To close racial wealth gap, Westchester churches aim to educate prospective homebuyers

The homeownership rate among Black and Latino residents in Westchester County is half that of white residents, according to recent data from the Westchester Community Foundation.

And, median incomes for white and Asian households far outpace those of Black and Latino residents.

Both are indicative of a racial wealth gap that appears to be growing. Despite the end of some widespread discriminatory systems, predatory practices targeting uninformed communities persist, including in the homebuying process.

“As a way of eradicating the racial wealth gap, homeownership is a path that will create generational wealth in our communities,” said James Bason, executive director of the congregational alliance and the head of TruFund Financial Services, a nonprofit based in New York City.

A coalition of churches hope to take a step toward addressing that gap on Saturday by hosting a homeownership seminar at the Union Baptist Church in White Plains.

Building wealth: Bailey Initiative takes on racial gaps in homeownership, generational wealth

Latest debates: Experts: NY bail reform laws keeping jail population down, but racial disparities persist

Redlining and heat: Study: Yonkers sees higher temps in areas impacted by discriminatory housing practice

Residents interested in learning about pathways to buying a home can get information on credit, the mortgage approval process and first-time homebuyer programs with presentations hosted by the Westchester Congregational Alliance, a consortium of five historically Black churches, and Community Housing Innovations, a White Plains nonprofit.

“It’s really, really important that the bedrock of our continued financial literacy outreach for community development be centered around an educational component," Bason said, "making information available to the members of our congregations, and the community at large.”

Disparity, predatory practices persist

Black Americans have historically been denied access to homebuyer programs. They also experienced redlining, the racist system used by banks and realtors for decades through the 20th century to deem which areas got loans; communities of color and immigrant communities were outlined in red ink — meaning they were risky for investing.

In 2020, Federal Reserve staff estimated white families have eight times the wealth of Black families and five times that of Latino families. Officials defined wealth as the difference between gross assets and liabilities. Experts say that gap is growing.

Today, Black people remain much more likely to be denied mortgages by banks, according to a January analysis by Zillow of data from the Home Mortgage Disclosure Act. They are often subject to predatory lending practices with high-interest, subprime loans that make it more difficult to pay off mortgages, which contributed to the 2010 foreclosure crisis, a 2018 study in the journal Housing Studies found. When Black people own homes, they’re consistently undervalued, a 2018 Brookings Institute report said.

“We can see across the board from Westchester County, and just nationally, that there’s just a huge discrepancy in Black and Brown homeownership,” Anthony Bailey, a board member of the Westchester Community Foundation, who launched the Bailey Initiative with a cohort mostly composed of Black women to purchase their first homes.

He pointed to disparities in homeownership connected to racial inequities within financial services, job prospects and intergenerational wealth. This is even more difficult in one of the most expensive areas of the country.

In May, the Westchester Community Foundation released an index showing 37% of Black residents and 35% of Latino residents in the county owned their home, compared to 73% of white people and 64% of Asian people. The index looked at U.S. Census Bureau figures between 2016 to 2020.

Westchester’s figures were better than New York State, but they were worse than national averages, as well as other Hudson Valley counties and Nassau County. Black and Latino residents tend to have lower homeownership rates in Yonkers, Mount Vernon and New Rochelle, which all have large communities of color.

In Westchester, the median income for a Black household, at $64,000, is nearly half that of a white household, at nearly $116,000.

What's happening Saturday

Saturday’s seminar, held in part with Citibank, will address topics from first-time homebuyer programs to budgeting, said Tiffany Kilpatrick, the director of homeownership and housing retention at Community Housing Innovations.

Churches in the congregational alliance have been focused on affordable housing, including White Plains' Mt. Hope AME Zion Church, which is building a 60-unit development for seniors. Now, they aim to address homeownership.

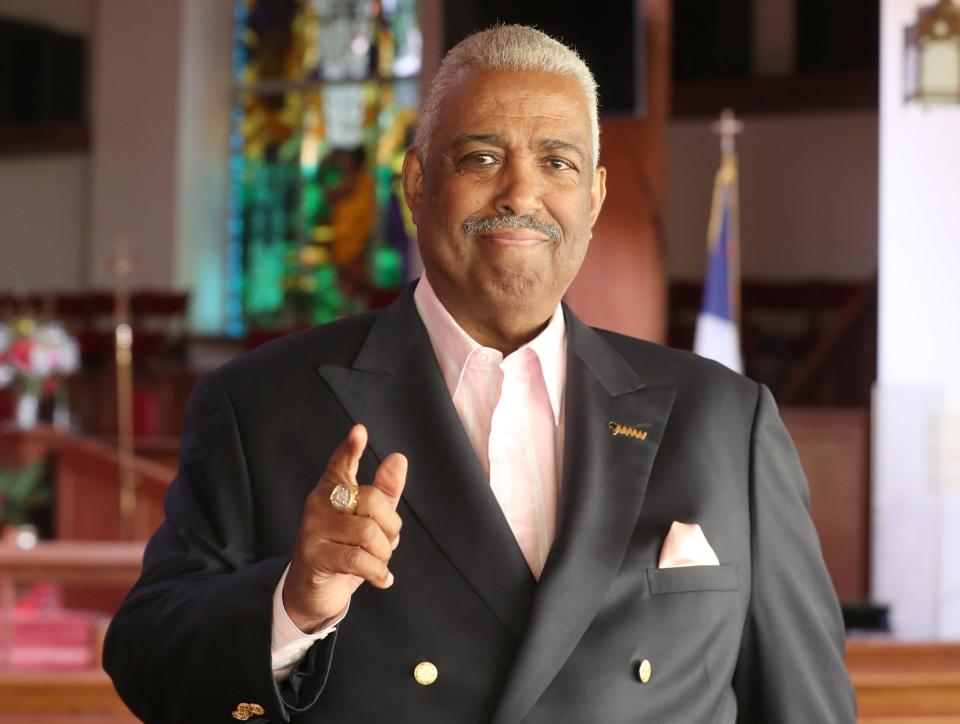

“If we can improve the housing stock and people of color owning this asset, we believe it will begin to tear apart the social evils that are intransigent within our community," the Rev. Gregory Robeson Smith Sr., the senior pastor of Mt. Hope, who chairs the congregational alliance, said. "If people don’t have a place to live ... then life is a tinkling cymbal," a Corinthians reference that means emptiness.

Organizers hope the seminar prepares residents to own and keep a home when they're ready. Eventually, they can pass that wealth on to future generations.

“We want to make sure you’re able to sustain your home,” Kilpatrick said, “not that you just get in it.”

The seminar is set for 10 a.m. to noon at the Union Baptist Church, 31 Manhattan Ave., in White Plains. Residents can also participate via Zoom by registering on Eventbrite: app.promotix.com/events/details/Pathway-to-Home-Ownership-tickets.

Eduardo Cuevas covers diversity, equity and inclusion in Westchester and Rockland counties. He can be reached at EMCuevas1@lohud.com and followed on Twitter @eduardomcuevas.

This article originally appeared on Rockland/Westchester Journal News: Westchester churches to address racial wealth gap through homebuying