‘Construction boom’: Raleigh ranks among top cities for new apartments. Is it enough?

As one of the fastest growing cities in the country, Raleigh is seeing a major uptick in new rental construction.

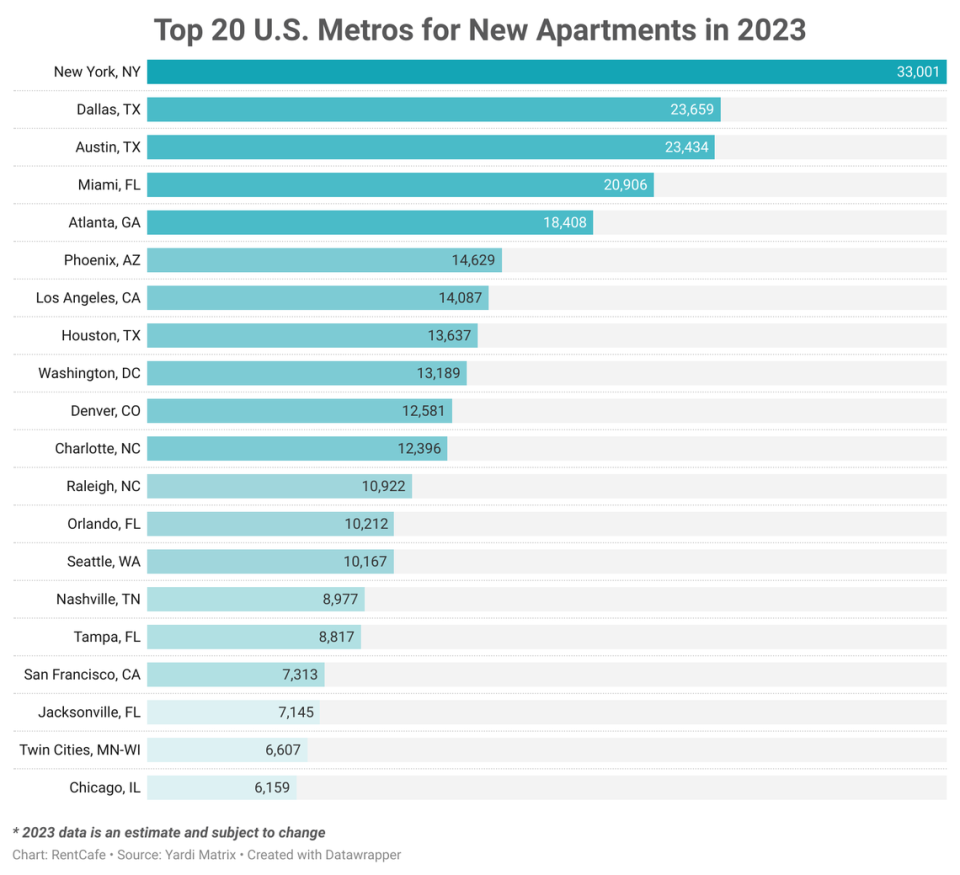

Some 10,922 apartments are on track to be built in the Raleigh-Cary metro area by year’s end — hitting a six-year peak and surpassing large hubs like Seattle and San Francisco, according to new report from the listing service RentCafe.

Out of 296 cities across the country, Raleigh ranked 12th for new apartment construction this year, just behind Charlotte, which had 12,396 units.

“That’s a huge jump from the metro’s 2020-2022 performance when it wasn’t included among the nation’s top 20 builders,” says RentCafe’s communication specialist Felicity Domentii.

The surge comes as the U.S. benefits from a post-pandemic construction boom “not seen since the 1970s,” the report says, with 1.2 million apartments added to the market in just the last three years.

The Raleigh metro area delivered 12,182 apartments during that span. This year, it’s expected to deliver the most apartments (6,334) in the region, followed at a great distance by Wake Forest (1,071 units), Cary (904 units) and Holly Springs (635), the report said.

The report is exclusively based on apartment data related to buildings containing 50 or more units.

Raleigh’s construction boom

Eight multifamily projects and three for-sale projects are under construction in downtown Raleigh, according to Downtown Raleigh Alliance’s second quarter market report.

Platform and 400H developments will deliver 442 and 242 units, respectively, later this year. Meanwhile, The Alexan Glenwood South, which will have 186 units, has begun site preparation work at 401 W Lane St.

An additional 6,445 residential units in 21 developments have been proposed or are in planning, the report finds.

“There’s definitely a construction boom of multifamily properties,” says Matt Fowler, executive director of Triangle MLS, a real estate listings platform. “Anecdotally, you can see it driving around the Triangle. They’re everywhere.”

That influx of new housing can’t come soon enough, say experts.

While inventory is edging up slowly and the market is starting to normalize, the Triangle is still facing a massive housing shortfall. The Raleigh metro area alone needs at least 17,000 more units, according to a recent Zillow study.

More housing of all types, including single-family homes, will be needed to meet demand, but the new supply helps “in the short term,” Fowler says.

Rents cooling

In the meantime, for renters, finally some good news: rents are cooling.

After prices skyrocketed by as much as 50% in parts of the Triangle, rents are slowly coming down as new units come online, says Dustin Engelken, government affairs director at Triangle Apartment Association.

“It hasn’t been dramatic, but we’re definitely making positive strides,’” he says.

The median rent in Raleigh currently stands at $1,500 in September, down 2.5% year-year-over year, according to Apartment List. The median rent in Durham stood at $1,416, down 4% year-over-year.

Despite the historic construction boom and the projections for 2023, headwinds remain. Among them: the rising costs of construction materials, labor and land, and the tightening of bank lending standards.

In general, construction debt starts at 8% interest, and most banks only lend 60% or less of the total cost of a project. This financing structure is making it harder for companies to initiate new projects, experts say.

Nationwide, the number of new apartments is expected to drop by 15% year-over-year — from 484,000 in 2024 to 408,000 in 2025, according to Yardi Matrix estimates.

Engleken said he’s seeing this trend play out on the ground in the Triangle.

“We’re not seeing as many new projects proposed,” he said. “If folks can’t get projects financed and through the development pipeline, we might see our numbers start to fall off a cliff, and this will have just been a blip on the radar.”

Yardi Matrix predicts new completions will bottom out in 2026 at approximately 400,000 units. The pace of construction is projected to gradually recover in 2027 and 2028, it said.

You can find the full report on apartment construction online here.