Could this week bring clarity to wood-to-energy giant Enviva's future?

The already financially troubled wood-to-energy company hasn't had a good start to 2024, with a missed bond payment and a warning that it could soon be delisted from the New York Stock Exchange (NYSE) because of its sinking stock price.

Enviva's stock price also was hovering around 60 cents a share Tuesday, down more than 99% from its high less than two years ago,

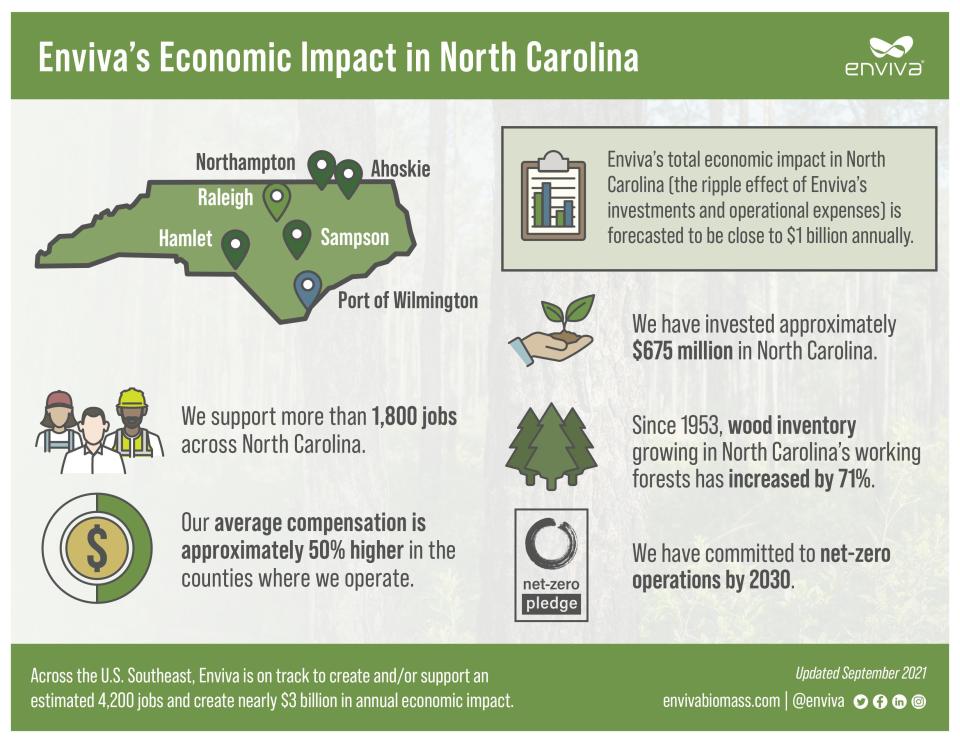

But the next few days could bring some clarity to what the future holds for the company that has a significant economic footprint in Eastern North Carolina, supporting more than 1,800 jobs at its four wood pellet production plants and Port of Wilmington facility.

What's happened in 2024?

Last month, Enviva decided to skip a $24.4 million payment to bond holders, entering a 30-day grace period to negotiate with its lenders and customers. According to a filing with the U.S. Securities and Exchange Commission (SEC), the company said the move "enhances its short-term flexibility."

With its finances already in trouble, Enviva announced in November while reporting its dismal 2023 third-quarter results that it was undertaking a "comprehensive review of alternatives" and its capital structure amid worries that it wouldn't be able to continue to operate in its current form.

Enviva's third-quarter results showed an $85 million loss, up from $18.3 million in the third-quarter 2022. The company's financial woes are largely due to collapsing prices for wood pellets, meaning the company is making less money even though it's selling more pellets than ever before. With Enviva locked into several long-term contracts with customers at low prices, losses could continue to mount unless the company is able to renegotiate the agreements.

Last month's missed bond payment prompted Fitch Ratings, a global credit-rating agency, to downgrade the company's debt further into junk bond territory.

CHOPPED: Wood pellet giant with major operations in Eastern NC skips bond payment

Falling below $1

On Jan. 23, Enviva received notice from the NYSE that the company was out of compliance with listing criteria because its stock price had fallen below $1 a share. The exchange's listing criteria require companies to maintain an average closing share price of at least $1 over a consecutive 30-trading-day period.

Enviva can regain compliance at any time within the next six months if the stock has a closing share price of $1 and an average closing share price of at least $1 over the 30-day trading period ending a month.

While obviously a red flag, the notice from the NYSE does not impact Enviva's ongoing business operations or the ability to buy and sell the company's stock.

Why this week matters

With the company quiet about its future plans and still yet to report its 2023 four-quarter financial results, which are expected to show lots of red ink, there has been a lot of speculation as to Enviva's future.

Tim Hynes, global head of credit research at Debtwire, expects that to change this week when the company's 30-day grace period to pay bond holders expires.

"It will stop the uncertainty," he said.

Whether that financial framework on how to move forward involves bankruptcy or some streamlining of Enviva's operations to keep it as a going concern in a smaller capacity is yet to be known. But Hynes said an agreement of some sort with the company's bond holders is likely this week.

An Enviva spokesperson Monday said the company had no comment on its financial future beyond what it has already shared publicly.

Troubled business plan?

Enviva supplies European and Asian utilities with wood pellets as an alternative to burning dirty coal.

But environmentalists and clean-energy advocates question the alleged sustainability value of chopping down trees in the U.S. South, processing them and then shipping the pellets thousands of miles to burn as a "clean" fuel source for power plants. They also criticize countries receiving the pellets as attempting to "greenwash" their environmental credentials by stating the pellets are a renewable energy source that's helps them reach net-zero emission goals amid pressure to respond to climate change.

Enviva also has faced environmental justice questions over its logging practices and emissions from pellet production, since many of the company's operations are located in low-income and minority communities. The company has repeatedly said it embraces sustainable logging practices and provides jobs in areas where other economic opportunities are often limited.

Reporter Gareth McGrath can be reached at GMcGrath@Gannett.com or @GarethMcGrathSN on X/Twitter. This story was produced with financial support from the Green South Foundation and the Prentice Foundation. The USA TODAY Network maintains full editorial control of the work.

This article originally appeared on Wilmington StarNews: Enviva's future could be determined this week