From the college kid who made millions on a meme stock to Kim Kardashian's crypto misadventures, here are 7 of the craziest stories from markets in 2022

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

Markets had a wild ride this year, with volatile swings punctuated by moments of sheer absurdity.

A college kid earning millions on Bed Bath & Beyond, and a Kardashian's run-in with the SEC were only some of the highlights.

Here are seven of the wildest, most absurd, and shocking moments from markets in 2022.

Amid volatility, soaring inflation, and grim prognostications of a looming recession, markets in 2022 were also punctuated by strange, shocking, and absurd occurrences.

Meme stocks died a slow death, but at least one of them made some lucky college kid a cool $110 million.

A person going by the name Razzlekhan was accused of helping to pull off a massive crypto heist.

Elon Musk put us all through agony with his back and forth Twitter saga, which culminated in his tumultuous takeover of the social media company in October.

And that's just some of the weirdness that went down in markets this year. Here are seven of the craziest moments from 2022.

College kid makes $110 million on Bed Bath and Beyond stock

College student Jake Freeman made a tidy $110 million profit on Bed Bath Beyond this summer when the meme stock skyrocketed and more-than-tripled in price.

Freeman purchased a $25 million stake in the struggling home goods retailer, and later sold his shares for $130 million. Shortly after Freeman cashed in, Gamestop CEO Ryan Cohen sold his stake in the company, causing share price to plummet 19%.

Though he isn't exactly your average day trader (he's a finance whiz kid who made his first investment when he was 13, and raised millions from friends and family to amass his initial BBBY stake), it was an impressive gain amid an otherwise agonizing year for meme stocks and the Wall Street Bets crowd.

Razzlekhan and Dutch are accused of laundering $4.5 billion in crypto

Ilya Lichtenstein (aka Dutch) and Heather Morgan (aka Razzlekhan and the Crocodile of Wall Street) were charged with laundering $4.5 billion in bitcoin and hacking the crypto exchange Bitfinex, pulling off the biggest crypto heist to-date.

The NYC couple garnered attention for their bizarre and cringeworthy social media posts, Morgan in particular, rapping under the TikTok pseudonym Razzlekhan. She was also previously a contributor to Forbes, where she once wrote an article on cybercrime protection.

Upon arrest, authorities found items like hollowed-out books, hardware wallets, and a bag labeled "burner phone" in their home, leading them to suspect the couple was planning on assuming new identities in Ukraine and Russia.

They've been billed as crypto's Bonnie and Clyde, and both Hulu and Netflix have reportedly ordered series based on the activities of the suspected crypto capers. Lichtenstein and Morgan are awaiting trial.

'Big shot' and the LME nickel fiasco

Nickel prices gained 111% in one day and briefly topped $100,000 a ton after western sanctions on Russia led to a short-squeeze on the precious metal, which is known as one of Russia's major exports and is used in a range of high-tech lithium-ion battery applications.

As prices soared to atmospheric heights, the London Metal Exchange cancelled all nickel trades for the day, sparking backlash from angry traders. The halt stopped $3.9 billion of nickel trades from going through, leading to an investigation from the Financial Conduct Authority and the Bank of England.

In the aftermath, it was revealed that a single Chinese metals tycoon, known in market circles simply as "Big Shot", was one character at the center of the episode. Big Shot is Xiang Guangda, the founder and chairman of Tsingshan Holding Group, a large producer of nickel alloy products. The company had amassed a large short position that was reportedly down about $8 billion at the end of the whole trading fiasco.

Kim Kardashian pays $1.26 million for unlawfully pumping crypto on Instagram

The "Keeping Up with the Kardashians" star was charged by the Securities and Exchange Commission this year for touting EMAX tokens on her Instagram. Kim ran afoul of a 1930s securities law, which requires promoters of a security to disclose if, how, and how much they're getting paid, SEC chief Gary Gensler said.

The TV reality star's post contained "#ad" - a hashtag used by influencers to signify that a post is an advertisement. But the SEC said it found Kardashian failed to disclose that she was paid $250,000 to publish the post about EMAX tokens. Her post contained a link to the EthereumMax website that had instructions for potential investors to purchase the tokens, the regulator said.

Kardashian paid $1.3 million to the SEC, though a class action lawsuit against Kardashian and other celebrity promoters was later dismissed.

The entire Elon Musk-Twitter saga

Beginning with his announcement that he was amassing a stake in the publicly traded social media firm, Elon Musk formally embarked on his journey to acquire Twitter in mid-April.

Musk then spent months trying get out of the deal, proclaiming the site was overrun with spam bots and that he should be allowed to walk away. Twitter executives wouldn't budge, and the saga sent the shares on a rollercoaster ride, often trending well below the $54.20 share price that Musk and Twitter agreed on when they struck the deal.

Musk closed the deal not long before the two parties were set to begin a nasty legal fight. As it was unlikely he'd win in court and be allowed out of the agreement, Musk took over Twitter in October.

Since then, he's embarked on a controversial revamp of the struggling social media platform, including slashing 70% of its workforce and not paying rent for Twitter's offices. This month, users voted for Musk to step down as the company's CEO in a poll Musk conducted on the site. Though he said he'd abide by the result, he has yet to make any formal moves toward appointing a successor.

The west's unprecedented sanctions and weaponization of markets against Russia's economy

Russia shocked the world with its invasion of Ukraine in February. As the west struggled to respond, leaders took some extreme measures which Russian President Vladimir Putin probably wasn't expecting.

The US and allies sanctioned Russia's central bank and froze billions of its assets. It also cut some Russian banks off from the SWIFT messaging system, a lynchpin of the global banking network that left Russian financial institutions isolated and unable to conduct normal business. Measures were also put in place to ban anyone in the US from engaging in transactions with Russian institutions, a move meant to spark higher inflation, wreck Russia's purchasing power, and hobble investment.

And that was all before the latest round of energy sanctions banned Russian seaborne oil imports to the European Union, capped the price of Russian oil at $60, and severely limited the flows of Russia's natural gas exports.

President Vladimir Putin has balked at the sanctions, and hasn't acknowledged any negative effect on the economy. He's also called the price cap on Russian oil "stupid," while former-President Dmitry Medvedev warned the west would "face the wrath of God" for punishing Russia.

But the economic isolation and limited trade with allies have already started to hack away at Russia's economy, with the nation's GDP set to contract around 3% this year, according to its central bank.

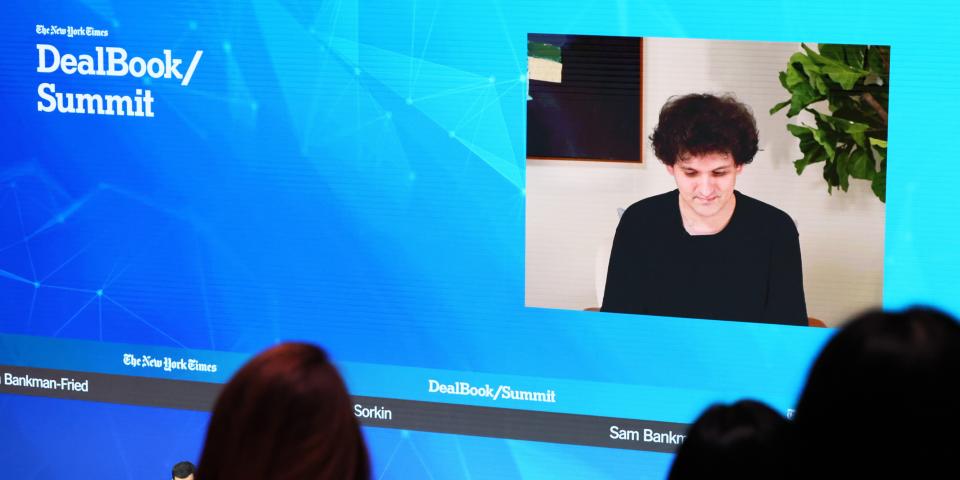

Sam Bankman-Fried's stunning, bizarre downfall

Capping off a wild 2022 was the fall of the second-largest cryptocurrency exchange, FTX, helmed by a CEO once thought to be the benevolent face of the whole industry.

Amid a run on the exchange's native token (sparked likely by the CEO of FTX's biggest rival, Binance), FTX declared bankruptcy on November 11.

Amid restructuring proceedings, it was discovered that the exchange had no in-house accounting department, shelled out millions for Bahamian vacation properties, and had commingled customer funds with Alameda Research, the trading arm of Bankman-Fried's crypto empire.

The fallen founder went a bizarre month-long apology tour, often giving rambling, contradictory, and possibly self-incriminating statements about the activities of the exchange and how he didn't knowingly defraud anyone.

At the end of December, Sam Bankman-Fried was arrested in The Bahamas, extradited to the US, and has been charged with fraud, money laundering, and conspiracy.

Read the original article on Business Insider