New coaching program is designed to help you fix finances

Many of us who made resolutions for 2020 – exercising more, decluttering and, yes, doing a better job managing our money – can relate to the idea of having a coach in our corner.

Now, Farmington Hills-based GreenPath Financial Wellness – with the support of a $345,000 grant from JPMorgan Chase – will be developing a pilot program to expand financial coaching efforts for low- to moderate-income consumers across the country.

The program will use one-on-one phone conversations along with digital tools, such as texts.

"The majority of households are struggling with financial insecurity," said Colleen Briggs, head of community innovation at JPMorgan Chase.

Many do not have a savings buffer, she said, to deal with unexpected bills or volatility in their income. The coaching program is designed to test some virtual financial coaching methods to improve the financial health of people in underserved communities.

Many times, financial heartache is only one emergency away since most people live paycheck to paycheck.

Four out of 10 U.S. households maintain they would have trouble paying $400 for an unexpected expense, according to a Federal Reserve Board measure of financial well-being in 2018. The study was released in May 2019.

The study indicated that 61% of adult say they'd cover that $400 emergency with cash, savings or a credit card that would be paid off at the next statement.

But 27% said they would need to borrow money somehow or sell something to pay for the expense, and 12% would not be able to cover the expense at all.

Another startling stat: 17% of adults are not able to pay all of their current month's bills in full.

Who inspires you?: USA TODAY seeks your Women of the Century to commemorate 19th Amendment

Social Security: 4 changes coming in 2020

Many times, Briggs said, people know they want to save, a lot like they know they want to lose weight. Financial literacy efforts only go so far, she said, by helping people understand basics, such as the need to budget for bills or pay attention to your credit score.

"Financial literacy efforts do not actually lead to behavioral change," Briggs said.

Financial coaching takes the next step by finding out what motivates an individual to change habits and develop their own solutions for building their savings, improving their credit, reducing debt and ultimately building wealth, she said.

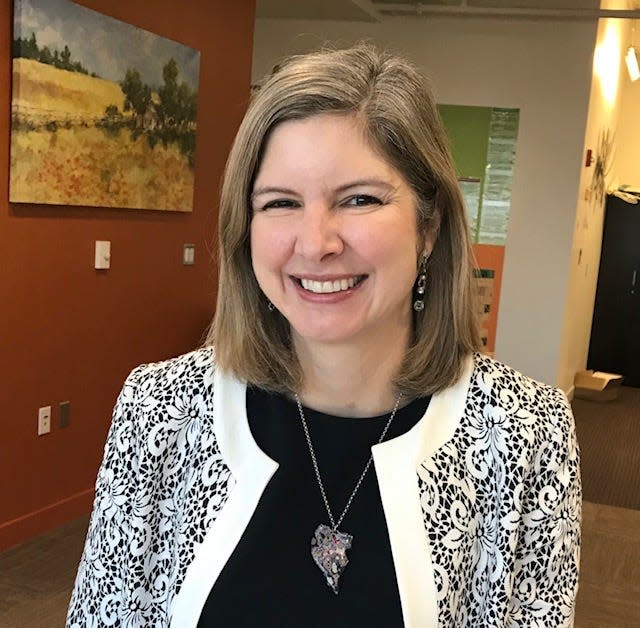

Kristen Holt, GreenPath's president and CEO, said the pilot program will include some personality assessments to better determine what motivates an individual to stay on course.

"Everybody's different," Holt said. "What motivates me might not work for you."

The Center for Financial Security at the University of Wisconsin-Madison, which has experience with financial coaching, will offer support in designing the program and evaluating results throughout the two-year pilot.

Holt said the virtual financial program is in the design phase and the actual coaching is expected to start next quarter. Consumers who are interested in the program – or obtaining one-hour of free counseling now to discuss their financial challenges – can contact GreenPath at 800-550-1961.

GreenPath, based in Farmington Hills, Michigan, also plans to work with its network of credit unions and other partners, including Chase, to promote the pilot program.

While consumers can still expect to talk one-on-one with counselors, the virtual program will include ways to reach out to clients via text or other methods to provide extra accountability and encouragement. The virtual aspect of the new program may help cut down overall costs and broaden the reach to more consumers.

People want a relationship with a coach – much like a personal trainer – to support them on their journey. Sometimes, people take steps because they don't want to let their coach down. Or they say things like "I can't wait to tell my coach what I did," Holt said.

"We use a lot of behavioral economics here," Holt said.

Holt said counselors are trained to be empathetic when talking with people about financial roadblocks.

"GreenPath is a judgement-free place," Holt said. "We've seen it all."

People cannot think clearly and take positive steps to get out of a jam if they're living in shame, fear or constant stress.

"When you feel that relief, then you can take action," Holt said.

One key tip for consumers who are trying to get on a better financial track: "Set it and forget it."

Figure out a way to have an extra $5 or $25 automatically taken out of a paycheck consistently and directly deposited into an account that isn't used pay the regular bills. It's one strategy for building an emergency savings fund that could be used to cover unexpected car repairs and the like.

The trick is to make sure there's added friction to make the money harder to access and prevent you from dipping into that savings too easily.

GreenPath, founded in 1961, is a nonprofit with about 500 employees in more than 60 offices in a variety of states. It provides financial wellness programs in the workplace, programs for those who have trouble repaying their student loans, home ownership education and foreclosure prevention, as well as debt management plans.

And yes, not surprisingly, Holt says, call volume at GreenPath has gone up significantly in January as many people are making financial resolutions and struggling with holiday bills. "We just have everyone answering the phone," Holt said.

Contact Susan Tompor at 313-222-8876 or stompor@freepress.com. Follow her on Twitter @tompor. Read more on business and sign up for our business newsletter.

This article originally appeared on Detroit Free Press: GreenPath, JPMorgan Chase test virtual financial counseling