Clearfield (NASDAQ:CLFD) Shareholders Have Enjoyed An Impressive 172% Share Price Gain

Clearfield, Inc. (NASDAQ:CLFD) shareholders might be concerned after seeing the share price drop 10% in the last month. On the other hand, over the last twelve months the stock has delivered rather impressive returns. During that period, the share price soared a full 172%. So it is important to view the recent reduction in price through that lense. Investors should be wondering whether the business itself has the fundamental value required to continue to drive gains.

View our latest analysis for Clearfield

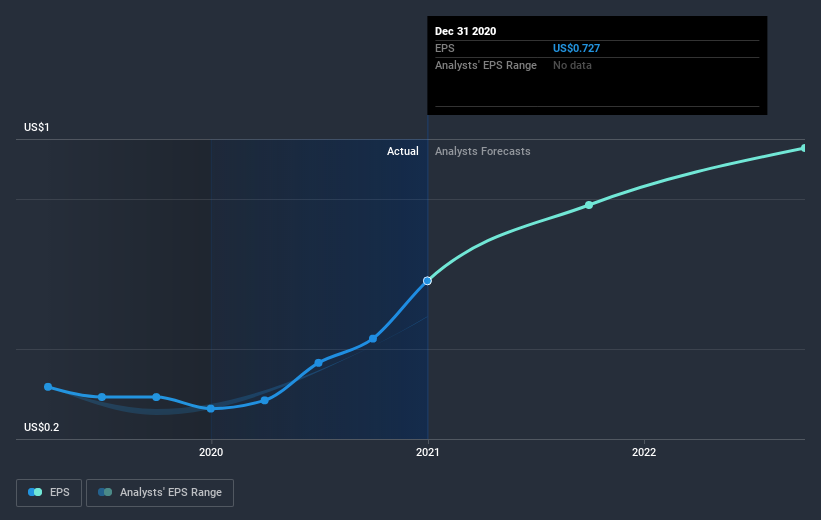

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Clearfield was able to grow EPS by 141% in the last twelve months. We note that the earnings per share growth isn't far from the share price growth (of 172%). So this implies that investor expectations of the company have remained pretty steady. We don't think its coincidental that the share price is growing at a similar rate to the earnings per share.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Clearfield's earnings, revenue and cash flow.

A Different Perspective

It's good to see that Clearfield has rewarded shareholders with a total shareholder return of 172% in the last twelve months. That's better than the annualised return of 13% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Clearfield that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.