CNB Financial Corporation (NASDAQ:CCNE) Looks Interesting, And It's About To Pay A Dividend

CNB Financial Corporation (NASDAQ:CCNE) stock is about to trade ex-dividend in 4 days time. Investors can purchase shares before the 27th of February in order to be eligible for this dividend, which will be paid on the 13th of March.

CNB Financial's next dividend payment will be US$0.17 per share, on the back of last year when the company paid a total of US$0.68 to shareholders. Looking at the last 12 months of distributions, CNB Financial has a trailing yield of approximately 2.4% on its current stock price of $28.79. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

See our latest analysis for CNB Financial

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Fortunately CNB Financial's payout ratio is modest, at just 26% of profit.

Generally speaking, the lower a company's payout ratios, the more resilient its dividend usually is.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. Fortunately for readers, CNB Financial's earnings per share have been growing at 11% a year for the past five years.

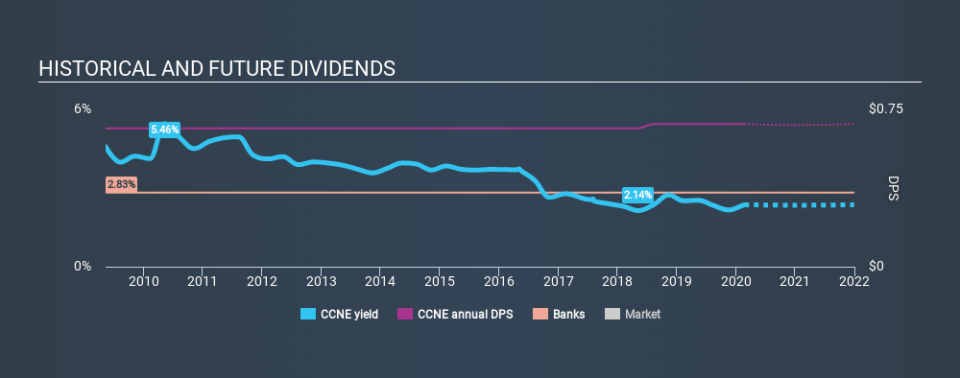

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. CNB Financial's dividend payments are effectively flat on where they were ten years ago.

The Bottom Line

Should investors buy CNB Financial for the upcoming dividend? When companies are growing rapidly and retaining a majority of the profits within the business, it's usually a sign that reinvesting earnings creates more value than paying dividends to shareholders. Perhaps even more importantly - this can sometimes signal management is focused on the long term future of the business. We think this is a pretty attractive combination, and would be interested in investigating CNB Financial more closely.

Curious what other investors think of CNB Financial? See what analysts are forecasting, with this visualisation of its historical and future estimated earnings and cash flow.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.