Clearwater Paper (CLW) Q4 Earnings & Revenues Miss Estimates

Clearwater Paper Corporation CLW reported fourth-quarter 2020 adjusted earnings per share of $1.45, which missed the Zacks Consensus Estimate of $1.62. However, the bottom line soared 292% from 37 cents reported in the prior-year quarter aided by continued elevated demand for tissue products and solid operational execution.

Including one-time items, the company reported earnings of $1.34 per share compared with 12 cents per share in the prior-year quarter.

The company generated revenues of $453 million in fourth-quarter 2020, reflecting year-over-year growth of 4%. Nevertheless, the top line figure lagged the Zacks Consensus Estimate of $468 million.

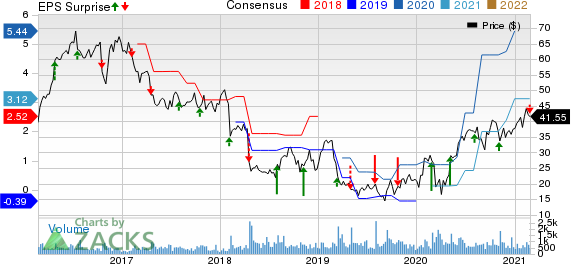

Clearwater Paper Corporation Price, Consensus and EPS Surprise

Clearwater Paper Corporation price-consensus-eps-surprise-chart | Clearwater Paper Corporation Quote

Cost of sales was $376 million, down 2% year over year. Gross profit surged 49.5% year over year to $376 million. Gross margin was 16.9% in the reported quarter compared with 11.8% in the prior-year quarter.

Selling, general and administrative expenditure increased 13% to $32.6 million from the year-ago quarter. Adjusted EBITDA was $71.6 million in the reported quarter, reflecting an improvement of 39% from $51.7 million in the prior-year quarter. Adjusted EBITDA margin was 15.8% compared with 11.9% in the year-ago quarter.

Segment Performance

Consumer Products: Net sales improved 6% year over year to $244 million. Adjusted EBITDA was $44 million in the reported quarter compared with $20 million in the prior-year quarter.

Pulp and Paperboard: Net sales inched up 2% year over year to $209 million from the prior-year quarter. The segment reported adjusted EBITDA of $43 million, which declined 2.5% year over year.

Financial Position

Clearwater Paper’s cash and cash equivalents were $35.9 million at the end of 2020 compared with $20 million at the end of 2019. Operating cash flow was $247 million in 2020, marking a significant improvement compared with $55.6 million in the prior year. The company’s long-term debt was $716 million as of Dec 31, 2020, down from $884 million as of Dec 31, 2019.

2020 Results

Clearwater Paper’s adjusted earnings per share in 2020 was $5.30, a significant improvement from the prior-year’s figure of 23 cents. However, the bottom line missed the Zacks Consensus Estimate of $5.44. Including one-time items, the company delivered an earnings per share of $4.61 in 2020 against a loss per share of 34 cents in 2019. Sales rose 6% year over year to $1.87 billion but missed the Zacks Consensus Estimate of $1.88 billion.

Outlook

In first-quarter 2021, the company expects demand for tissue products to be volatile due to COVID-19. It will also be lower year over year as the pandemic buying of tissue had soared in first-quarter 2020 as the crisis spread. The company also anticipates some inflationary headwinds, notably in market pulp pricing.

Share Price Performance

Over the past year, Clearwater Paper has gained 43.7% compared with the industry’s rally of 45.3%.

Zacks Rank & Stocks to Consider

Clearwater Paper currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks worth considering in the basic materials space include Impala Platinum Holdings Limited IMPUY, Fortescue Metals Group Limited FSUGY and BHP Group BHP. All of these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Impala Platinum has an expected earnings growth rate of 195.9% for the current fiscal. The company’s shares have rallied 84% in the past year.

Fortescue has a projected earnings growth rate of 84.3% for the current fiscal. The company’s shares have soared 182% in a year.

BHP Group has a projected earnings growth rate of 65.6% for the current fiscal year. The company’s shares have appreciated 75% in a year.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.9% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BHP Group Limited Sponsored ADR (BHP) : Free Stock Analysis Report

Impala Platinum Holdings Ltd. (IMPUY) : Free Stock Analysis Report

Fortescue Metals Group Ltd. (FSUGY) : Free Stock Analysis Report

To read this article on Zacks.com click here.