Should You Consider Perseus SA (ATH:PERS)?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Building up an investment case requires looking at a stock holistically. Today I've chosen to put the spotlight on Perseus SA (ATH:PERS) due to its excellent fundamentals in more than one area. PERS is a company that has been able to sustain great financial health, trading at an attractive share price. In the following section, I expand a bit more on these key aspects. For those interested in understanding where the figures come from and want to see the analysis, take a look at the report on Perseus here.

Undervalued with excellent balance sheet

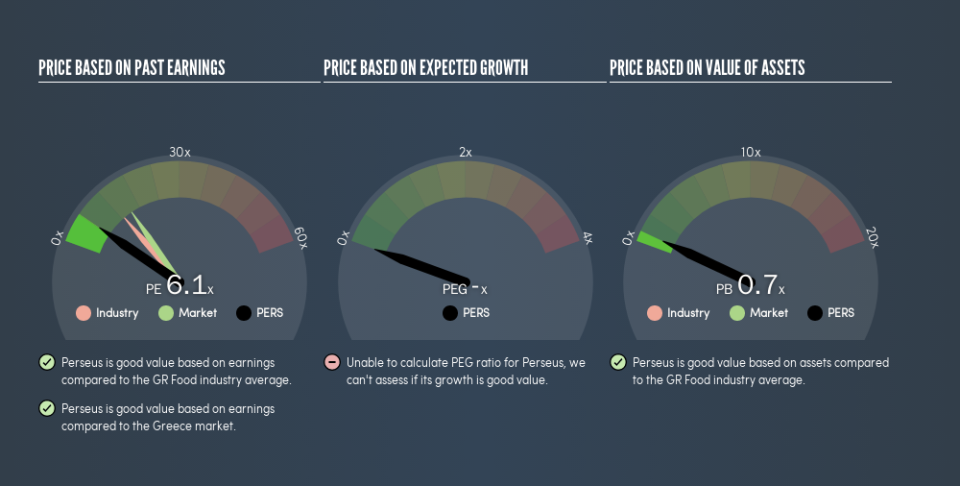

PERS is financially robust, with ample cash on hand and short-term investments to meet upcoming liabilities. This suggests prudent control over cash and cost by management, which is an important determinant of the company’s health. PERS appears to have made good use of debt, producing operating cash levels of 0.46x total debt in the prior year. This is a strong indication that debt is reasonably met with cash generated. PERS's shares are now trading at a price below its true value based on its discounted cash flows, indicating a relatively pessimistic market sentiment. This mispricing gives investors the opportunity to buy into the stock at a cheap price compared to the value they will be receiving, should analysts' consensus forecast growth be correct. Also, relative to the rest of its peers with similar levels of earnings, PERS's share price is trading below the group's average. This further reaffirms that PERS is potentially undervalued.

Next Steps:

For Perseus, there are three essential factors you should look at:

Future Outlook: What are well-informed industry analysts predicting for PERS’s future growth? Take a look at our free research report of analyst consensus for PERS’s outlook.

Historical Performance: What has PERS's returns been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

Other Attractive Alternatives : Are there other well-rounded stocks you could be holding instead of PERS? Explore our interactive list of stocks with large potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.