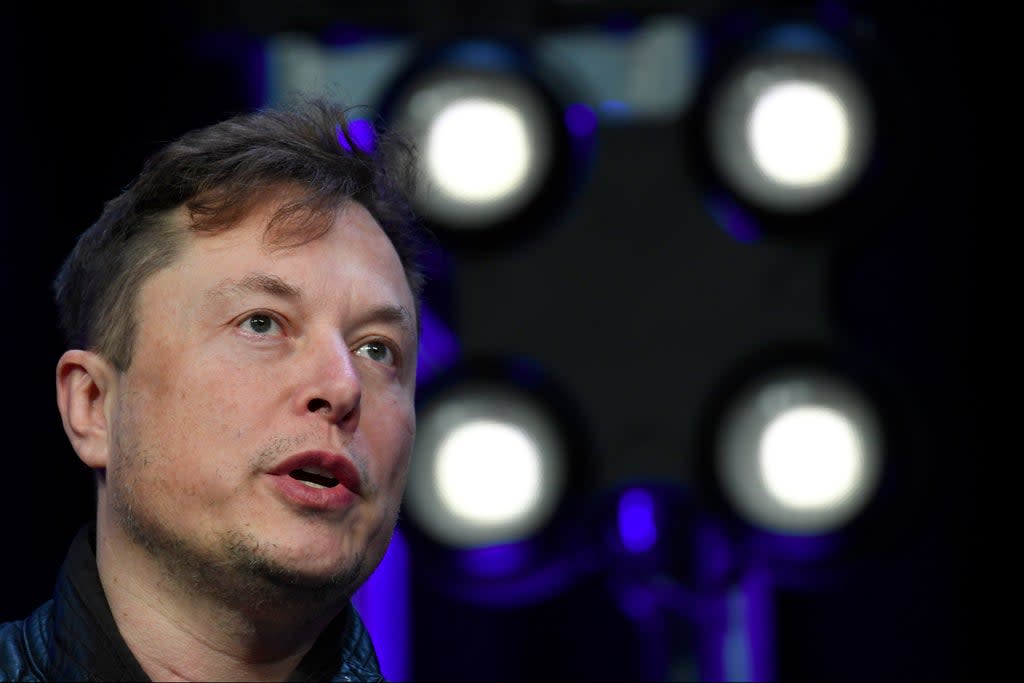

Hats off to Elon Musk. The eccentric billionaire’s electric vehicle company has surpassed the $1 trillion market cap milestone — the first car company to do so.

Commentary will focus on Tesla’s success or otherwise. A debate rages as to whether the business is chronically overvalued.

But the landmark should also give London pause for thought. Why hasn’t our market produced anything like a Tesla?

Even if you think the car maker is overvalued, there is no arguing that the UK has missed the boat when it comes to innovative tech over the last decade.

Past governments have done a good job of boosting the UK’s startup scene with initiatives like Tech City but bigger businesses still struggle. The City has let them down.

The London Stock Exchange has been far too slow to adapt to changes in the global equity markets — just look at the glacial movement on SPACs and dual-class shares.

Then there’s the London investor class, who are more obsessed with limiting downside risks than placing big bets. London punishes, rather than rewards, innovators. No wonder they flock to New York.

The government is making the right noises about the next big wave: green tech. Boris’s ambition to make the UK the “Qatar of hydrogen” is admirable.

But as New Financial’s report today shows, there is more to do. Our track record on tech suggests we may struggle. The City needs to wake up and smell the hydrogen.

Read More

Fund buying Tesla Megapacks and Pod Point IPO bring batteries to London

COP26: London losing to Europe on green finance says New Financial