Colombia’s Government Bets Public Pension Fund Would Revive Capital Market Flows

(Bloomberg) -- Colombia’s government is betting that its proposed public pension fund would reinvigorate investment flows in the local bond and equity markets, according to a top Finance Ministry official.

Most Read from Bloomberg

China Embassy Rips ‘Brutal’ Russia Border Incident in Rare Move

S&P 500 Wipes Out Almost 1% Gain; Bond Yields Drop: Markets Wrap

Trump Cites Self Incrimination Concern in Lawsuit Against Cohen

South Africa Spurns US Pressure to Stop Using China’s Huawei Technology

The fund could be used to stimulate local markets while also facilitating access to long-term capital, José Roberto Acosta, the Finance Ministry’s Public Credit Director, said during an event at Bloomberg’s Bogotá office.

“The Finance Ministry is concerned because the equity market is nonexistent, and the corporate bond market has also been dry for a long time,” Acosta said. “We are willing to make the mistakes that are necessary, but we need to act.”

President Gustavo Petro’s overhaul envisions a government-run system that would receive contributions from workers earning as much as four minimum wages a month, with those earning more than that saving the surplus in private pension firms. The plan would also set aside money in a fund to help finance future retirement payments.

Some investors worry those plans would hurt the $118 billion local bond market, given a quarter of its investments come from private pension firms that would stand to see weaker inflows. Other critics say the money could be used for current spending.

Read more: Corporate Bond Sales Drop 85% as Shocks Hit Colombia Market

Finance Minister Ricardo Bonilla wants those savings to be managed independently, Acosta said. Detailed rules on how the fund will operate should be included in the pension reform bill to “shield those resources,” he said.

The pension bill was already approved by a Senate committee, and it still needs to pass three more debates before becoming law. The legislation will be discussed in congress in the second half of this year.

Debt Balance

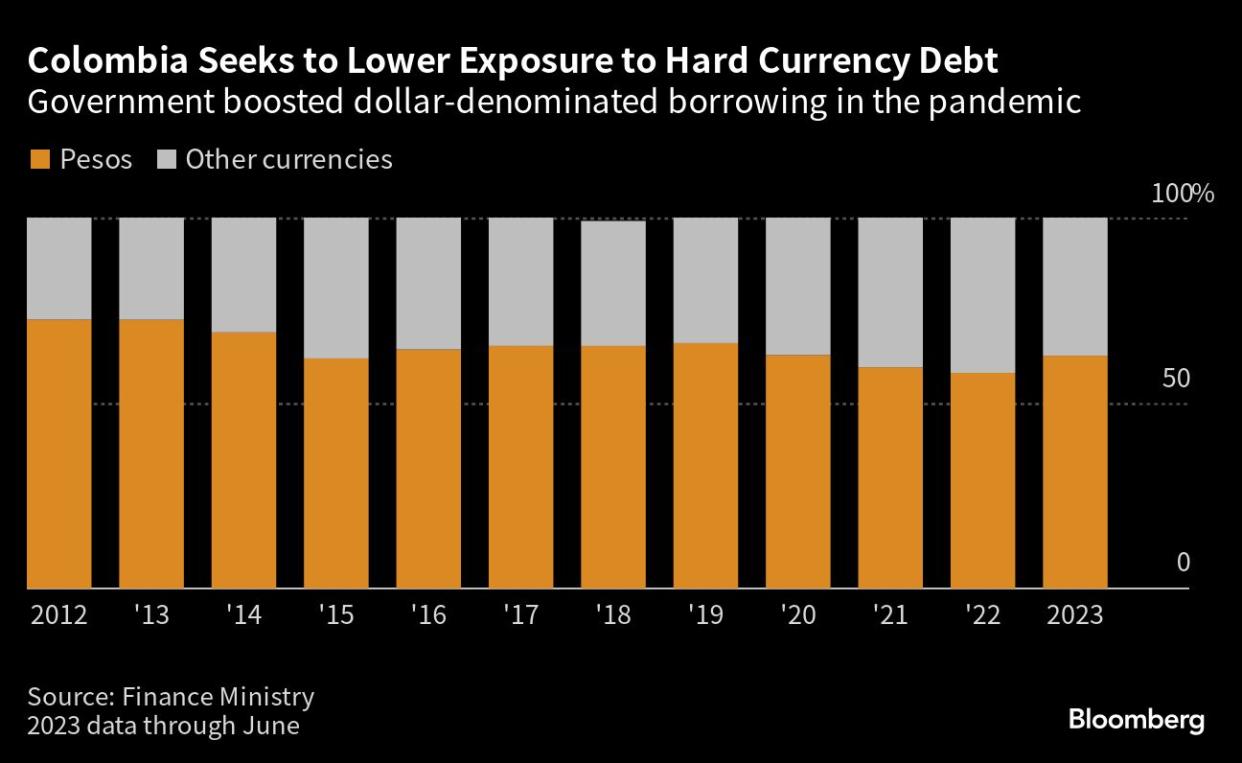

On government borrowing, the amount of debt in foreign currency rose to about 40% of the total stock in the aftermath of the pandemic, making the nation more vulnerable to external shocks. To cushion against this, Petro’s administration is seeking to have 70% of its debt in pesos and the remaining in hard currency, Acosta said.

“It is a difficult task, but we already have it on the map,” Acosta said, adding that the administration has seen “good appetite” from investors.

Colombian-peso denominated bonds have returned almost 22% this year, local debt from Brazil has gained around 14% and notes from Mexico have returned 4.8%, according to an index of local-currency debt.

Read more Leftist Leader’s Flop Hands Big Bond Gains to BlackRock, T Rowe

--With assistance from Ezra Fieser.

Most Read from Bloomberg Businessweek

Influencers Built Up This Wellness Startup—Until They Started Getting Sick

Teen Gamers Swiped $24 Million in Crypto, Then Turned on Each Other

AI in Hollywood Has Gone From Contract Sticking Point to Existential Crisis

With AI Booming, Gary Gensler Wants to Keep Finance Safe for Humans

©2023 Bloomberg L.P.