‘Coronavirus can’t kill the industry.’ China cruise market here to stay, analysts say

Just six years ago, the largest cruise companies in the world were racing each other to China, lured by the country’s growing middle class. The ships, some custom-built for Chinese taste, docked full time in places like Shanghai and Beijing, taking tourists from mainland China and other countries in Asia mostly on short cruises around the region.

Now, in the midst of the coronavirus (COVID-19) outbreak, Chinese ports are shuttered, and Miami-based cruise companies have re-positioned ships to other parts of the world, temporarily halting the China cruising that was meant to be a boon for the industry. The change comes right in the middle of “wave season,” the time of year when cruise companies offer their best promotions to attract bookings.

The largest three cruise companies — Carnival Corporation, Royal Caribbean Cruises Ltd., and Norwegian Cruise Line Holdings Ltd. — have all warned investors that the coronavirus, a respiratory disease that originated in China and is responsible for more than 2,000 deaths, will impact 2020 profits. But sector analysts say China cruising is here to stay despite the disease.

“Coronavirus can’t kill the industry,” said Ingrid Leung, managing director of Hong Kong travel agency Incruising. “It’s a temporary negative impact, but it’s going to be OK in the long run.”

Cruising has weathered crises before, including other viruses. As recently as 2015, the MERS outbreak in Korea drove ships away temporarily. They returned.

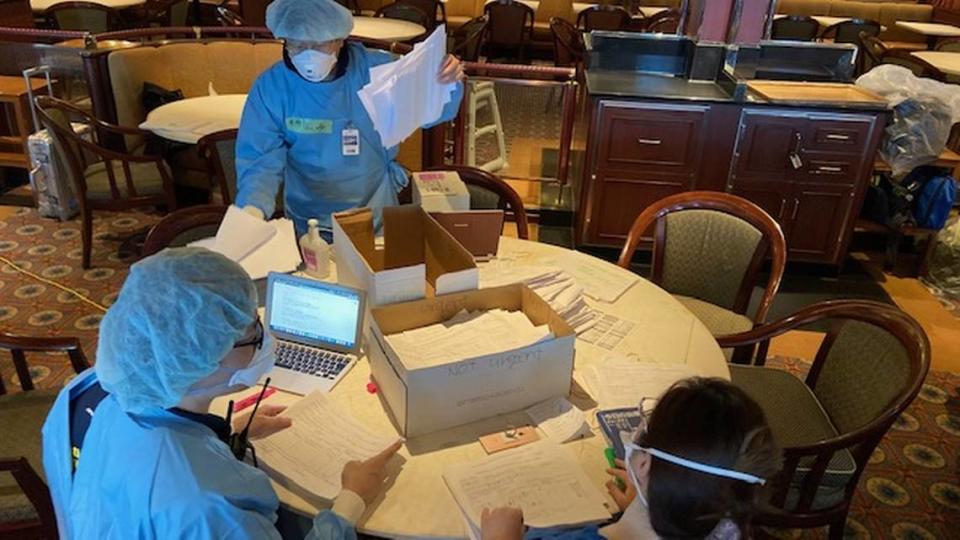

But this time, the industry became part of the outbreak when Japan quarantined the Diamond Princess cruise ship in Yokohama, outside Tokyo, for 14 days with 3,711 people aboard after a former passenger tested positive for the disease. More than 600 people on the ship contracted coronavirus, and two have died. The U.S. flew hundreds of passengers — some infected, some not — to military bases in California and Texas this week for further quarantine.

Even before the Diamond Princess quarantine, the first of its kind in modern history, cruising’s popularity in mainland China was waning. Cruise ship visits to ports in mainland China have dropped 30% since peaking in 2017, according to data compiled by Cruise Line International Association (CLIA). People from mainland China represent the largest share of cruisers in the Asia market, 55.8% in 2018, but that share also declined from the previous year.

Despite the slump, most cruise companies remain committed to the China market. Royal Caribbean, which has around 6% of its fleet in China, announced last year that its upcoming Wonder of the Seas ship, to be the largest in the world, will be stationed in Shanghai full time when it debuts in 2021. At a conference last year, Carnival Corp. CEO Arnold Donald predicted China would overtake the U.S. as the most popular passenger source market by 2030. The company has about 5% of its fleet in China. Norwegian Cruise Line pulled its made-for-China ship out of the market and moved it to Alaska last year but had a smaller ship sailing in the region seasonally.

Coronavirus will not waver that commitment to China, said Mitchell Schlesinger, chief marketing officer at MJS Consulting, a travel marketing firm, and a former executive at several cruise lines.

“You never want to leave a market that you started,” he said. “There’s just way too much potential here to give the market up. The Big Three [companies], which make up 85% of entire industry, they can weather this. Does it put a dent in the overall revenue picture? Sure. But they are looking at how do we weather it and the question they’re asking themselves clearly is, ‘Do we take the ships out for 6 months?’ ”

Cruise companies have moved ships out of Asia since the outbreak began and imposed travel restrictions for people who have recently visited China, Hong Kong and Macau. Carnival Corp., Royal Caribbean and Norwegian Cruise Line have warned investors that the outbreak will affect 2020 profits, and stocks for the three biggest cruise companies have dropped by an average of 12% since mid-January. Carnival Corp. and Royal Caribbean estimate the outbreak could impact the companies’ 2020 financial performance by as much as $0.65 per share. Norwegian Cruise Line estimates shares will be hit by as much as $0.75.

Wave season success

Those figures don’t worry Leung, the travel agent from Hong Kong. As the number of cruisers from mainland China has decreased over the last few years, the number of cruisers from Hong Kong nearly doubled from 2016 to 2018, according to CLIA. Cruise ship visits in all of Asia have remained steady since 2017.

Some of Leung’s clients were on board the Holland American Line Westerdam ship, run by Carnival Corp., when it was trapped at sea earlier this month after being turned away from five Asian countries for fear of coronavirus cases, she said. When Holland America Line offered passengers credit to use for a future cruise, Leung said many booked their next cruise right from the stranded ship. Other clients of hers who were booked to sail in Asia on the Norwegian Spirit ship are rebooking its new itinerary in Greece. The company canceled all Asia sailings on the ship through December.

Leung said she expected to grow the travel agency’s business by 10-20% in 2020. Now she said she thinks she will break even.

“It’s going to be a hard time for 2020, but I think it will pick up very soon once the restrictions are lifted,” she said. “I still get inquiries booking for June, July. The number has been decreased, but at least there’s still inquiries. There’s still confidence in cruising. They know it’s an independent incident.”

At the World Health Organization this week, Dr. Mike Ryan, the leader of WHO’s emergencies program, cautioned against bans on cruise ships or travelers from certain countries. The epicenter of the outbreak remains China’s Hubei province, where the virus originated, Ryan said.

“This is a very serious outbreak, and it has the potential to grow,” Ryan told Reuters. “But we need to balance that in terms of the number of people affected. Outside Hubei, this epidemic is affecting a very tiny, tiny, tiny proportion of people. So if we are going to disrupt every cruise ship in the world on the off-chance that there may be some potential contact with some potential pathogen, then where do we stop? We shut down the buses around the world?”

North American travel agents say their business has been largely unaffected. A survey of 400 travel agents conducted by Travel Leaders Network earlier this month found that more than 80% reported no cancellations outside of Asia.

Kari Halpern, a travel agent and owner of Sunny Destinations agency in New York, said she has had a successful wave season so far, largely unaffected by coronavirus. A few of her clients who had originally booked Asia cruises for the end of 2020 have rebooked to South America or Australia.

“Wave season has always been a peak time for cruise sales, and this year is following suit,” she said via email. “Regarding my overall sales volume, I have not seen any negative impact from the coronavirus.”