Could The Lee Man Chemical Company Limited (HKG:746) Ownership Structure Tell Us Something Useful?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The big shareholder groups in Lee & Man Chemical Company Limited (HKG:746) have power over the company. Institutions often own shares in more established companies, while it's not unusual to see insiders own a fair bit of smaller companies. Warren Buffett said that he likes 'a business with enduring competitive advantages that is run by able and owner-oriented people'. So it's nice to see some insider ownership, because it may suggest that management is owner-oriented.

Lee & Man Chemical is not a large company by global standards. It has a market capitalization of HK$3.4b, which means it wouldn't have the attention of many institutional investors. In the chart below below, we can see that institutions are noticeable on the share registry. Let's take a closer look to see what the different types of shareholder can tell us about 746.

View our latest analysis for Lee & Man Chemical

What Does The Institutional Ownership Tell Us About Lee & Man Chemical?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

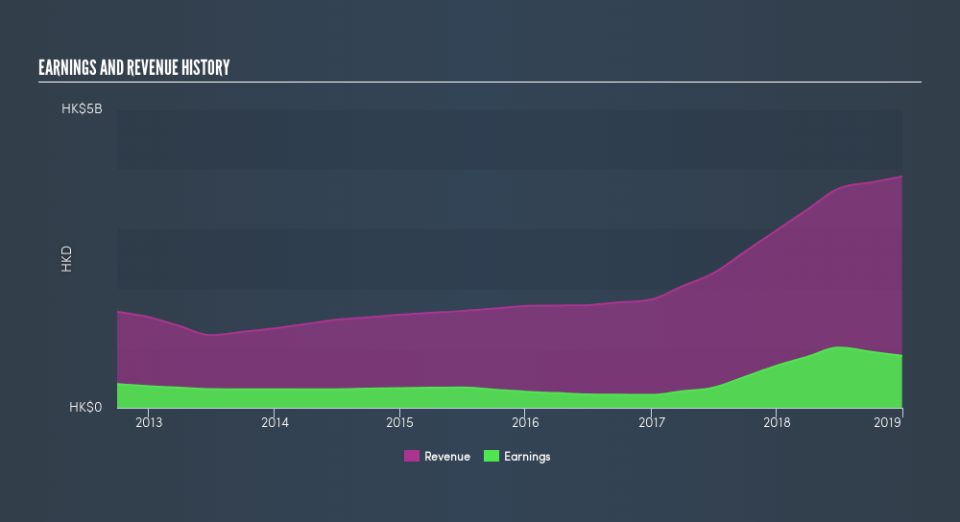

We can see that Lee & Man Chemical does have institutional investors; and they hold 6.3% of the stock. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Lee & Man Chemical's historic earnings and revenue, below, but keep in mind there's always more to the story.

Hedge funds don't have many shares in Lee & Man Chemical. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of Lee & Man Chemical

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

It seems that insiders own more than half the Lee & Man Chemical Company Limited stock. This gives them a lot of power. So they have a HK$2.5b stake in this HK$3.4b business. It is good to see this level of investment. You can check here to see if those insiders have been buying recently.

General Public Ownership

The general public holds a 19% stake in 746. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Lee & Man Chemical better, we need to consider many other factors.

I like to dive deeper into how a company has performed in the past. You can access this interactive graph of past earnings, revenue and cash flow for free .

Of course this may not be the best stock to buy. Therefore, you may wish to see our free collection of interesting prospects boasting favorable financials.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.