Is the county's tax abatement process too cumbersome? Council members aim to simplify it.

A proposed measure from the St. Joseph County Council would eliminate the county’s tax abatement ordinance and replace it with a simpler application.

The county's tax abatement process now asks businesses to fill out a 37-page document. Instead, council members suggest it could be reduced to just four or five pages.

Amy Drake, who’s sponsoring the measure with fellow Republican council member Joe Thomas, said their goal is to “streamline” the process and let developers “know they can do business in St. Joseph County without a lot of cumbersome requirements.”

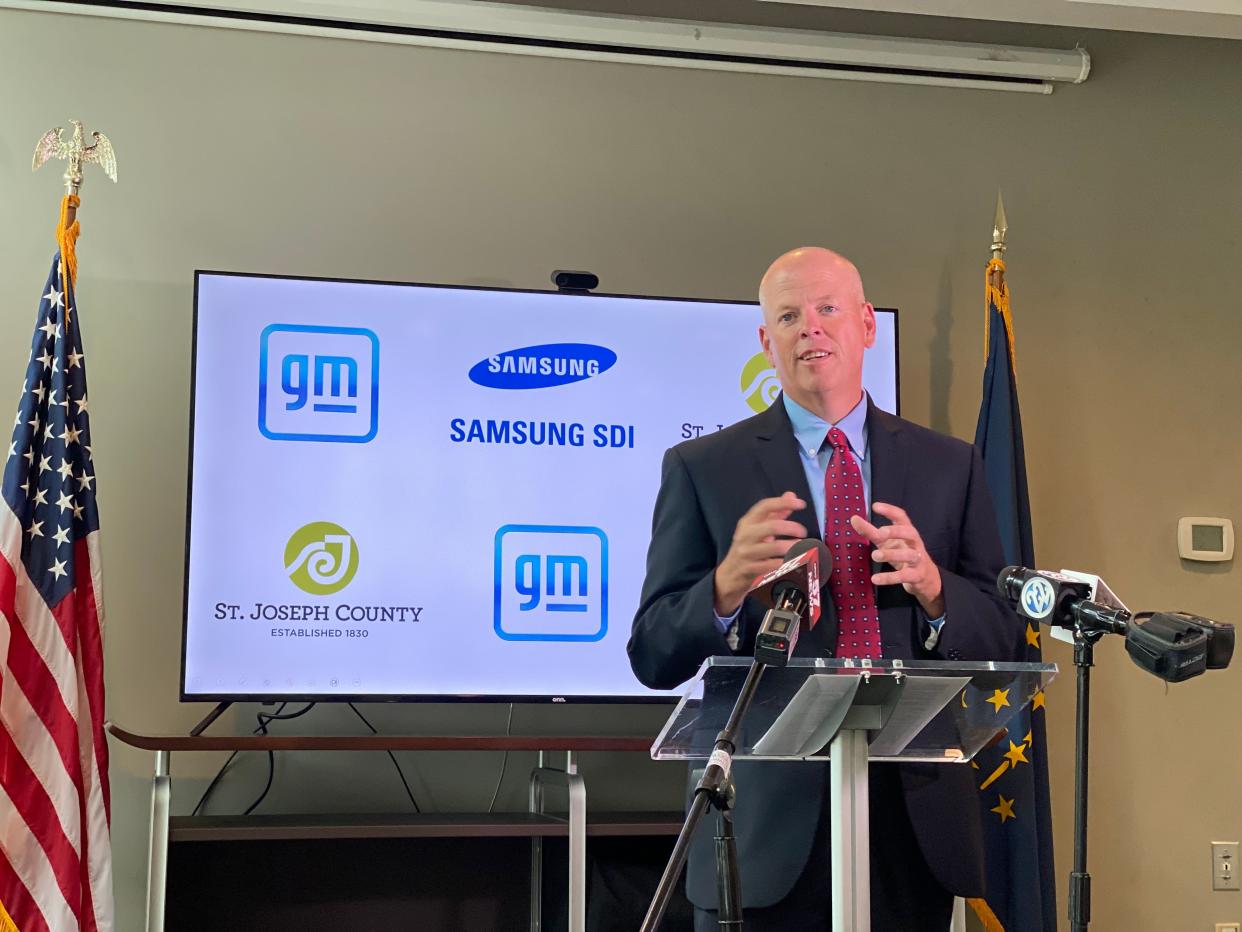

It comes as more developers are showing interest in the farmland near New Carlisle that the county has been offering for commercial development in the Indiana Enterprise Center.

Jeff Rea, president and CEO of the South Bend Regional Chamber of Commerce, believes the current process could be an impediment.

“Everybody that we’ve talked to that’s navigated your process has said it’s really complicated,” he told the council members at their committees meeting on Feb. 27. “You have a reputation of being one of the most complicated in the state.”

He encouraged council members to go with a simpler application. The city of Mishawaka made that switch several years ago, he said, recalling his experience with it when he worked in economic development for the city and then served as its mayor.

In Mishawaka, which modeled its system after the one in Indianapolis, he said, the economic development staff review the applications, then present their recommendations to the Mishawaka Common Council for an ultimate vote.

“Simple doesn’t mean there are no standards,” Rea said, noting that there’s a trend toward a simpler abatement process in other communities.

But Bill Schalliol, the county’s executive director of economic development, asked council members to hold off on making the change.

He said state law now allows enhanced abatements that the county hadn’t ever offered, and he suggested the county may want to explore them. For example, he said there are opportunities to offer agricultural abatements for personal property and real estate.

“I would ask that you take a month and maybe have work sessions and education sessions or something like that,” Schalliol said. “Our office wasn’t involved in writing this new abatement ordinance. So we’re kind of catching it at the back end.”

Democratic council members Diana Hess and Mark Catanzarite agreed that the matter needed more time to gather input and reach some common ground.

But the Land Use Planning Committee on Feb. 27 voted 4-3 to send the measure to the full council with a favorable recommendation, with Republicans in favor and Democrats against.

That sends it to the full council for a vote at their meeting at 6 p.m. March 12 on the fourth floor of the County-City Building.

South Bend Tribune reporter Joseph Dits can be reached at 574-235-6158 or jdits@sbtinfo.com.

This article originally appeared on South Bend Tribune: St. Joseph County Council Jeff Rea seeks to simplify tax abatement