CMC Markets (LON:CMCX) Is Paying Out A Larger Dividend Than Last Year

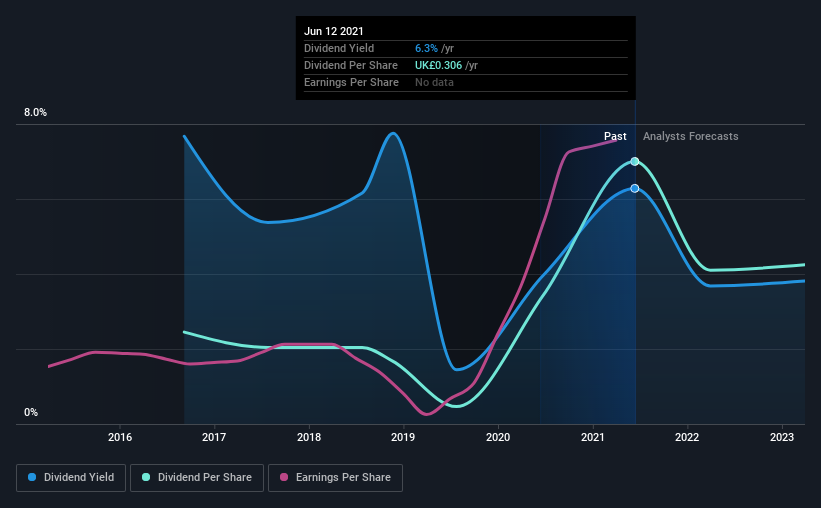

The board of CMC Markets plc (LON:CMCX) has announced that it will be increasing its dividend on the 9th of September to UK£0.21. This will take the dividend yield from 6.3% to 6.3%, providing a nice boost to shareholder returns.

See our latest analysis for CMC Markets

CMC Markets Doesn't Earn Enough To Cover Its Payments

A big dividend yield for a few years doesn't mean much if it can't be sustained. CMC Markets was earning enough to cover the previous dividend, but it was paying out quite a large proportion of its free cash flows. The company is clearly earning enough to pay this type of dividend, but it is definitely focused on returning cash to shareholders, rather than growing the business.

Over the next year, EPS is forecast to fall by 40.8%. Assuming the dividend continues along recent trends, we believe the payout ratio could reach 108%, which could put the dividend under pressure if earnings don't start to improve.

CMC Markets' Dividend Has Lacked Consistency

It's comforting to see that CMC Markets has been paying a dividend for a number of years now, however it has been cut at least once in that time. This makes us cautious about the consistency of the dividend over a full economic cycle. Since 2016, the dividend has gone from UK£0.11 to UK£0.31. This works out to be a compound annual growth rate (CAGR) of approximately 23% a year over that time. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

The Dividend Looks Likely To Grow

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. We are encouraged to see that CMC Markets has grown earnings per share at 32% per year over the past five years. The company doesn't have any problems growing, despite returning a lot of capital to shareholders, which is a very nice combination for a dividend stock to have.

In Summary

In summary, while it's always good to see the dividend being raised, we don't think CMC Markets' payments are rock solid. While CMC Markets is earning enough to cover the dividend, we are generally unimpressed with its future prospects. This company is not in the top tier of income providing stocks.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 4 warning signs for CMC Markets (of which 2 make us uncomfortable!) you should know about. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.