Stocks shrug off losses as potential COVID-19 vaccine touted

European stocks closed higher on Monday despite a slump in oil prices, as Johnson & Johnson (JNJ) touted a potential vaccine for the novel coronavirus.

The FTSE 100 (^FTSE) closed up 0.9% in London, Germany’s DAX (^GDAXI) ended up 1.6% and the CAC 40 (^FCHI) closed up 0.5%.

All had been lower in early trade, with the FTSE 100 starting the morning off more than 1%.

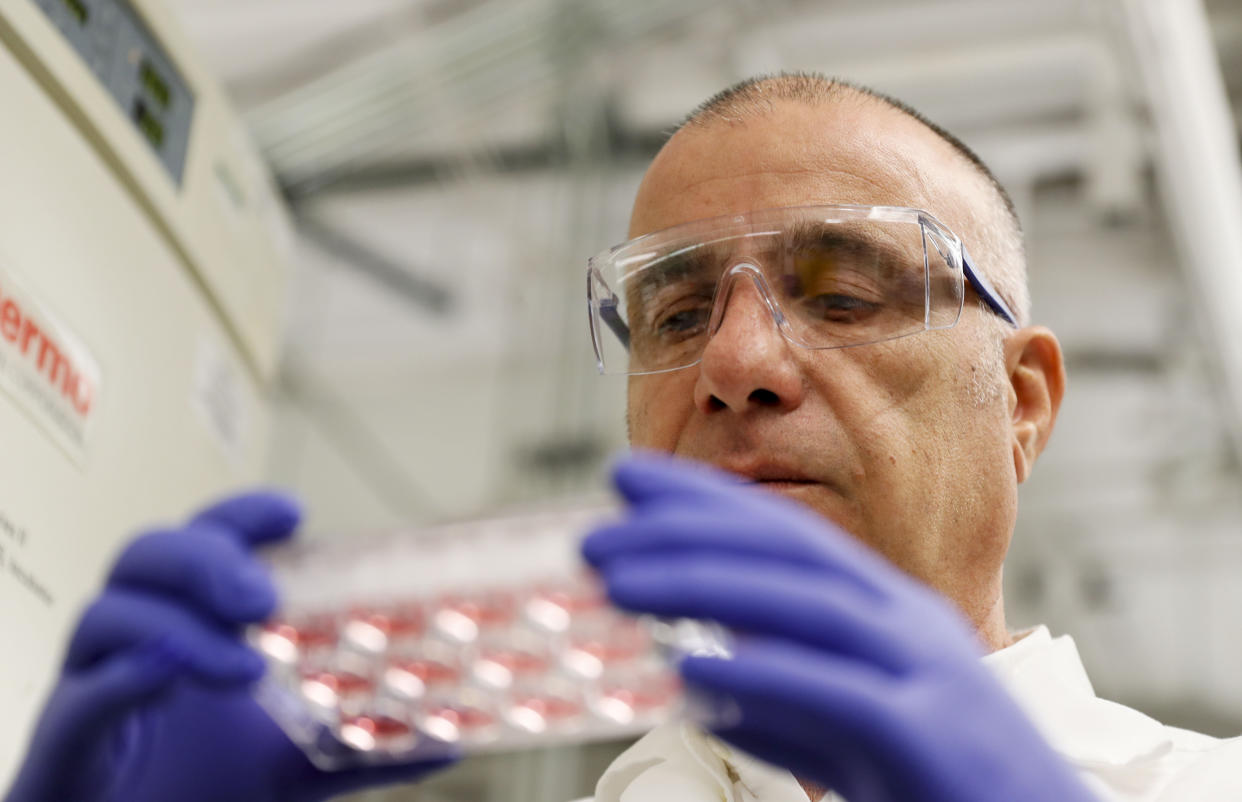

The rebound came as US drugs giant Johnson & Johnson announced it had identified a “lead vaccine candidate” for COVID-19. Human trials are expected to begin in September.

Alex Gorsky, chairman and CEO of Johnson & Johnson tells NBC News’ TODAY the drug had “a high degree of probability of being successful against the covid-19 virus”.

“Literally within the next few days and weeks, we're going to start ramping up production of these vaccines as well and we should be able to have several hundred million doses available by the middle of next year,” Gorsky said. “Our goal is to have a billion prepared by the end of 2021.

Dr Adam Barker and Dr Tara Raveendran, research analysts at Shore Capital, wrote in a note: “A vaccine remains the ‘exit route’ for most strategies of virus control.”

The announcement helped US stock markets open higher. The S&P 500 (^GSPC) was up 2.2% by the time Europe closed, while the Nasdaq (^IXIC) was 2.7% higher and the Dow Jones Industrial Average (^DJI) had gained 2%.

Prior to Johnson & Johnson’s announcement, futures had suggested a lower open as investors focused on slumping oil prices.

Crude oil (CL=F) was down 5.1% lower at $20.41 per barrel on Monday. Brent (BZ=F) fell by 11.5% to $22.04, a 17-year-low.

The slide came amid the continued price war between Saudi Arabia and Russia, which began at the start of the month. The market has been flooded with supply just as demand is plunging due to the coronavirus pandemic.

Jack Allardyce, an oil and gas analyst at Cantor Fitzgerald Europe, said: “With major producers pumping barrels freely and the IEA suggesting that short-term demand could fall by a fifth due to travel restrictions, global storage is likely to hit capacity over the next two-to-three months.”

Michael Hewson, chief market analyst at CMC Markets, said: “Pictures of grounded aircraft fleets sitting parked on runways across the US point to a global economy that has ground to a virtual standstill, with US crude at one point dropping below $20.

“In some cases, producers in the US are paying to have oil taken off their hands, they can’t give it away.”

Monday was a quiet day for data but later this week attention will turn to Chinese manufacturing data, PMI surveys, and US jobs figures. The data will give an indication of the scale of economic damage caused by the coronavirus pandemic and efforts to contain it.

“We are going to be left with having to deal with a decline in activity that will be as sharp as anything seen since the Great Depression and likely greater in some countries,” Deutsche Bank strategist Jim Reid and team wrote in a morning note to clients on Monday.

“Indeed going forward now, the bad news will come from the real time data and earnings reports that could in some cases create existential risks. The good news will come from a run of slower new virus case growth numbers and mortality rates around the world.”