Columbus city leaders cut property taxes in last-minute budget move

Columbus Council cut property taxes Tuesday night after a long and sometimes complicated debate over the city’s 2024 fiscal year budget, which starts July 1.

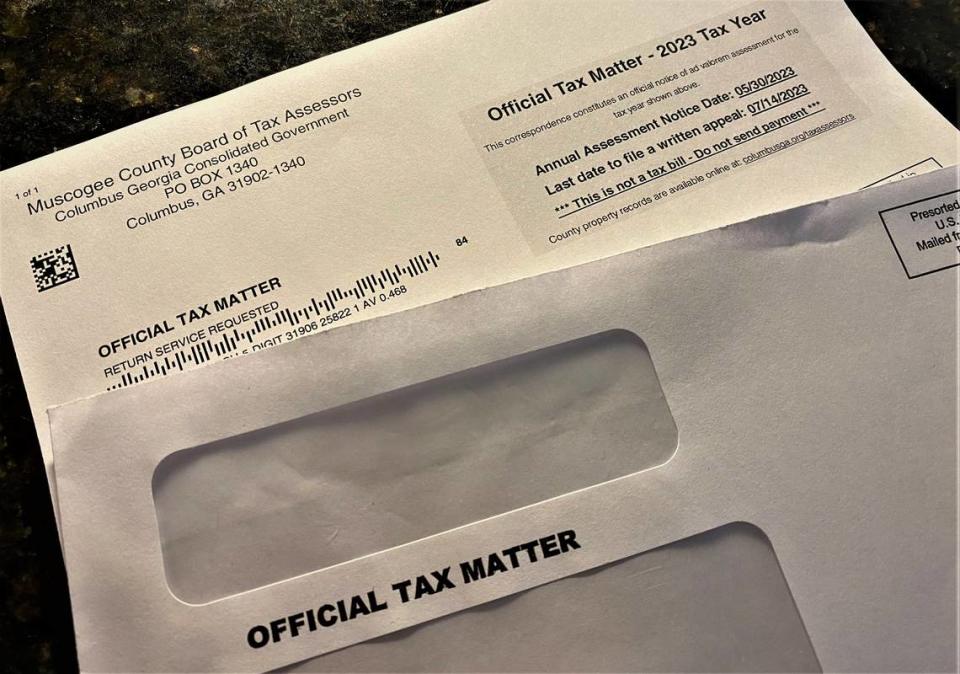

How the reduction will play out remains to be seen, as the city already has sent residents property assessments for the taxes to be paid this year.

But city administrators offered these examples of the effect:

A home assessed at $100,000 in taxable value would get a reduction of $69.84.

A home assessed at $375,000 would get a reduction of about $170.

Some of the assessments jumped so much that taxpayers complained to councilors.

Citywide Councilor Judy Thomas said the push to reduce the tax rate was driven by a boost in the tax digest, the value of all taxable property in the city.

As council in May was digging through the $334 million operating budget for 2024, the digest was expected to grow by 2%. When councilors got an updated estimate this month, the growth was projected at 10%, Thomas said.

Feeling the city was now in a much more comfortable position financially, councilors decided they could afford to cut back on the anticipated gains.

Expecting $10 million more in revenue from taxable property, council decided to slash that by $7 million, with District 2 Councilor Glenn Davis making the motion that eventually passed unanimously.

“I think we did the right thing,” Thomas said Wednesday morning, noting councilors already were getting calls and emails thanking them.

District 4 Councilor Toyia Tucker said the modest tax cut shows council made a “good faith gesture” to respond to constituents’ complaints: “Even though it probably will be small, it is something,” she said.

Responding to a Ledger-Enquirer inquiry via email, Muscogee County Tax Commissioner Lula Huff, whose office sends out the property tax bills and collects the taxes, said she expects to have updated figures by the time those bills go out later this year.

“I don’t think this will affect the process,” she wrote. “The assessment notices were for values only.”

Those notices mailed May 30 allow taxpayers to appeal their assessments before the tax digest is finalized. The deadline to appeal is July 14, according to the city tax assessor’s office.

The reduction will not affect residents in owner-occupied homes benefiting from the homestead exemption and protected by the city’s freeze on property tax assessments. Their assessments don’t change as long as they live in their homes and do not make major additions or other alterations that would trigger a reappraisal.

Some residents have been in their homes so long that they pay little or no taxes, because of the freeze. Approximately 5,200 property owners out of 70,700 pay no taxes, officials said.