The Compugen (NASDAQ:CGEN) Share Price Is Down 63% So Some Shareholders Are Wishing They Sold

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It's nice to see the Compugen Ltd. (NASDAQ:CGEN) share price up 18% in a week. But don't envy holders -- looking back over 5 years the returns have been really bad. The share price has failed to impress anyone , down a sizable 63% during that time. So is the recent increase sufficient to restore confidence in the stock? Not yet. However, in the best case scenario (far from fait accompli), this improved performance might be sustained.

View our latest analysis for Compugen

Compugen isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

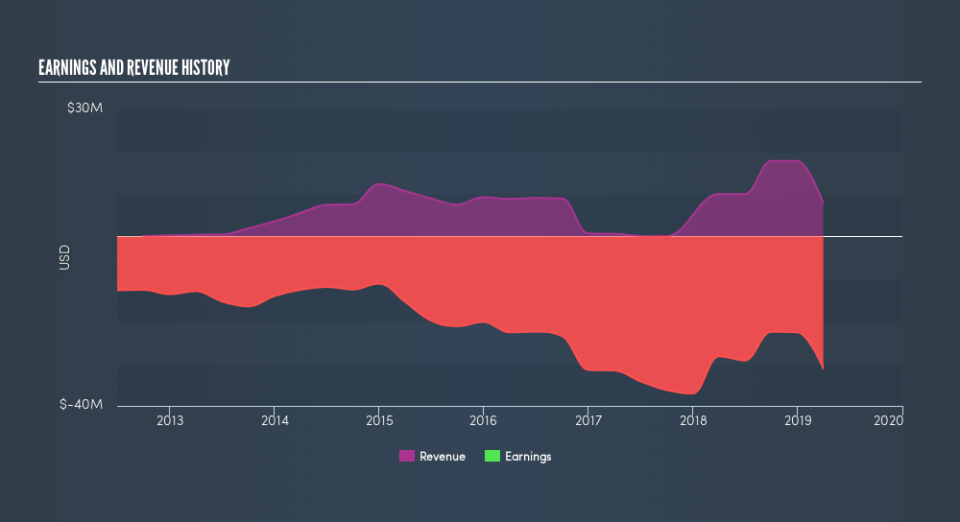

In the last half decade, Compugen saw its revenue increase by 6.0% per year. That's far from impressive given all the money it is losing. This lacklustre growth has no doubt fueled the loss of 18% per year, in that time. We'd want to see proof that future revenue growth is likely to be significantly stronger before getting too interested in Compugen. However, it's possible too many in the market will ignore it, and there may be an opportunity if it starts to recover down the track.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

Take a more thorough look at Compugen's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market gained around 3.1% in the last year, Compugen shareholders lost 13%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 18% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.