County Council raises alarms about possible 'predatory lending' in PACE energy program

A state program that is designed to provide homeowners with financing for new roofs, heat pumps, solar panels, wind-resistant windows and other projects through property tax assessments is causing major headaches in Volusia County.

The PACE (property-assessed clean energy) program was created by the state legislature in 2010 with the intent of boosting clean energy projects in the state.

"But the program is being abused by some in a way that preys upon those with few financial resources to repay the liens/loans," according to Volusia County Tax Collector Will Roberts.

Owners of more than 200 properties in Volusia County signed up for loans through the program in the first nine months of the year, and many of them are facing huge hikes in their tax bills and hefty interest payments.

How it works

The programs allow homeowners with sufficient equity to finance improvements with no money down and no minimum credit score with 100 percent financing.

Property owners pay for the repairs in installments that are billed annually as part of their property tax bill. The loan is a lien against the property, so people can ultimately lose their homes if they don't pay.

The residential lending program in Volusia County is mainly administered through the Florida PACE Funding Agency, which describes itself as "an independent special purpose local government."

The agency oversees "program administrators" such as Home Run Financing and FortiFi that fund the projects. The funds made available for lending come from the sale of bonds.

The problem

The cost of financing through the PACE program can be heavy.

Roberts provided data on property owners who signed up for home improvements through the Florida PACE Funding Agency in Volusia County from Jan. 1, 2023, through Oct. 10.

"A lot of these homeowners are going to be paying more in interest than they actually financed," he said.

For example, one property owner borrowed about $79,789 at a rate of 9.99 percent over 30 years for a new roof. They are facing about $173,918 in interest payments. They will pay an annual assessment of $8,457 on their tax bill.

Another property owner faces about $26,232 total in interest payments for solar panels. That property owner in DeLand borrowed about $27,633 at 4.99 percent over 30 years. The annual assessment will be just over $1,796.

Participation in the program has spiked in recent months.

From January through Oct. 10, around 240 residential properties had liens recorded through the Florida PACE Funding Agency. In 2022 there were only 40 properties with such liens, according to Roberts.

No surprises

Roberts said he wants to make sure consumers are fully aware of what they're signing up for so that they're not surprised by big tax bills or unaware of other details such as how much interest they're paying. He's also concerned that some financing for some of the repairs will last longer than their lifespan.

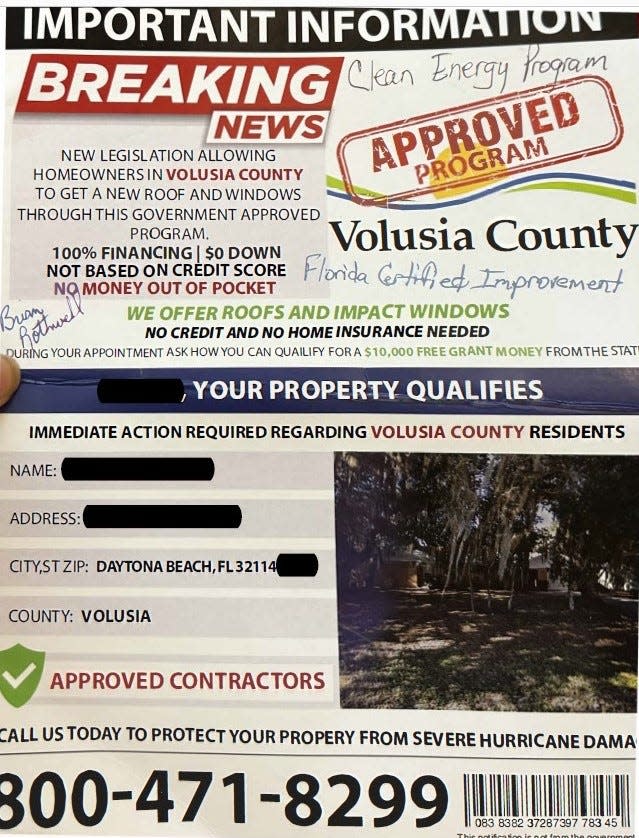

Mailers went out this year advertising the program, and Roberts shared a couple of examples. One has the Volusia County government logo with the phrase "approved program," but the mailer notes in small print at the bottom that it's not from the government. The mailer came from Florida Certified Improvements, a Kissimmee-based firm that provides windows, doors, roofs and air conditioning units.

Florida PACE Funding Agency Executive Director Michael Moran said the agency doesn't have anything to do with the advertisements.

In response to a question about the use of the county logo, Ronald Melara, owner of Florida Certified Improvements said the county is required to allow the PACE program to operate. While the program is allowed under state law, county government officials say an interlocal agreement is required.

Melara said customers receive full details on how the loans work and how much they will be paying. His business also explains how long the roofs and other upgrades will last, he said. Florida Certified Improvements does things ethically, he said.

"We don't hide anything," he said.

Dispute arises over where Pace operates

A main source of tension between Florida PACE Funding Agency and local governments is where they operate.

Local government officials in Volusia County say that the Florida PACE Funding Agency only has the authority to operate in areas where an interlocal agreement exists.

Florida PACE Funding Agency officials believe they have statewide authority to operate based on a bond validation decision in 2022 in Leon County Circuit Court.

The judgment authorized the Florida PACE Funding Agency to finance up to $5 billion in property improvements and said that the agency can operate in the state "without interference or regulation from local governments," according to the Volusia County attorney's office.

Volusia County government had authorized the commercial PACE program in unincorporated areas but not residential work. The County Council recently rescinded that authorization along with declaring the Florida PACE Funding Agency's unauthorized operation a public health emergency.

"The Council finds that the FPFA's continued operations in the County under its asserted independent authority pose an immediate danger to the health, safety, or welfare of the citizens of the County and compromise the significant legal rights of the County," the resolution says.

County approves legal action

The Volusia County Council voted a few weeks ago to have the county attorney's office prepare legal action against the Florida PACE Funding Agency.

"That's the best chance we have of stopping this what I believe is predatory lending," District 5 Councilman David Santiago said.

County Council Chairman Jeff Brower said he agreed with Santiago.

"At the very least, it's deceptive lending and so … I look at this as protecting the residents of Volusia County, and a lot of times they're going after elderly individuals," Brower said.

At-Large Councilman Jake Johansson said the Port Orange City Council approved its interlocal agreement with PACE providers while he was the city manager.

"The two companies that talked to us had great programs and people started using them because they knew it would be ... a long-term fix to a short-term problem, and seemed like they understood it," he said. "But now it's getting a little too predatory for me to be comfortable with."

Agency gets statewide pushback

Collier County ended its residential PACE program through the Florida PACE Funding Agency in 2019 after "reports of contractor abuse and predatory lending, targeted at low-income residents, including seniors," according to the Naples Daily News. But the agency has ramped up activity there in 2023 following the Leon County decision.

Multiple local governments and entities around the state are fighting the Florida PACE Funding Agency in court to keep it from operating in areas where it doesn't have an interlocal agreement, Volusia County Attorney Mike Dyer said.

The Daytona Beach City Commission recently voted to voice their opposition against the Florida Pace Funding Agency operating in the city. And the Jacksonville City Council voted unanimously to allow the city to take the agency to court to stop it from operating there, according to a city news release.

“Florida PACE operates a business preying on our residents,” City Council President Ron Salem said.“Their financing options will end with homeowners paying grossly inflated property tax bills which could end in a tax deed sale should the property owner not be able to pay their property taxes. We cannot put our constituents in these types of situations and must protect them from these predatory practices.”

County Council: Former Volusia councilwoman Heather Post agrees to pay $1K to clear up ethics case

Local government regulates contractors

In a statement, the Florida PACE Funding Agency said property owners who work with the agency choose their own contractors, and the agency doesn't regulate them. Rather, local governments have the responsibility of "vetting and licensing contractors."

The program has checks in place, according to the agency. The contractor gets paid after the property owner verifies he or she is satisfied during a recorded closing call. Also, a recorded confirmation call goes over the details of the loan.

The agency says its mission is to help homeowners and businesses fund "significant projects" through tax assessments. Some home projects might not otherwise be possible because of financial limitations.

"The Florida PACE Funding Agency upholds transparency and ethical conduct through a rigorous process," according to the agency.

Nevertheless, Johansson issued a warning to residents.

"You need to read everything in these PACE programs," he said.

This article originally appeared on The Daytona Beach News-Journal: Volusia County Council OKs lawsuit against Florida PACE provider