Should Clabo (BIT:CLA) Be Disappointed With Their 90% Profit?

One simple way to benefit from the stock market is to buy an index fund. But many of us dare to dream of bigger returns, and build a portfolio ourselves. For example, the Clabo S.p.A. (BIT:CLA) share price is up 90% in the last three years, clearly besting than the market return of around 15% (not including dividends).

View our latest analysis for Clabo

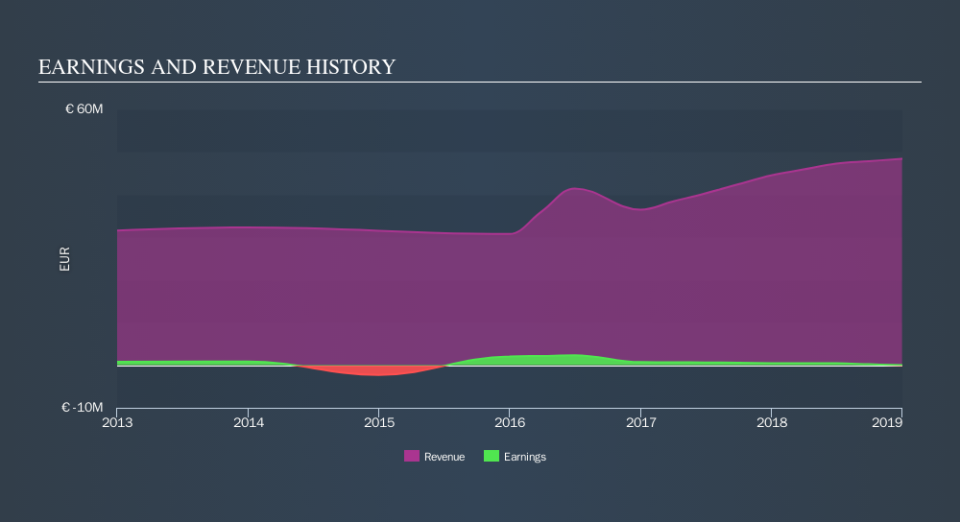

Because Clabo is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 3 years Clabo saw its revenue grow at 12% per year. That's a very respectable growth rate. While the share price has done well, compounding at 24% yearly, over three years, that move doesn't seem over the top. Of course, valuation is quite sensitive to the rate of growth. Keep in mind that the strength of the balance sheet impacts the options open to the company.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Dividend Lost

The share price return figures discussed above don't include the value of dividends paid previously, but the total shareholder return (TSR) does. By accounting for the value of dividends paid, the TSR can be seen as a more complete measure of the value a company brings to its shareholders. Over the last 3 years, Clabo generated a TSR of 92%, which is, of course, better than the share price return. Even though the company isn't paying dividends at the moment, it has done in the past.

A Different Perspective

The last twelve months weren't great for Clabo shares, which cost holders 50%, while the market was up about 6.5%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Investors are up over three years, booking 24% per year, much better than the more recent returns. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.