Coinbase-Backed Stablecoin Claims Rivals Deceptively Pump Market Caps

Touted as the next big thing in crypto, stablecoins promise investors volatility-proof exposure to decentralized assets, but insiders say that this emerging asset class is vulnerable to the same manipulative practices that have tarnished the broader ecosystem.

According to Nevin Freeman, chief executive officer of Reserve, a Coinbase-backed stablecoin, many of his rivals artificially inflate their market caps and trading volumes, creating misleading data on crypto-tracking sites like CoinMarketCap and The Stablecoin Index.

Freeman identified two dubious tactics used by stablecoin operators to pump their metrics: giving discounts to investors who agree to lock up their funds for a set timeframe; and encouraging “wash trading,” where traders simultaneously buy and sell the same cryptocurrency to inflate the appearance of volume and liquidity.

Paxos & Gemini Ignite Crypto Price War

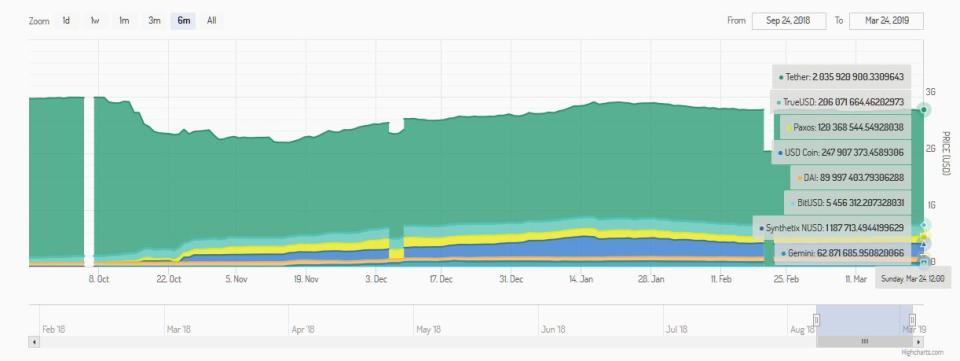

Reserve alleges that investors can’t trust what they see on crypto data sites. | Source: Stablecoin Index

Recent examples of discounting tactics include Paxos and Gemini, both of which offered select over-the-counter (OTC) trading desks 1% discounts last year to kickstart adoption. These discounts were predicated on OTC partners agreeing to hold their stablecoins for a predetermined “lock-up” period.

Reserve claims these rebate schemes are the reason PAX and GUSD activity surged last December, on both OTC desks and exchanges like Huobi and Binance. For example, GUSD’s market cap soared from roughly $87 million on December 17 to over $103 million the next day, according to CoinMarketCap data.

In the case of Paxos, their discount program coincided with the launch of HUSD, a pool of stablecoins offered by Singapore-based exchange Huobi, which enabled traders to swap stablecoins without actually trading them. This led to an arbitrage frenzy where certain traders tried to mass-withdraw PAX, even going as far as to creating dozens of dummy accounts to circumvent Huobi’s $10,000 withdrawal limit.